Trump’s World Liberty Financial Buys 200M WLFI Tokens

A newly created multi-signature portfolio linked to World Liberty Financial from Trump bought 200 million WLFI tokens after withdrawing USDC $ 10 million from Binance.

The transaction that took place at the beginning of February 18 was reported by the chain analysis platform. The purchase adds to the current activity around WLFI, a controversial cryptography project with solid political ties with the Trump family.

According to the latest from Bitmart Research reportWLFI raised $ 455 million thanks to tokens sales on February 9, 2025. The project raised $ 319 million compared to the first public sale of 21.3 billion WLFI tokens at a price of $ 0.015 each, and Additional $ 136 million from a second cycle of sales at a price at a level of sales at an end price of $ 0.05 per token.

Although he presented himself as a DEFI loan platform, WLFI has not yet introduced deffi services, so there is no clear utility for its tokens. The objective of the project seems to be focused on the construction of its $ 327 million in chain and centralized chain exchange.

The intimate links of WLFI with the Trump family drew attention to its selection of assets. Market observers see the token, like other tokens affiliated to Trump, as a component of a wider plan to take advantage of Trump policy power. In particular, the Trump family controls 75% of the sales of tokens.

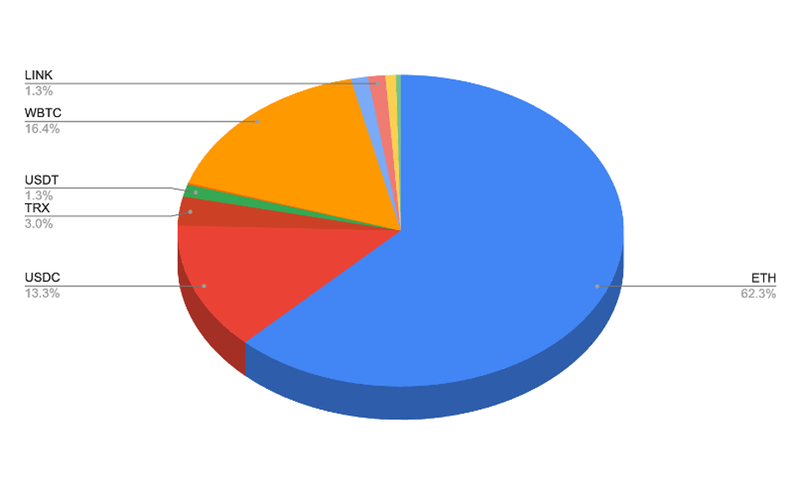

Justin Sun, the founder of Tron (Trx), also developed strong links With the project and is now the largest institutional investor in WLFI, which has contributed $ 75 million. The project allocated $ 63.41 million to assets linked to the sun like TRX and Bitcoin wrapped (WBTC).

According to the report, WLFI had $ 47.49 million in Stablecoins (before purchase) and moved $ 307.4 million to Coinbase Prime for Guard. In addition to stimulating its exposure to active world active ingredients and Defi protocols, the project’s investment strategy shows that it is focused on the growth of its main assets, in particular Bitcoin (BTC) and Ethereum (Ethn).

Post Comment