3 reasons why Ethereum price may go parabolic soon

Ethereum fell for two consecutive weeks while concerns about low demand and drop in market share remain.

Ethereum (Ethn) fell to a hollow of $ 2,140 this week and rebounded at $ 2,620 while the cryptographic industry stabilized. There are around 37% below its highest level in December from last year.

Solana becomes a great rival

Challenge flame The data show that the volume of negotiation of Ethereum at 30 days was $ 95 billion compared to that of Solana (GROUND) $ 264 billion.

Ethereum was also exceeded in terms of costs this year. Its network has collection $ 172 million in fresh, making it the sixth most profitable cryptocurrency project after Tether, Tron, Jito, Solana and Circle.

The price of the ETH has also dropped due to Controversies of the Ethereum Foundation and discharges of tokens. Here is why he could be ripe for a return:

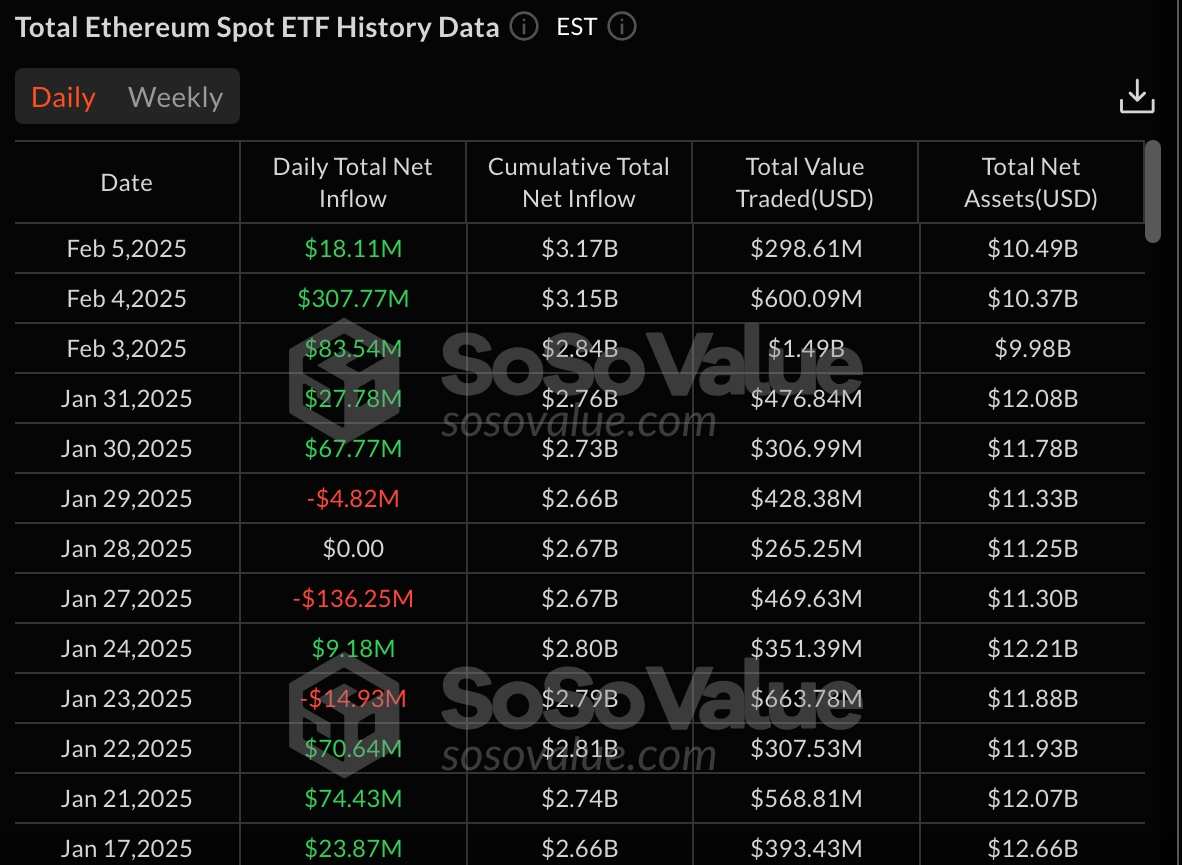

Identify the entries of FNB ETF

A potential catalyst for ETH is the current place ENTF ETF ETF. Sosovalue data show that these funds have had cumulative net inputs in the last six consecutive days, bringing the total flows to $ 3.17 billion.

