AAVE processes $210m in liquidations without accumulating additional bad debt

The Decentralized Loan Protocol AAVE successfully treated $ 210 million in liquidations without adding to its existing bad debt debt.

Data from Chaos laboratories shows that the following Monday Flash crash, which roughly wiped out $ 2.2 billion In the market value of the crypto, the extreme volatility of the market has led to a sudden peak of liquidations through the protocol. Liquidations have summarized up to $ 210 million, the largest total liquidation since August 5 accident.

As a general rule, high volatility periods create circumstances for questionable debts, because the perfect storm of multiple liquidation requests, high price reductions and a low request create long lines of liquidation that a protocol may have trouble clarifying.

Faced with this situation on Monday, Aave managed to evolve through what was equivalent to a stress test without adding a fresh debt, and even reducing its total debt debt in existing 2.7% due to a reduction the value of bad debt assets.

Analyzing the successful liquidation, Chaos Labs declared in an article on X:

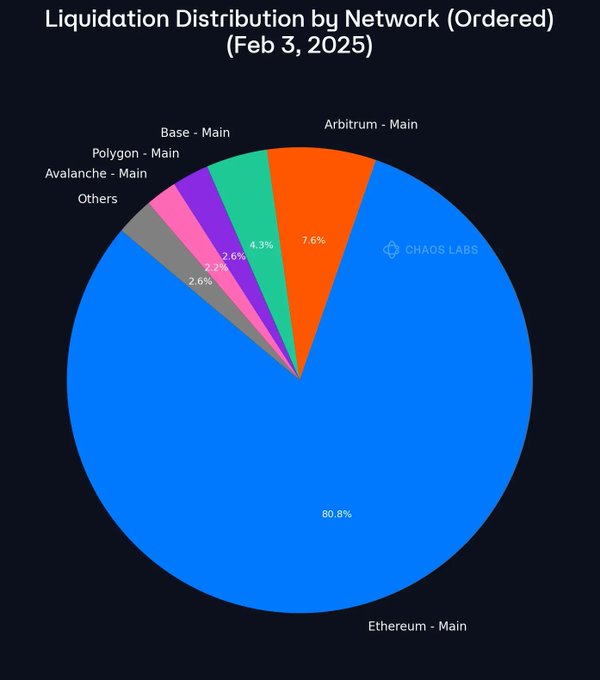

The liquidations were carried out effectively through the protocol, most of which were carried out on the main body of Ethereum. The robust risk management mechanisms within the AAVE assured that the guaranteed positions were paid as planned, minimizing the loss of protocol.

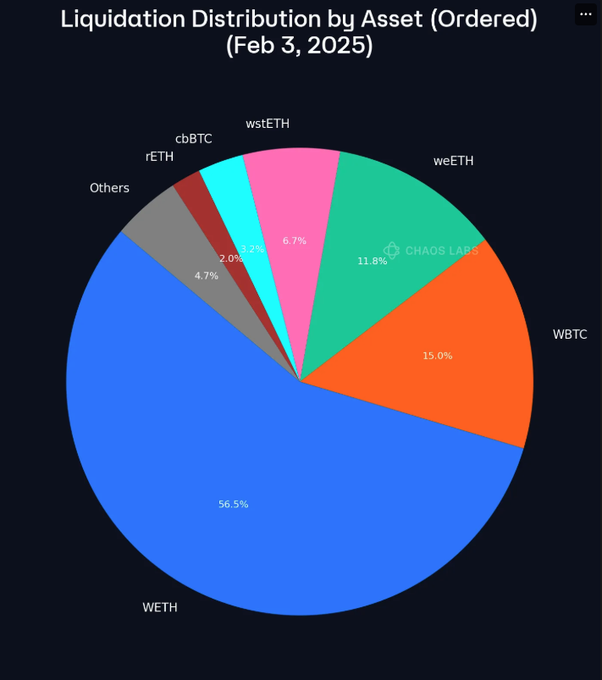

Ventilation of liquidations shows that Weth represented $ 96 million, while WBTC represented $ 25 million. 20 million dollars in Weeth have also been liquidated because $ 11 million in Wsteth. A basket of smaller active ingredients, including Reth and CBTC, constituted the remaining recorded liquidations.

Aave’s performance market response has been praise, analysts including IOC Bitwise Matt Hougan congratulating the protocol to take into account control.

In January. 7, Aave confirmed Its deployment on the Aptos Testnet, its very first deployment Non EVM, as part of its ambitious plan to extend deployment to 6 new channels, notably Aptos, Botanix Labs Spider Chain, Linea, Mantle and Sonic.

Post Comment