Justin Sun Cashes Out $209M ETH From Lido Finance

TRON founder Justin Sun requested the withdrawal of 52,905 ETH, worth $209 million, from Lido Finance. This could affect Ethereum prices, according to historical data.

The withdrawal is part of a larger Ethereum (ETH) accumulation strategy where Sun reportedly purchased 392,474 ETH at an average price of $3,027, now posting an estimated profit of $349 million.

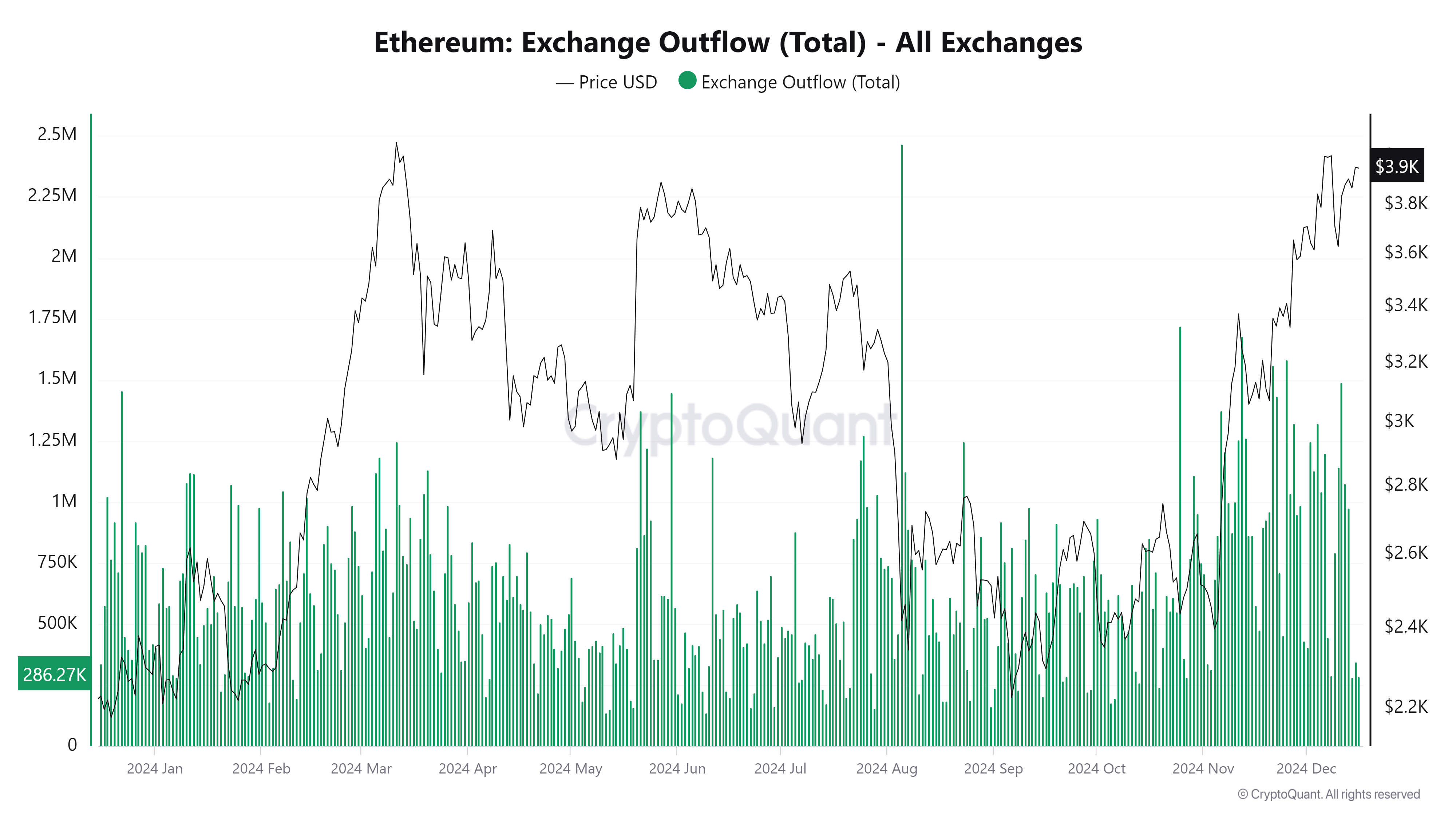

This is not the first time Sun has withdrawn large amounts of ETH. On October 4, 2023, Sun withdrew 80,253 unstaked ETH, or approximately $131 million, from Lido and transferred it to Binance within four days, around mid-October. Shortly after, a 5% drop in ETH prices was observed. Analysts wonder whether Sun will employ something similar when retired assets are “delivered” to exchanges for possible sales.

The $209 million withdrawn from Lido Finance is notable because it highlights the magnitude of Lido’s importance to Ethereum. Proof of Stake infrastructure. As a liquid staking protocol, Lido solves the problems of traditional staking, resource inaccessibility, and illiquidity by allowing users to stake ETH and remain liquid through the stealth tokens traded.

Pool enables over 30% of all ETH staked on the network, making it one of the pillars of Ethereum’s PoS mechanism. Large withdrawals such as Justin SunThe withdrawal of raises questions about the liquidity of staking and possible effects on the market. Although the Lido liquid staking While the solution makes tokens more accessible, the fear of sudden large-scale withdrawals reveals a vulnerable flashpoint in staking protocols. Such measures may fuel fears of dwindling liquidity. One such incident was on August 5 of this year, when withdrawals, possibly by whales, caused the price of ETH to fall from $3,317 to $2,419.

Although Lido withdrawals are not immediate, given that they must pass through Ethereum’s staking queue, such large movements can be indicative of market changes, particularly if multiple large stakeholders follow suit. the step, causing an imbalance between the assets put into play and not put into play.

Besides withdrawing ETH, Sun deposited $964,000 EIGEN on HTX, a crypto exchange. Own (OWN) is the native work token of EigenLayer, a protocol that strengthens the security of the blockchain by allowing the recovery of guarantees against intersubjective faults. This filing further states that it aims to diversify liquidity between established tokens and other high-risk tokens it may own.

Post Comment