Coinbase shares jump 8% as reported revenue beats expectations

US Crypto Coinbase’s US shares jumped more than 8% on Thursday after the company has published stronger than expected profits.

Cryptocurrency exchange Jamming saw its shares bonded from 8.44% to $ 298.11 on Thursday, February 13, after reporting its strongest quarterly income in three years.

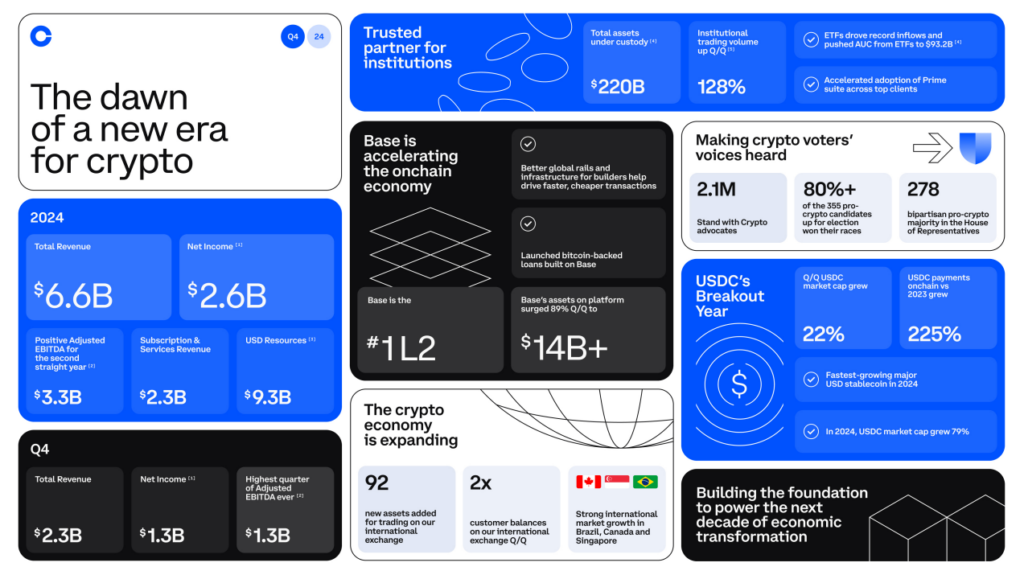

According to his Q4 2024 Gains reportCoinbase generated $ 2.3 billion in revenues, an increase of 138% compared to 2023, beating the estimation of $ 1.88 billion of LSEG analysts. Net profit reached $ 1.3 billion, while profit per share came to $ 4.68, exceeding $ 2.11 forecast By factst and $ 1.81 expected by lseg.

The exchange indicates that its growth was due to the increase in commercial activity and to a change in the regulatory landscape.

“Zoom out, the last months have shown a sea change in the regulatory environment, unlocking new opportunities for Coinbase and the crypto industry.”

Jamming

Transactions revenues reached $ 1.6 billion, up 172% compared to the previous quarter, while subscription income and services increased to $ 641 million.

Coinbase is optimistic about his future, calling for the latest regulatory changes under the Trump administration “dawn of a new era for the crypto”. The company says that it “will double what we have always focused on: construction”, with plans to stimulate the adoption of stablecoin, develop its layer 2 network BaseAnd develop cryptographic payments.

“At the same time, you will see us working hard to bring more people on the waves thanks to products like our main Layer 2 platform base, Smartwallet and Coinbase Developer Platform.”

Jamming

However, challenges remain. Stablecoin transaction fees dropped 9% in a quarter to $ 226 million, but Coinbase says partnerships and new products will help balance things. With a large Q4 behind, the company sees an “unprecedented opportunity” to come – if market conditions and regulations remain favorable.

Post Comment