Trump tariffs and DeepSeek shake up ETF inflows

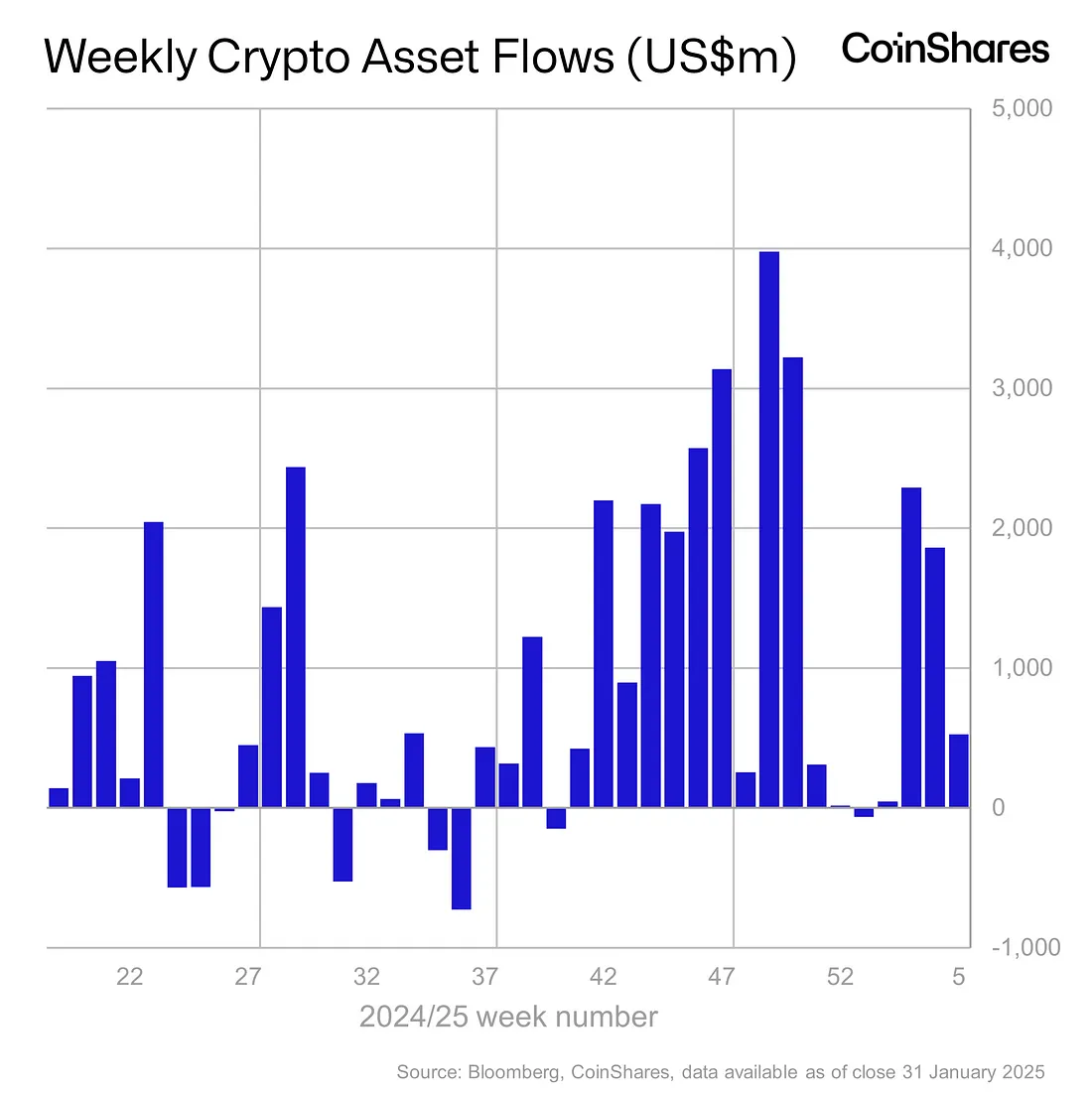

Weekly entries went from billions to $ 527 million last week, mainly due to feelings of volatile investors such as Deepseek and prices.

Crypto Investment Products saw $ 527 million entries, balanced by almost the same amount outputs. This number is far from the entries which arrived a week earlier, which reached nearly $ 2 billion.

According to Coinshares research reportIntraweek Flows reflected the feelings of volatile investors. Larger market problems, such as the emergence of China’s deep AI society, have triggered outings of up to $ 530 million.

However, the market has managed to bounce back with more than a billion dollars in the last half of the week, compensating for the outings. The Coinshares research manager, James Butterfill, explained that the sale, although quite large, is not unexpected. This is due to the $ 44 billion in the entrances observed in 2024 twinned with the $ 5.3 billion inputs for the start of the year and large price gains from several cryptocurrencies.

The United States continues to carry out entries by country with $ 474 million, bringing the start of the year to $ 5 billion. Europe experienced similar trends with $ 78 million entries last week and $ 93 million in admissions for the start of the year, led by Switzerland and Germany with $ 57.9 million and $ 22.3 million at entry respectively.

On the other hand, Canada has seen outings of $ 43 million, perhaps due to the imminent threat of trade rates in the United States, which was put into force on February 1.

Bitcoin (BTC) Remains the biggest contributor for entries with $ 486 million, while Bit-Bitcoin products have experienced a second week of $ 3.7 million. A major development occurred with XRP (Xrp) emerging as the second most efficient Altcoin, seeing nearly $ 15 million in entries last week and $ 105 million entries.

On the other hand, Ethereum (Ethn) saw zero net flows, fell earlier in the week. Butterfill attributes this fall to a larger exhibition in Ethereum to the technological sector and to the world market, which makes it sensitive to the volatile feeling of the market. As for smaller altcoins, Solana (GROUND) saw $ 4.6 million entries, ChainLink (LINK) saw $ 3.1 million and cardano (ADA) added $ 1 million.

In addition, Coinshares also noted that blockchain actions have also experienced $ 160 million entries for the start of the year, because investors see more purchasing opportunities in the middle of current price reductions.

Post Comment