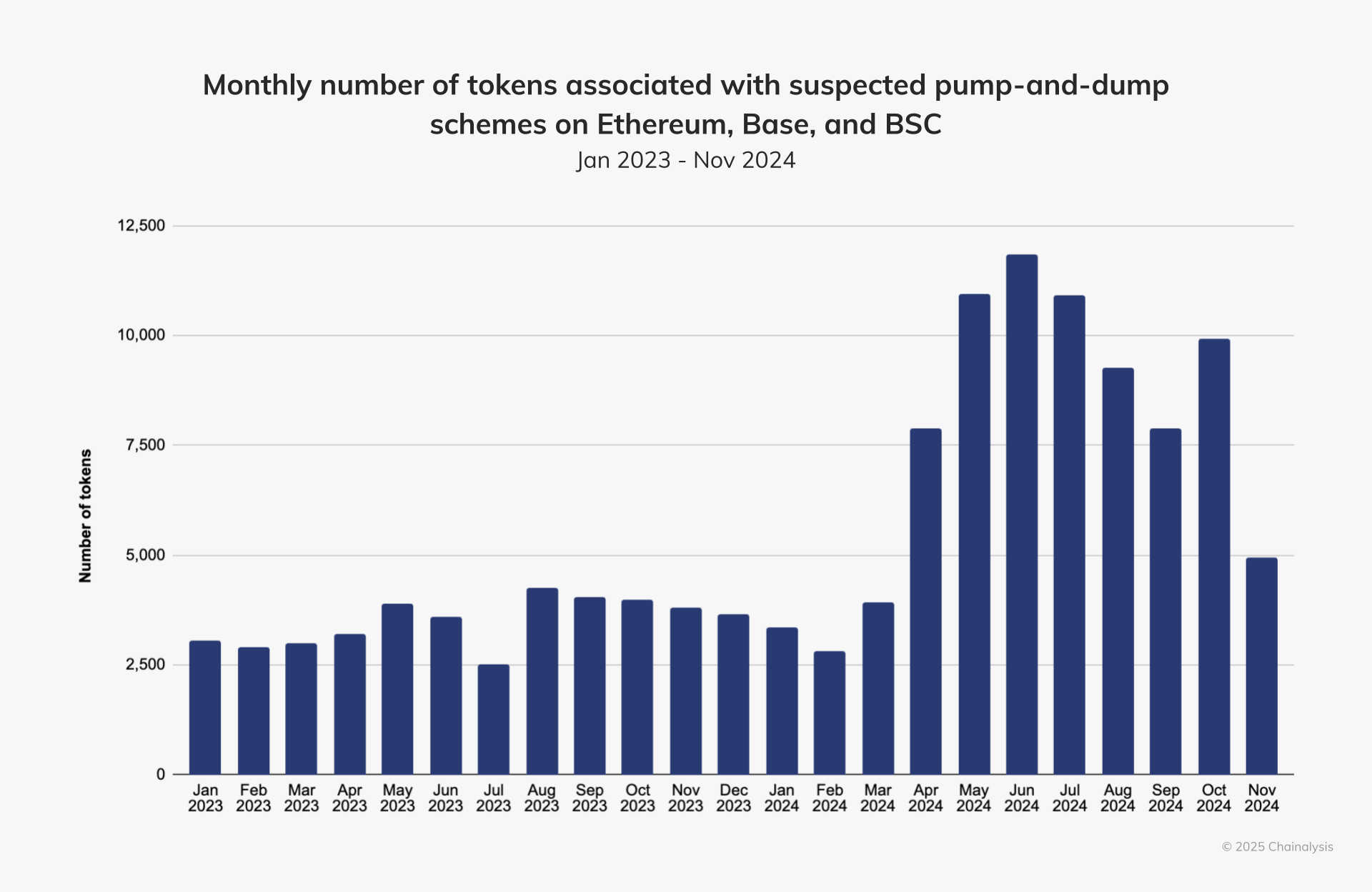

Over 4.5% of all tokens launched in 2024 have pump-and-dump traits

The washing trading on Ethereum, the BNB chain and the Coinbase base reached around $ 2.57 billion in 2024, according to Chainalysis analysts.

Almost 5% of all the tokens launched on various networks during 2024 had models similar to the pump and delight diagrams, Blockchain FIRCESIC Chain-analysis complaints. In a blog On January 29, the company based in New York revealed that more than 3 million tokens had been launched in 2024, with almost 1.3 million (more than 40%) listed on decentralized exchanges.

Despite the figure, only a small fraction – only 1.7% – has been actively negotiated in the last 30 days. The chain-analysis suggests that the gap could be due to the fact that many tokens were “abandoned shortly after creation”, perhaps because of the lack of interest. Analysts also note that some of these tokens could have been part of short -term patterns such as the pump and waste or carpet prints.

“It is also possible that some of these tokens facilitate the intentional short-term patterns designed to exploit the initial overhaul before vanishing, also known as pump-and-napl or carpet.”

Chain-analysis

In addition to this, almost 90% of decentralized exchange basins suspected of being involved in pump and dump patterns were “robust” by the address that created the Pool Dex, the chain score note . The others were robust by the addresses funded by the swimming pool or the creator of tokens. In some cases, the creator of the swimming pool and the address that robust the swimming pool seemed funded by the same source, suggesting a coordinated effort to operate users.

Analysts point out that the volume of washing trading through Ethereum,, BNB chainand coinbase Base Reached around $ 2.57 billion in 2024, although the company recognizes to use “different methodologies” to detect various types of washing trading.

Post Comment