Trump’s tariffs send Bitcoin and crypto market tumbling

After President Donald Trump targeted China, Mexico and Canada with longtime import taxes, the cryptography market fell on February 1 in risk action. The price of Bitcoin dropped by 5%, which has made its way in altcoins.

As of February 1, the United States impose 25% prices on imports from Canada and Mexico and 10% on Chinese products, adding additional complexity to current commercial wars.

Consequently, in the last 24 hours ending on February 3, Bitcoin (BTC) experienced a notable drop in the market on a market scale. The cryptocurrency dropped by more than 5%, reaching a minimum of around $ 91,200 before bounced back to around $ 94,000 when writing this article.

Despite this recovery, the BTC remains approximately 13% below its $ 109,000 summit, and the commercial volume jumped more than 200%, which suggests considerable sales pressure or market panic.

In addition, the global global market capitalization fell by almost 12% during the same period, regulating around 3.15 billions of dollars.

It should be noted that the inauguration of President Donald Trump on January 20, Bitcoin and other altcoins experienced a significant increase in prices. However, since this peak, recent developments – including new pricing policies – have contributed to a drastic drop in market feeling and asset values.

Given the recent Bitcoin price crash, he had a cascade effect on Altcoins. In the past 24 hours, Ethereum (Ethn) fell by almost 20%, Ripple (Xrp) by 22%, Solana (GROUND) 8% and a piece of binance (Bnb) more than 15%.

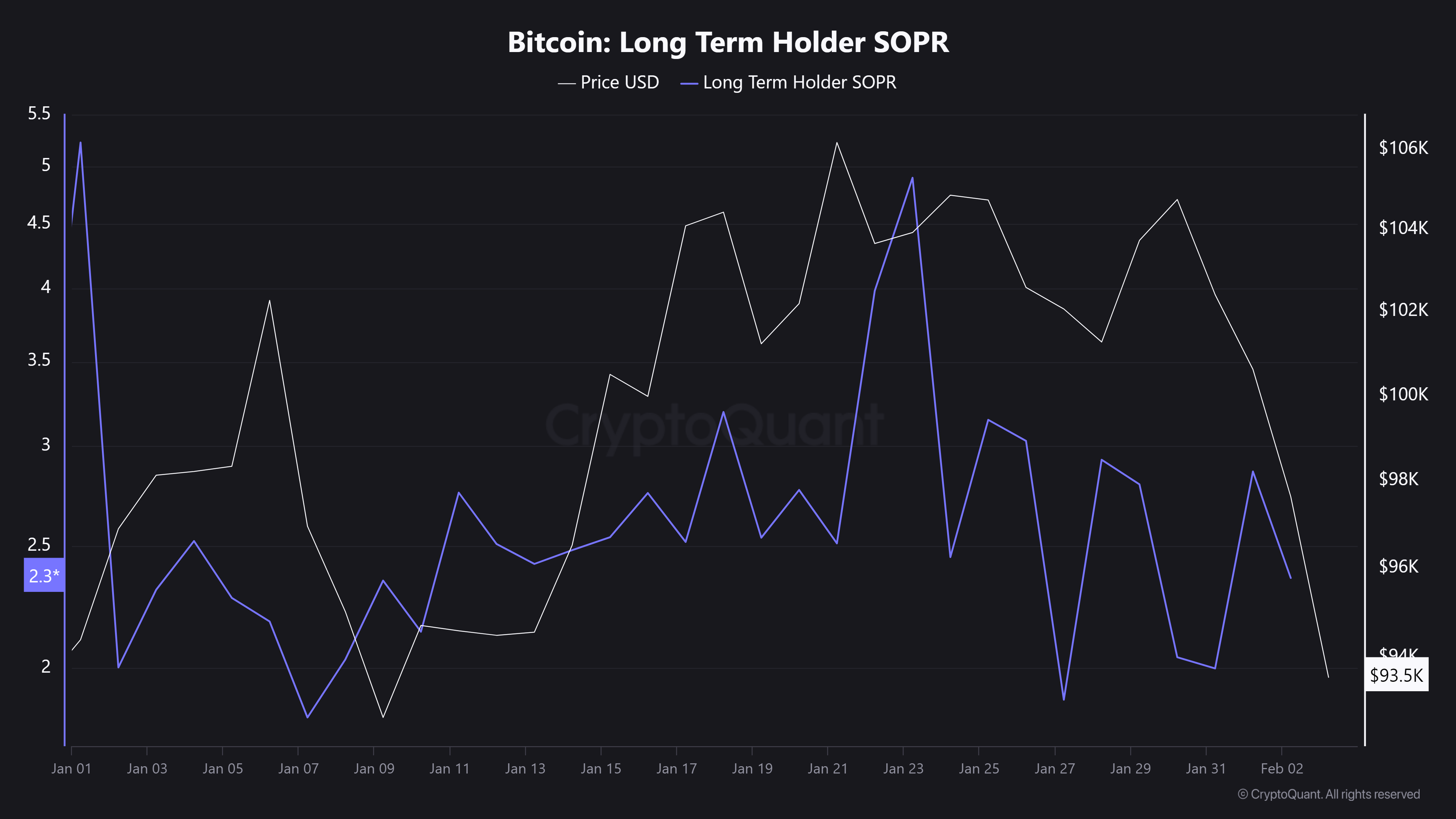

The increase in the volume of negotiation alongside price reductions often signals high sales pressure or market panic, as more and more traders unload their assets. This model suggests that long -term investors now sell their parts to lower profits than their purchase price – or even a loss of up to date – as illustrated by the Sopr Bitcoin graph: Holder Sopr.

Such behavior often indicates capitulation among long -term holders, a common phenomenon during the lower trends and corrections of the market. Experts, including Bitmex CEO, Arthur Hayes, even warned that a “financial crisis” could be on the horizon.

Post Comment