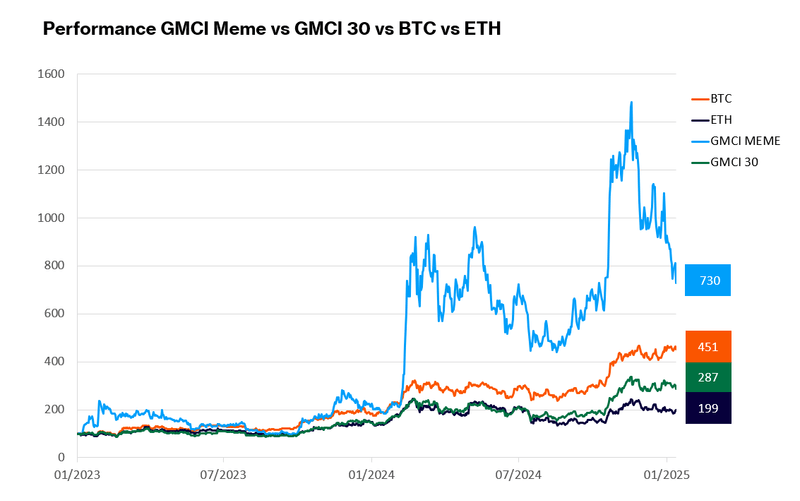

Memecoin rally fades but GMCI meme index still outpaces BTC and ETH

GMCI data suggests that the memes currency rally has cooled, although the pieces even have a strong lead on Bitcoin and Ethereum.

GMCI memes indexFollowing the main parts of memes by market capitalization, has been down around 60% since its sum heights. Despite this drop, GMCI even (730 points) still maintains a solid lead on Bitcoin (BTC), currently seated at 451 points, and Ethereum (Ethn) at 199 points. The GMCI 30 index, which represents a selection of the 30 best cryptographic assets, is at 287.

The GMCI memes index began its rapid ascent at the end of 2023, culminating well above 1,000 points in 2024. This overvoltage left Bitcoin and Ethereum dragging by a significant margin, reflecting the lenses of Momentum memes transparent during the year. THE December 2024 report by Coingecko revealed that the pieces even captured almost 15% of the overall interest of investors, a leap of 6% compared to the previous year. Furthermore, Binance annual analysis reinforced the domination of the parts even in 2024, signaling an annual gain of 212% for the sub-sector. This thrust was largely fueled by the popularity of Pump.fun, a MEE of money paving stone which saw more than 5.7 million new projects launched and generated more than $ 400 million in income throughout the year .

Reflecting the drop in the same GMCI, market analysts began comment on Cooling of the meme parts sector. In a recent PublishKi Young Ju, CEO of cryptocurrency, said that if the media threshing around memes will disappear and that the market will evolve in a more sustainable market by 2030.

This perspective aligns with the broader vision of the industry that the story of the memes play can be at its peak, leaving room for the importance of the Au-A-Aggen tokens. Haseeb Qureshi, Director of Dragonfly Capital, Shared on X that coins are likely to lose market share for AI agent parts.

However, the fact that the pieces even have outdoed the BTC and the ETH, according to the GMCI memes indexsuggests that the story of the same money is always strong – at least for the moment.

Post Comment