Odds of Trump approving Bitcoin reserves fall: Polymarket

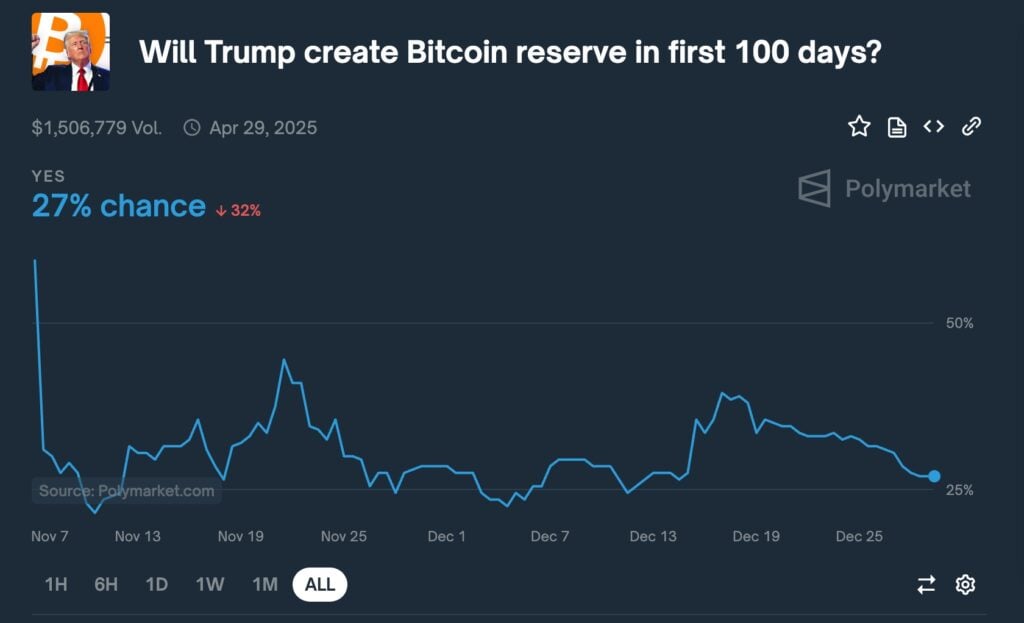

Polymarket users predict that President-elect Donald Trump will not approve a strategic Bitcoin reserve within the first 100 days of his administration.

A survey with more $1.5 million in funds, this probability is only 27%, compared to 60% after Trump’s election. This is a notable prediction since Polymarket has been very accurate in the past, including in its estimate on the last presidential election.

Kalshi users disagree

Other prediction market participants expect Trump to eventually accept Bitcoin (BTC) as a strategic reserve, alongside crude oil and gold. Kalshi, for example, has placed the chances of a BTC reserve occurring by January 2026 at 61%, the highest point since December 21.

Some conservative-leaning states like Texas, Ohio and Pennsylvania have also started working on their strategic Bitcoin reserves. A bill in Pennsylvania states that the government can invest at least 10% of the state’s General Fund in Bitcoin to combat inflation.

Nonetheless, Polymarket and Kalshi users expect the Bitcoin strategic reserve bill in Texas to take time. A Polymarché survey puts the chances of Texas passing the bill by March next year at 10%, while Kalshi has the chances at 24%.

Supporters of the United States adopting Bitcoin as a strategic reserve, including Senator Cynthia Lummisargue that this makes financial sense due to supply and demand dynamics. Data shows that demand for Bitcoin is increasing, with spot ETFs having over $128 billion in assets.

Supply is dwindling, and mining difficulties reached an all-time high after the last Bitcoin halving event in April this year. According to CoinGlass, Bitcoin balances on exchanges have continued to decline this year.

Supporters also point to the success of MicroStrategy, which helped it grow into an $80 billion company by becoming the largest holder of Bitcoin. Thus, some analysts predict that the United States could eventually use its Bitcoin holdings to pay part of its debt, which currently stands at more than $36 trillion.

Opponents argue that Bitcoin’s volatility, limited acceptance, market scale, regulatory constraints, and implications for sovereignty and trust make it an impractical solution for paying down the U.S. national debt.

Furthermore, the Federal Reserve has already stated that it not allowed to hold Bitcoinmeaning it would take an act of Congress to do so.

Trump has supported Bitcoin and suggested that the government convert its Bitcoin holdings into strategic reserves. Data by BitcoinTreasurers show the government holds 198,000 coins worth $18 billion.

Post Comment