Crypto median VC deal size down 86% since 2018, data shows

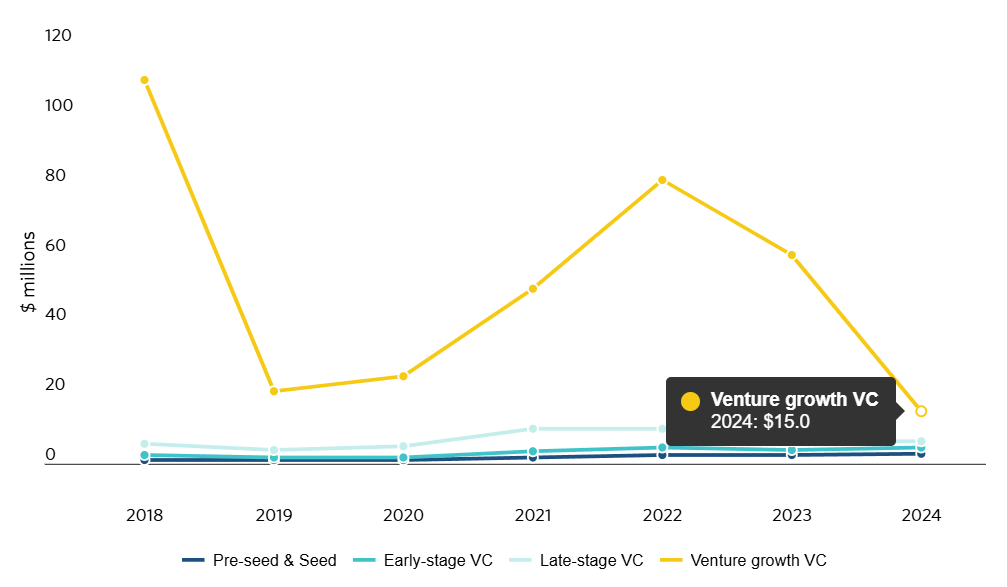

Although Bitcoin reaches a record summit of $ 100,000 in the fourth quarter of 2024, the venture capital activity in cryptographic startups has remained stable, the size of the VC agreement decreased almost 90% since 2018.

Pitchbook’s latest data reveal that the median size of venture capital agreements in cryptographic space has dropped almost 90% since 2018, showing a change in behavior of investors.

In a February 10 research reportPitchbook’s senior venture capital Journalist Michael Bodley noted that even with the increase in Bitcoin (BTC) Value in the fourth quarter of 2024, which traditionally leads more investment in the sector, the VCs seem to be more selective.

Investors have concentrated their bets on “fewer transactions, by pushing median assessments”, notes Bodley, adding that pre-money assessments for cryptographic startups have increased in all areas, median valuation reaching 32.1 million In 2024, against $ 18 million in 2023.

Pitchbook’s main analyst Robert Le, stressed that in 2022, cryptographic entrepreneurs “could raise capital with a white paper and very little traction”. Now, he says, the feeling of investment has changed, stressing that any founder seeking to raise capital on the current market “must really show a large quantity or traction or something other than a white technical paper”.

In an interview with Pitchbook, analysts have said that this trend will probably continue, concentrated agreements becoming the standard in the financing of the crypto-business.

However, at the end of December 2024, the pitchbook foreseen This Crypto VC funding would be “much stronger” in 2025 compared to 2024. In an interview with CNBC, the market said that the market would see “18 billion dollars or more in venture capital which would be invested in the crypto” . This represents an increase of 50% compared to 2024, but still less than the approximately $ 30 billion “which were invested in 2021 and 2022,” he added.

Post Comment