Stablecoins now represent over 1% of US dollar money supply, data shows

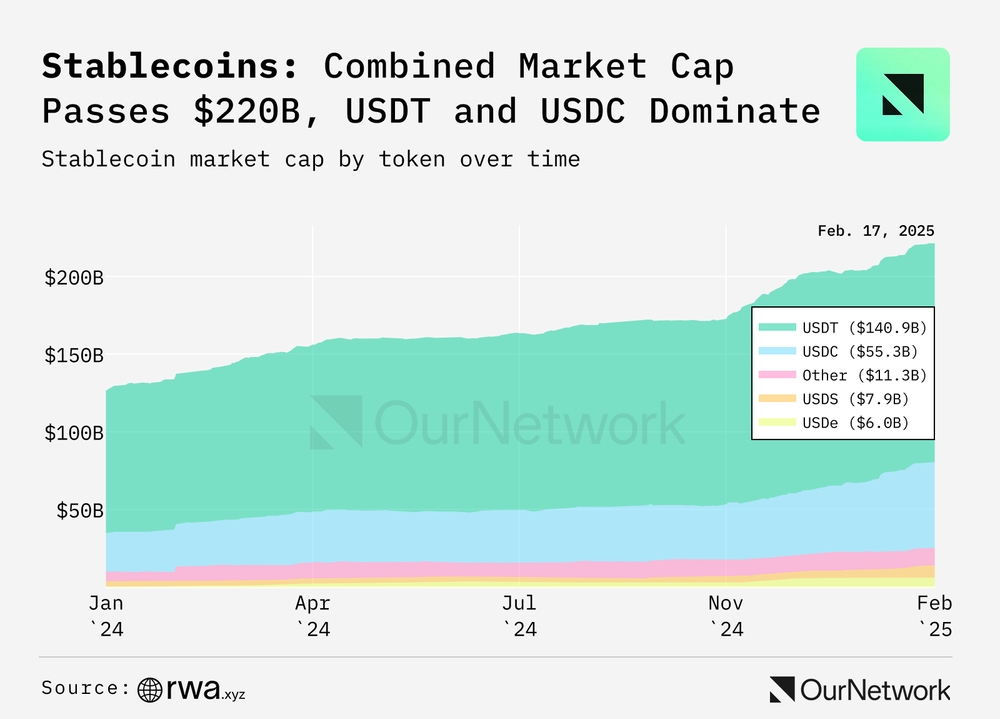

The total stablecoin offer exceeded $ 221 billion, representing more than 1% of the money supply of the US dollar.

StableOnce a niche sector is now representing more than 1% of the M2 US dollar – a wide measurement of money, including species and deposits – the money supply, the market reaching $ 221 billion after adding almost 100 billions of dollars since 2024, according to data Compiled by ournetwork analysts.

Tether’s (USDT) The market share increased from 73% to 64%, while Circle (USDC) gained ground, going from 20% to 25%. And although the two represent 89% of the total market share of the stablescoin, new players, such as the USDE of Ethena and USD0 of the habit, also have an impact.

The USDE synthetic dollar added $ 5.9 billion, while USD0 increased by $ 1.1 billion. FDUSD, who initially gained ground through promotions, finally “lost the market share as these incentives ended and that competition has intensified,” the analysts wrote.

According to Outnetwork, the recent growth of the USDC has been mainly pumped by adoption beyond Mainet d’Ethereum. Analysts note that the stablecoin issuer experienced “explosive growth” of more than $ 7.7 billion from USDC on Solana, “probably fueled by an increase in the negotiation activity of coins.” In addition to that, the USDC has also seen gains on layer 2 of Ethereum such as the base and the Coinbase arbitrum.

Meanwhile, the CEO of Circle Jeremy Allaire appears Regarding the strengthening of the American presence of the company, arguing that the dollar tokens transmitters should be required to register in the country. He said that “should not be a free pass” for stablecoin issuers in the United States, which could make it more difficult for his rival to develop in the country after having moved his headquarters to El Salvador.

Post Comment