It is a sign that Wall Street investors buy the decline, indicating more demand for these funds.

However, the ETHEREUM SPOT ETF have a long way to go to catch up with bitcoin (BTC), which has accumulated more than $ 40 billion in entries.

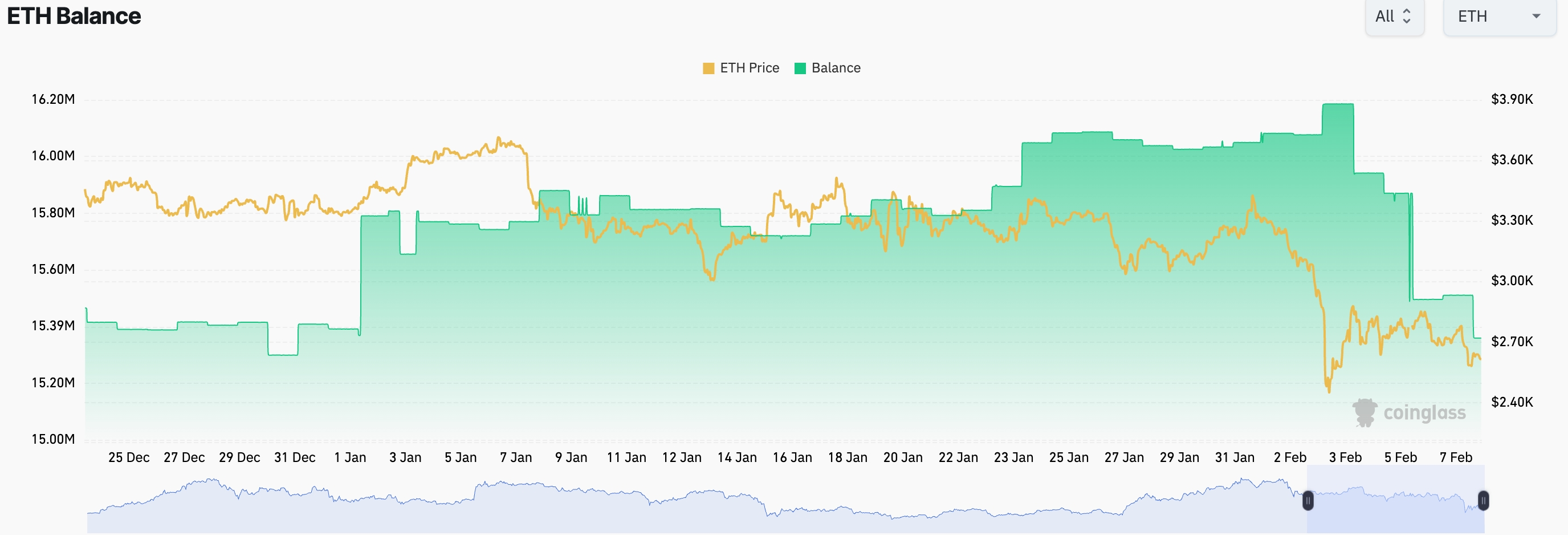

Falling Ethereum Balances on exchanges

The other catalyst for Ethereum prices is the fall in sales on scholarships, a sign of potential investors accumulation. ETH sales in the exchanges followed by Coinglass fell to 15.36 million, against 16.1 million earlier this year. They fell to the lowest level since December of last year.

The falling Ethereum sales occur when activity in the over -the -counter sector, or over the counter, is climb. The over -the -counter activity is common among large institutions wishing to execute large transactions outside centralized and decentralized public exchanges.

The Ethereum price table reflects August

The weekly graph shows that the price of the ETH crashed at a hollow of $ 2,140 this week. It is its lowest level since August of last year. He has since formed a hammer motif, which has a longer shadow and a small body and is a sign of popular bullish inversion.

A similar scheme occurred in August, when Ethereum has the bottom at $ 2,139. The two large drops occurred in periods of large peaks in lower volume. ETH also found support for the 200 -week mobile average.

Consequently, the piece will probably bounce and perhaps retest the resistance at $ 4,080. A break above this level will indicate more gains at the top of $ 4,800, followed by $ 6,000.

Post Comment