Ethereum adjusts gas limit for the first time since 2021

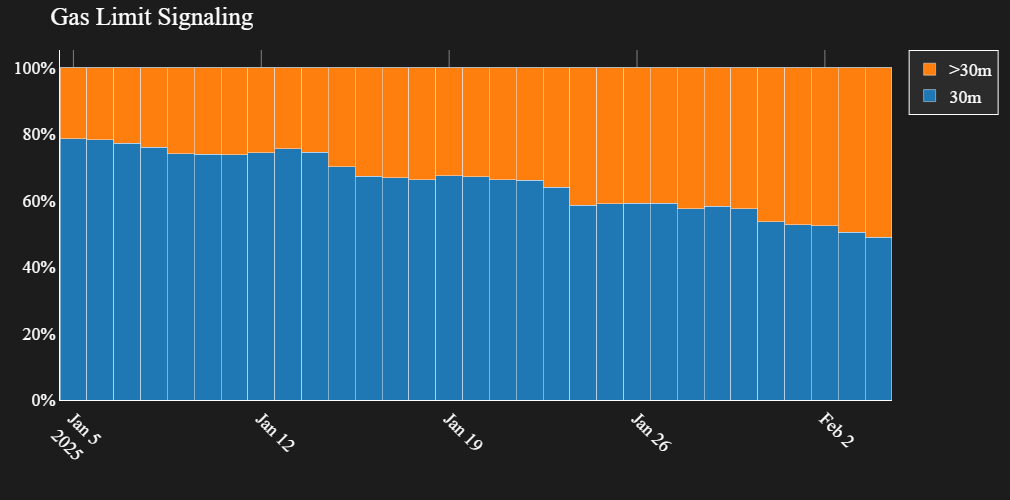

The Ethereum network has recently increased its gas limit to more than 30 million with more than 50% of the validators indicating the change.

According to data de Gaslimit.pics, the average gas limit in Ethereum (Ethn) The network has almost reached 32 million gas units in the last 24 hours, exceeding the limit of 30 million previous gases. X merchants expect it to increase even more to a maximum capacity of 36 million gas units.

This marks the first time that the ETH network has promulgated such a change since the implementation of its evidence of evidence for evidence. At the time of writing the time of the editorial staff, around 51.1% of the validators approved the adjustment of the gas limit without a hard fork.

The last time Ethereum The adjustments of its gas limit price were back in 2021 when the network doubled its gas limit from 15 million to 30 million gas units.

What does a higher gas limit for Ethereum mean?

In Ethereum ecosystem, gas is the terms used to measure the quantity of calculation effort required to treat transactions or intelligent contracts. Each block has a gas limit, which dictates the maximum quantity of gas which can be consumed by all transactions in a block.

This means that by increasing the gas limit, the network will be able to treat more transactions by block, potentially improving network productivity because it decreases congestion and helps the blocks to treat transactions more quickly. Not only can increase capacity also cause a drop in transactions costsBenefiting to cryptographic traders that frequently use the ETH network to transfer assets.

On the other hand, a higher gas limit could also cause larger block sizes, which could potentially increase the calculation load on the nodes. Although this does not directly affect traders, this could lead to more advanced material requirements for validators, potentially affecting the decentralization and safety of the network.

Post Comment