Litecoin daily transactions ballooned by ETF buzz

A growing confidence in the approval of an ETF of Litecoin Spot led the blockchain activity to almost $ 10 billion in daily transactions.

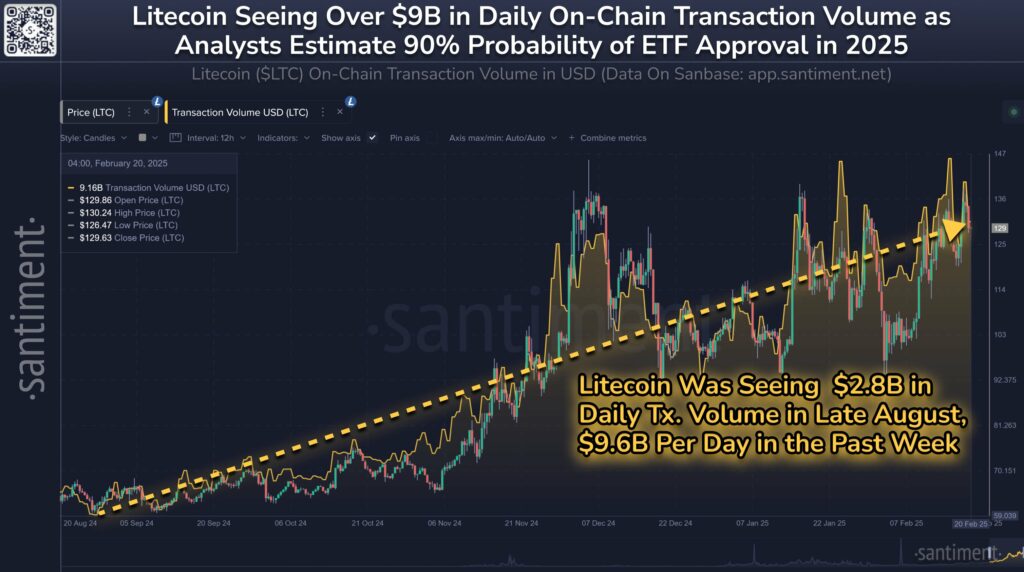

Litecoin (Thal) treated more than $ 9.6 billion in daily volume between February 15 and February 21, while the American Commission for Securities and Exchange seemed more and more likely to approve a fund translated by the LTC.

Santiment data has shown an increase in user activity, fueled by “clear excitation” for an ETF Litecoin. Daily transactions have increased by 243% in the past five months, coinciding with the Canary Capital deposit for an ETF SPOT LTC with the SEC in October.

Additional applications of transmitters such as Grayscale and Coinshares have further strengthened the optimistic momentum of the network. According to Santiment, the LTC market capitalization jumped 46% between February 1 and February 19.

The supply of digital assets in FNB allows investors to obtain exposure to cryptography via regulated markets, similar to stock market operations. It also eliminates the need to manage private keys or portfolios, reducing technical obstacles to the entry and enlargement of cryptographic access.

The issuers watched an ETF enlarged Crypto suite 13 months after the Bitcoin spot (BTC) The products made their debut in Wall Street.

President Donald Trump’s pro-Crypto program opened the doors for wider adoption as a reformed administration like dry and replaced skeptics such as Gary Gensler.

Heritage managers have requested authorization to list the LTC ((Xrp), Solana (GROUND), and Dogecoin (DOGE) Funds. However, analysts said Litecoin had the highest chances of approval. Bloomberg experts see a probability of 90% that the dry approves an ETF Spot LTC.

The Canary Capital file will probably be the first Litecoin fund outside the door, as it was the first transmitter at deposit his S-1 documents. The SEC has also started to examine all the pending spot funds.

Post Comment