$325b vanishes as liquidity evaporates

The cryptography market has lost more than $ 325 billion since Friday, with almost half of this annihilated in the past 24 hours.

According to The Kobeissi letterThe market capitalization of cryptography has lost more than $ 325 billion since Friday. In the past 24 hours only, around $ 150 billion has been liquidated, with $ 100 billion erased in just one hour today. The sale affected almost all cryptographic assets, including same.

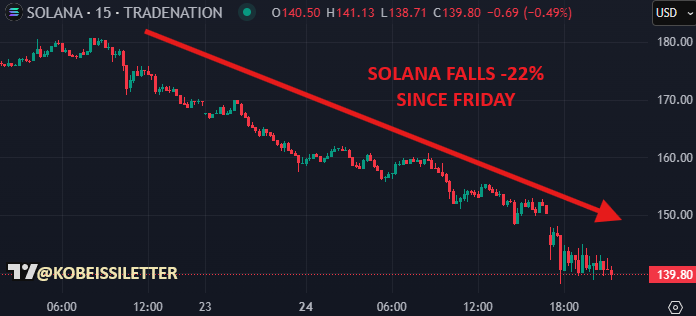

Kobeissi’s letter analysts Draw the start of the slowdown in Solana (GROUND), which has crushed 22% since Friday while the frenzy of the same has cooled.

Then Bitcoin (BTC) followed out, losing its relative force, while the S&P 500 began to withdraw Friday. Earlier in the day, Bitcoin broke below the level of support of $ 90,000, further strengthening the lower feeling.

The feeling of the market was also struck by the Hackwhich has now been confirmed as the second largest hack in the history of cryptography. On February 21, Parbit lost more than 400,000 ETH from its cold wallet. Consequently, Ethereum (Ethn), which had already shown a weak momentum before the hack, Weakened even further. According to CoinmarketcapETH opened $ 2,740 on February 21 and fell to a hollow of $ 2,408 when writing the editorial’s time, marking almost 12%.

Furthermore, Citadel titles“65 billion dollars pivot to cryptographic liquidity were strangely encountered by a reaction” Selling the news “on the market.

“Despite all this, Kobeissi’s letters analysts remain optimistic. “We saw countless with10% withdrawal from Bitcoin during this Bull Run. Technical withdrawals are healthy. However, given that the cryptography markets thrive on liquidity, a sustained reduction in risk appetite could maintain the pressure on prices, analysts added.

On the right side, the CEO of Ben Ben Zhou announcement that the exchange had covered the losses on February 24 and published an audit of proof of reserve to reassure the community. Bitfinex analysts have suggested that the reconstruction of customer funds by Bybit could lead to significant purchases of Ethereum, which could counter part of the sales pressure and generate higher ETH prices. They explained that the acquisition of ETH on the free market and other channels could have a stabilizing effect on its price.

That being said, Bitfinex analysts underlines This uncertainty remains high because the wider market remains in a correction phase. Bitcoin, Ethereum and Solana have everything denied In February after their rallies at the end of 2024. The pieces even, which jumped in December, also dropped by 37.4%. Finally, the monthly open interest in cryptography has decreased while traders take place from positions to profit at a lower moment and to increasing uncertainty.

According to Bitfinex, the next significant movement for Bitcoin and the wider market will depend on wider macroeconomic factors.

Post Comment