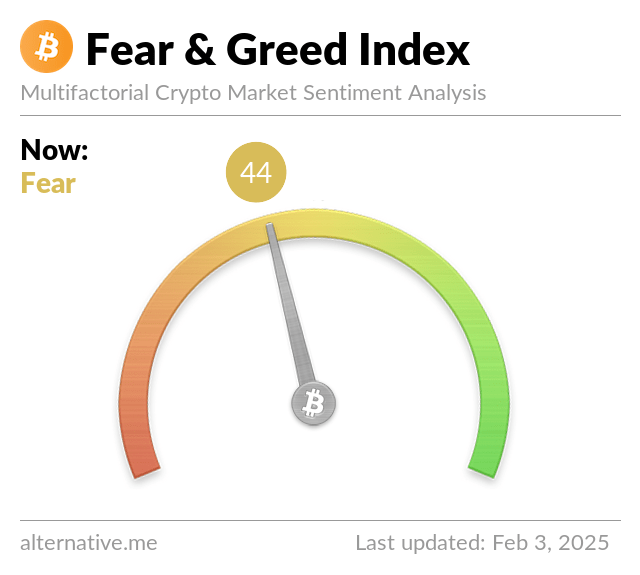

Crypto fear & greed index falls to 44 on fears of market wipeout

The Crypto Fear & Greed index fell to 44 months later after the cryptography market of $ 2.2 billion earlier during the day.

THE hintWho represents the feelings and emotions of the cryptography market on a scale of 0 to 100, had not fallen below 50 since October 12. Triggered by American president Donald Trump announcement of two -digit commercial prices on Canada, Mexico and China, total market capitalization of cryptography fell Almost 12% in the early hours of February 3, with Bitcoin (BTC) Only falling on 5%. The index immediately went from a “moderate greed” score from 60 to a “fear” score of 44, indicating a sale.

