Global think tank proposed Bitcoin reserve to Amazon

A global think tank has proposed that Amazon include Bitcoin in its strategic reserve by next year. This proposal is the same as that proposed by Microsoft by Michael Taylor a few weeks ago.

The National Center for Public Policy Research, an independent global conservative think tank based in Washington DC, has proposed Bitcoin (BTC) strategic reserve for the 5th largest company in the world, Amazon.

This proposal aims to offer the company’s cash and cash equivalents, worth $88 billion including US government, corporate and foreign bonds, to consider adding Bitcoin to its strategic reserve of here the next annual meeting in April 2025.

“Amazon should – and perhaps has a fiduciary duty to do so – consider adding to its treasury assets that appreciate more than bonds, even if those assets are more volatile in the short term. »

Based on the document shared by Tim Kotzman X’s message December 9

The US inflation rate reached a high of 9.1% in June 2022, which is the main reason why the company should adopt Bitcoin like the other company did. Since bond yields have also not exceeded real inflation, this is not enough to protect billions of dollars of shareholders by holding these assets.

The National Center also noted that Bitcoin performance over the past year reached 131%, outperforming bonds by 126%. It also outperforms corporate bonds by 1.246% in a single year.

MicroStrategy as an example for Amazon

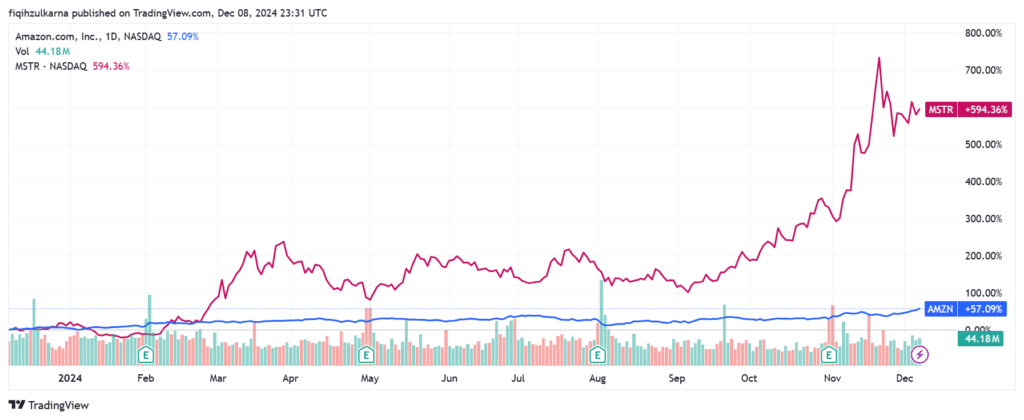

MicroStrategy started this move by adding Bitcoin as a financial asset in 2020, and now the stock performance has increased by 594%, outperforming Amazon (AMZN), which is up just 57% in a year.

A few weeks ago, Michael Saylor, executive chairman of MicroStrategy, also presented the Bitcoin reserve for Microsoft; the company will decide this week.

They also mentioned that Saylor’s action is followed by many companies and institutions, including BlackRock and Fidelity, which launched the Bitcoin ETF on the stock exchange earlier this year.

In conclusion, the National Center advised Amazon to diversify its balance sheet by adding at least 5% of its assets in Bitcoin. Not only is this part of the move tech companies need to make, but they also need to preserve their assets and shareholder value in the face of unbeaten digital asset inflation.

Post Comment