Which is the top blockchain of 2025?

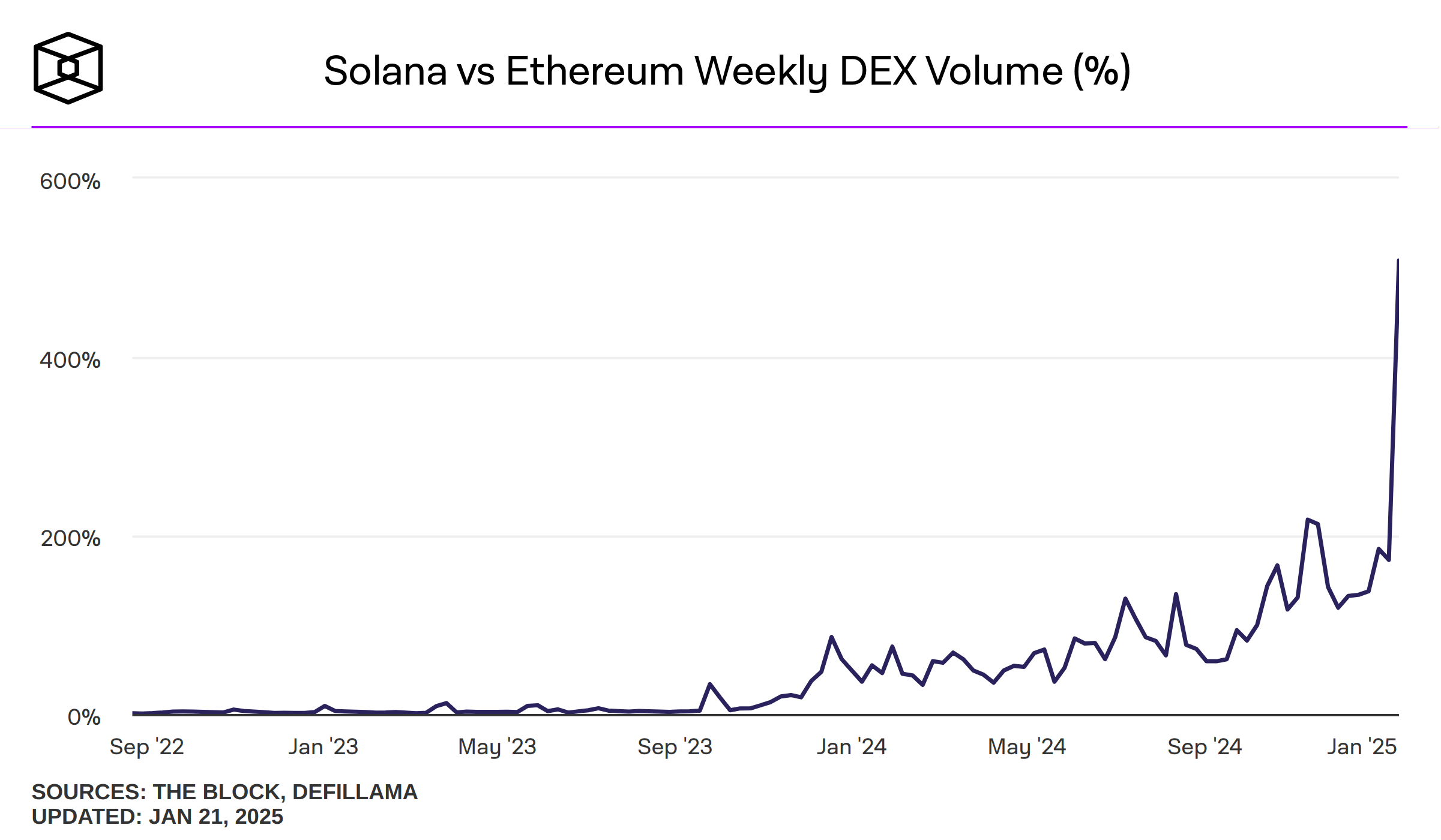

As of January 21, Solana saw $120.6 billion in its Dex trading volume, a 323.3% premium over the past seven days. Now, analysts are wondering if it can compete with Ethereum and position itself as the top layer 1 blockchain in 2025.

According to data from ParadeEthereum (Eth) Weekly Dex trading volume increased to $24.7 billion, an increase of 47.58%. Compared to Solana, this wave was largely led by UNISWAP, which accounted for over 73.7% of the trading volume and contributed $17.46 billion to Ethereum’s Dex activity.

On the other hand, Solana’s best dex was Raydium (RADIUS) saw a weekly change of 236%, with $52 billion in Solana last week. After Raydium, Meteora added 13,379% to Layer 1 weekly volume.

Comparatively, Solana will appear poised to make gains on Ethereum for Dex activity, given that it is attracting the attention of Dex traders, says analyst Knox Ridley of I/O Funds

Will Solana Overtake Ethereum as Top Layer 1?

Ridley believes Solana’s unique “proof of history” protocol will make it a market leader. Blockchain POH enables high throughput of 65,000 transactions per second without second layers, making it faster and more efficient than Ethereumthe Proof of Stake protocol, which comes to a maximum recorded TPS of 62.34, according to Chaincat.

Additionally, the new Solana update called Firedancer, built by Crypto to jumpaims to expand on layer 1 by increasing scalability and improving the overall network vulnerability to bugs and attacks.

Such new technical advantages, it is believed, will allow Solana to act as a more scalable and secure layer 1 blockchain – a real challenger to Ethereum, particularly in applications where speed and efficiency are important, believes Ridley .

Another factor adding to Solana’s popularity is its stablecoin infrastructure. While Ethereum still leads in stablecoins, Solana is rising, with a 67.48% gain in its stablecoin market cap, standing at $9.8 billion as of January 21, 2025.

Solana Volume/Market Cap Ratio overtakes Ethereum

Interestingly, Solana’s (SOL) 13.13% volume/to-market cap ratio suggests that it is witnessing an increase in trading activity against Ethereum’s (ETH) 10% ratio, according to Coinmarketcap.

Activity that underpins Solana’s growth. Dexes like Raydium and Meteora validate this growth, resulting in high liquidity. In contrast, Ethereum’s weak report indicates slower growth for Ethereum.

Additionally, analysts at Bitwise Europe also estimate that the price of Sol could increase by 3,000% by 2030 due to what they call the ‘iPhone Moment‘, making blockchain more likely to overtake Ethereum in 2025.

Post Comment