NFT sales suffer, Pudgy Penguins plunge: Here’s the latest

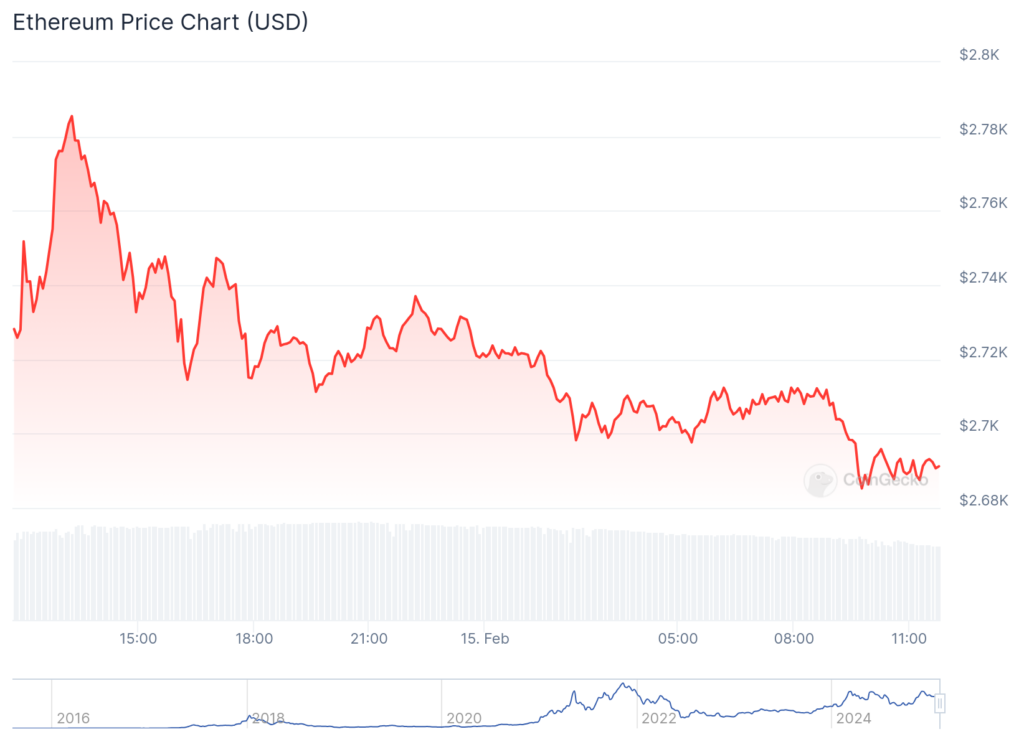

The NFT market is continuing its downward trend, even if the cryptography prices stabilize, Bitcoin extending up to $ 97,000 while Ethereum holds around $ 2,688 (see below).

The wider market of cryptography experienced a modest recovery, the total market capitalization of 3.24 billions of dollars compared to 3.13 dollars of last week.

New traders show interests despite lower volumes

According to Cryptoslam The data, the NFT sales volume (non -bubilist tokens) fell to $ 112.7 million. It is a decrease of 35.15% compared to the previous week. However, the market has experienced a significant increase in participation, suggesting a growing interest in new traders despite lower global values.

Market data show an interesting contrast between volume and participation:

- NFT sales volume fell to $ 112.7 million, compared to $ 119.5 million

- NFT buyers jumped 624.41% to 203,994

- NFT sellers increased by 519.61% to 158,805

- NFT transactions fell slightly 1.41% to 1,443 007

The volume of sales of Ethereum NFT drops by 41.25%

- Ethereum (Ethn) The market leader remains but has seen sales drop by 41.25% to $ 56.0 million. The network trading of the network dropped from 78.20% to 12.0 million dollars, although the number of buyers increased by 81.43% to 30,598.

- Mythos Chain held second place with $ 13.9 million in sales, up 4.66%.

- Solana (GROUND) maintained the third position with $ 11 million despite a drop of 32.56%.

- Polygon (Police) showed a force in fourth place with $ 8.1 million, increasing 10.76%.

- Bitcoin (BTC) fell in the fifth with $ 6.7 million, down 71.42%.

Dmarket leads NFT sales

Dmarket took the lead with $ 8.7 million in sales, up 7.98%. The collection has maintained a solid activity with 322,241 transactions and 24,413 buyers. The Court followed with $ 7.3 million, up 25.78% and seeing the number of bondi buyers of 122.44%.

Cryptopunks held third place with $ 5.2 million despite a drop of 30.01%. Grassinian penguins fell into fourth position with $ 5.1 million, down 55.29%. Azuki completed the first five with $ 5 million, down 79.17%.

The best sales of the week included:

- Ordinals not classified # 8912771: $ 7,749,449 (80.1296 BTC)

- Cryptopunks # 2550: $ 331,955 (125 ETH)

- Cryptopunks # 793: $ 146,683 (53.5 ETH)

- Cryptopunks # 9634: $ 128,988 (47.5 ETH)

- Cryptopunks # 9701: $ 122,883 (45 ETH)

What happened?

The NFTs were hot in 2021, but the market became more and more saturated. Sales have dropped, but showed signs of to come back in October.

But with thousands of projects flooding space, many that lack unique value proposals, buyers have apparently become more prudent about speculative investments.

The initial NFTS boom, fueled by a media threw, fueled by high -level endorsements – including a series of images photographed exhausted By Donald Trump while he campaigned – started to fade. Many early adopters have become disillusioned by projects that have not provided long -term value, while others are faced with the reality of unbearable assessments.

Consequently, the interest in the NFT trade has slowed down, in particular as an economic uncertainty, including the increase in inflation and fears of recession – pushed consumers to withdraw from speculative assets.

Despite these challenges, the NFT space is evolving. There is an increasing interest in NFT with real usefulness, in particular those linked to metavers and play ecosystems, suggesting that the market moves to more functional assets rather than speculative collective objects. As the market cools, the quality of the quantity becomes the determining factor in the future success of the NFT.

For more coverage on NFTS, see episode six of the Crypto.News show, with a special guest Anika Meier.

Post Comment