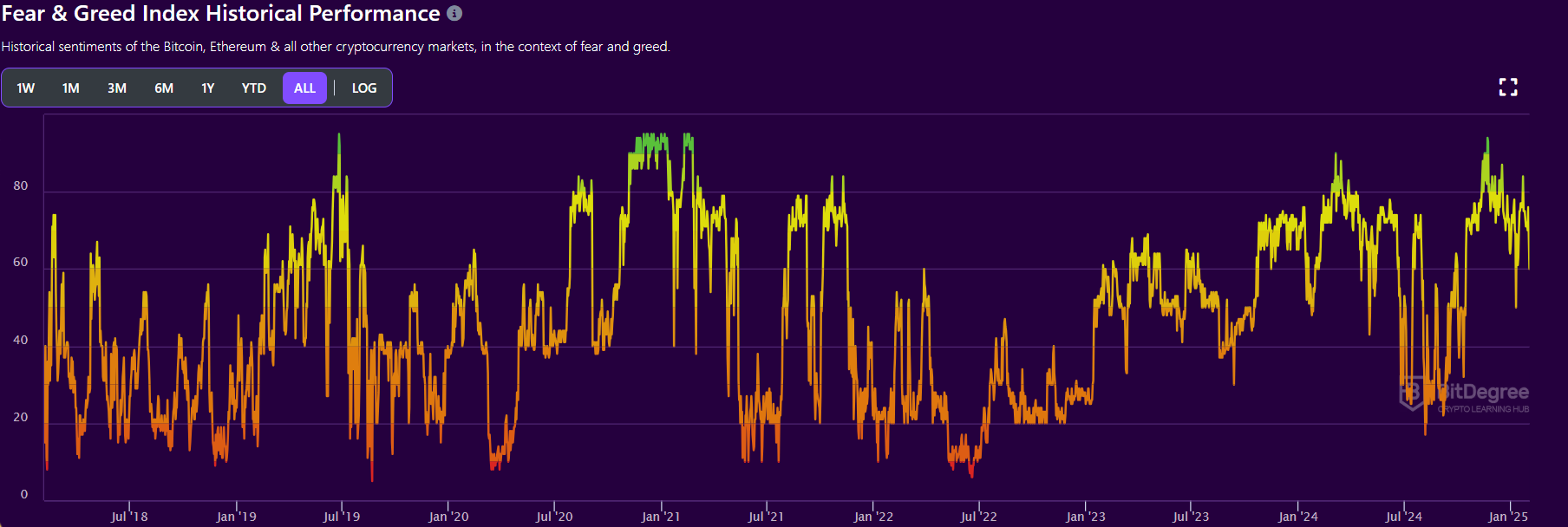

Although the current sale is statistically the largest event of liquidation in the history of cryptography at more than $ 2.2 billion at the time of the press, the score of the index does not yet indicate the existence of ‘A sustained market sale, as was registered during the lower markets in 2018, 2019 and 2022.

Until now, the market consensus in force seems to be that current market conditions are a blip on a bull market and do not mean the start of a sustained drop trend. Channel analyst Willy Woo captured the feeling in a post X where he postulated that Bitcoin has become a concept so psychologically powerful that it is indeed too large to fail.

At the time of the press, the sentence “Buy the dipWas one of the most trendy subjects on X, while Bitcoin and Ethereum slowly recovered from their 24 -hour respective hollows.

https://twitter.com/folami_capital/status/1886340353290125491

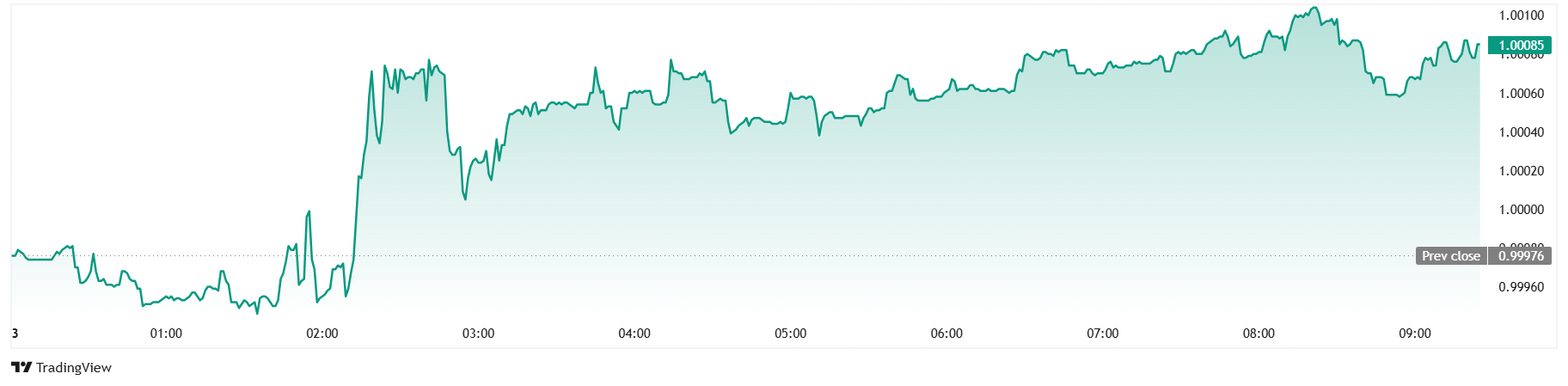

Bitcoin recovered 4% on a 24 -hour hollow of $ 91,200 at around $ 95,000, while Ethereum rose from 24 hours a day from $ 2,368 to around $ 2,600 at the time of the press. TETHER also recovered from 24 hours lower by 0.99946 to around $ 1,00085 Monday morning.

The relatively unusual resilience of the score of the index of fear and greed compared to the bloodbath of the market will be interpreted by some to signify that the major institutional investment in Bitcoin by tastes Microstrategy have created a calming effect on the notoriously volatile cryptographic markets.

Post Comment