Trump Euphoria triggers ETF inflows of $2.2b with total AUM ‘at all-time highs’

Digital asset flows reached more than $2 billion last week, fueled by enthusiasm for Trump’s inauguration, with total assets under management reaching more than $170 billion.

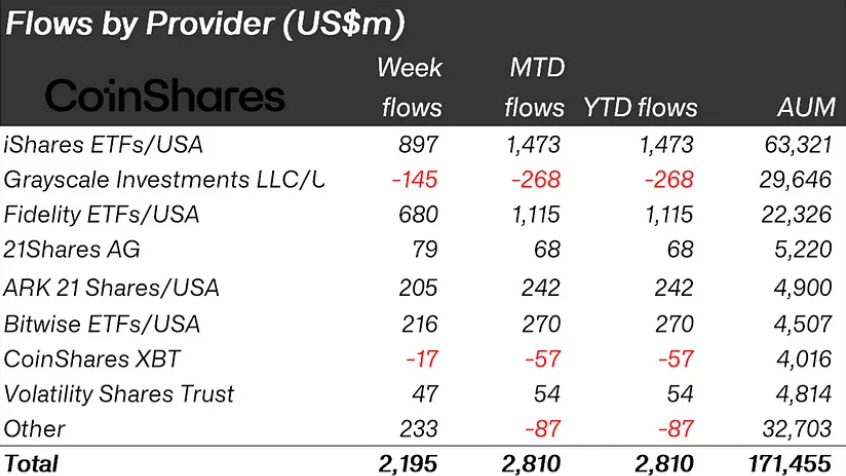

Crypto investment products saw inflows of $2.2 billion last week, according to data from the European alternative asset manager. Coin Shares. In a blog post On January 20, James Butterfill, head of research at CoinShares, said the latest development marks the largest weekly inflows so far in 2025, attributing the increase to the euphoria of Trump’s inauguration.

Total assets under management reached $171 billion, hitting a record high, Butterfill revealed, adding that trading volumes on exchange-traded products were also high, reaching $21 billion last week, accounting for 34%. bitcoin trading volumes on trusted exchanges.

Bitcoin (BTC), as in previous cases, dominated the flows, bringing in $1.9 billion. According to CoinShares, year-to-date BTC inflows now stand at $2.7 billion, noting that “unusually, despite recent price increases, we have seen minor outflows from short positions” .

Ethereum (ETH) saw inflows of $246 million, reversing earlier outflows this year. XRP (XRP) also recorded $31 million in inflows last week, bringing its total since mid-November to $484 million. Lower inflows were recorded for Stellar (XLM), with $2.1 million, while other altcoins saw little activity.

The United States dominated capital flows regionally, with $2 billion raised. Switzerland and Canada also contributed $89 million and $13 million, respectively. CoinShares notes that Ethereum remains “the worst performer from a flow perspective so far this year,” despite last week’s gains, while Solana’s (GROUND) entries totaled a modest $2.5 million.

Post Comment