‘Blind signing is an issue, but not the prime suspect’ expert says on Bybit $1.4b saga

Aneirin Flynn, co-founder and CEO of Faillsafe, spoke with crypto.Wews of the feat of Bybit, future preventive measures and why an Ethereum decline is impossible.

Cryptocurrencies prices have dropped following one of the largest cyber-braquents in financial history, as a group of Lazarus in North Korea raped Ethereum de Bybit (Ethn) Cold Wallet, steering wheel more than 400,000 Ethereum worth $ 1.4 billion at the time.

Ben Zhou, CEO of Bybit, was quick to defend the exchange. The community was kept informed, the industry leaders mobilized resources to help and have filled the financial gap in a few days, restoring withdrawals to normal.

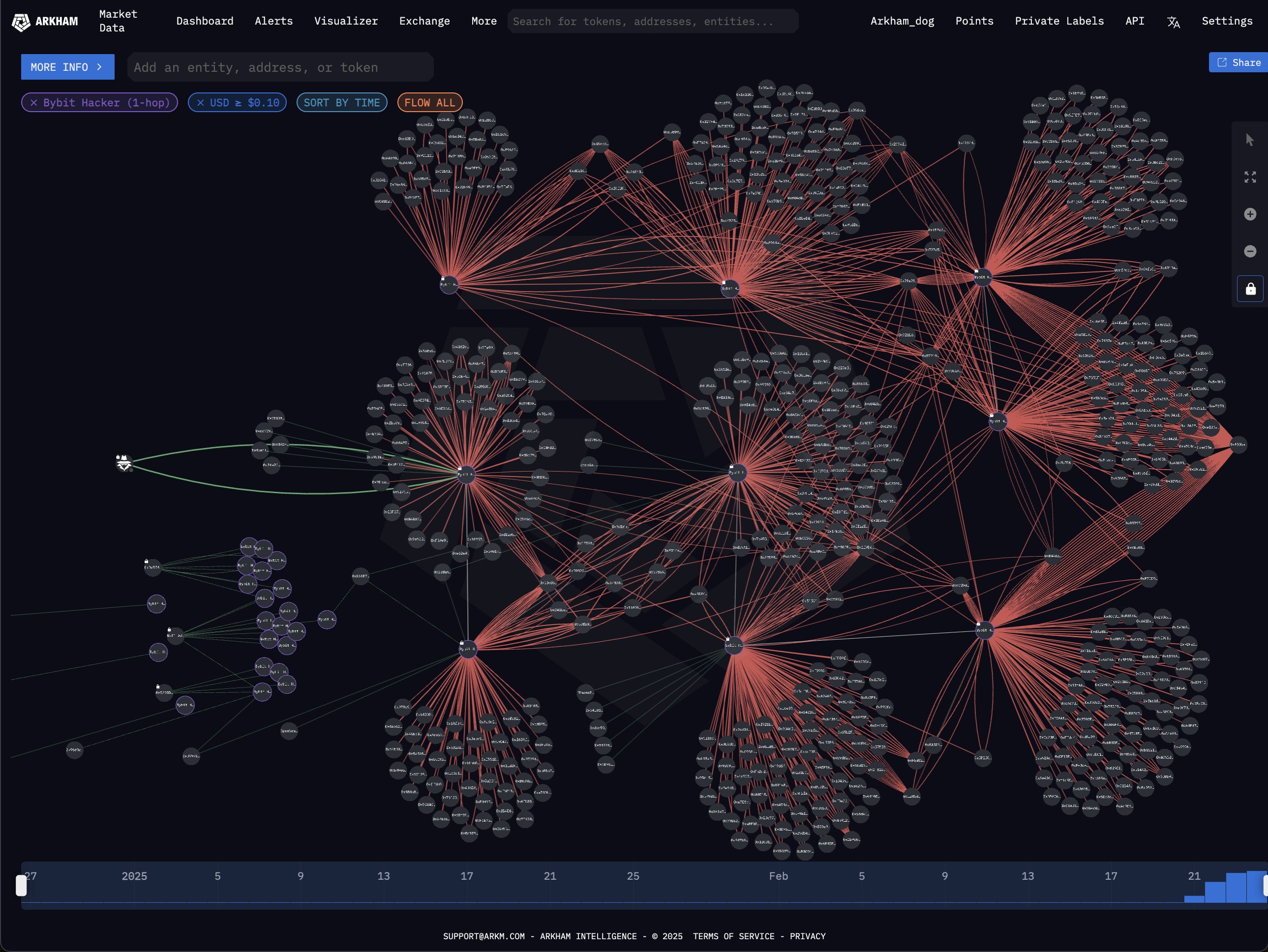

While the recovery efforts have progressed in a premium program and a chain follow -up, the pirates have laundered the stolen funds on thousands of addresses.

Hack, exploit or something else?

“It was a sophisticated social engineering attack,” the CEO of Faillsafe, Aneirin Flynn in Crypto.news, told CEO. Flynn said that hackers have used similar tactics against Radiant Capital, DMM Bitcoin and Wazirx.

In the case of Bybit, Zhou said that bad players had usurped the multi-Sig user interface and that the team signed the malicious transactions without knowing. Results of a audit Directed by Sygnia Labs and Verhains discovered that Lazarus agents used compromise access of a safety developer safely to deceive the multi-Sig signatories of Bybit.

This violation allowed cybercriminals funded by the North Korean to pass through a malicious transaction, siphoning funds from the cold portfolio of Bybit.

Multi-Signal blind sign

The incident has raised concerns concerning the blind signature, where users approve the transactions without fully checking details such as destination addresses.

According to Zhou, he was the final signatory and used a large book material portfolio to authorize the last approval. However, design limitations prevented the complete verification of transactions, ultimately allowing hackers to steal the funds.

“Yes, the blind signature is a problem, but this is not the first suspect in this case,” said Flynn when asked if it had allowed the theft. Instead, the CEO of Faillsfe underlined large groups of digital assets maintained by most of the more centralized exchanges and protocols in the industry.

Bybit painted a target on his back because he stored billions of crypto in a single multi-sig and Lazarus came to hit Flynn. The division of assets under management between several addresses can solve the problem, said the boss of Faillsfe.

Although greater vigilance of employees and safety tools for robust transactions have reduced the probability of a successful flight, the separation of assets would have been the most effective way to reduce the call of exchange to attackers.

Aneirin Flynn, co-founder and CEO of Faillsfe

Ethereum rollback not the solution for the support

Maelstrom CIO Arthur Hayes suggested going back the Ethereum blockchain to reverse bybit’s hacking, a decision that would restore transactions and portfolio balances to their pre-hack state.

Hayes argued that the 2016 Dao Fork established a previous one to happen. The pirates stole $ 60 million with Dao Ethereum at the time, a blow to Ethereum, which was still in its infancy at the time.

The DAO then voted for an “irregular change of state” to reduce the crisis. Ethereum was divided in two – Ethereum Classic, the original blockchain with the Dao Hack and Ethereum losses, the second blockchain today.

Short -term discussions based on the idea of Hayes noted that the Dao Hack 2016, an existential crisis for Ethereum at the time, was clearly different from the loss of $ 1.4 billion by Bybit, undoubtedly a splash in the ETH pond on the current market.

Flynn said that Ethereum’s reversal would now break too many protocols and smart contracts given the size of the ETH ecosystem. “Ethereum turning is technically possible through a hard but practically impracticable fork now due to the size, complexity and decentralization of the network.”

Post Comment