MOVE up 29% after World Liberty Financial investment, will the rally continue?

Move has rebounded his recent drop after World Liberty Financial of Donald Trump made a significant investment in Altcoin, aroused the speculation of a possible inclusion in the government’s strategic reserve of the government.

After reaching a hollow of $ 0.39,1121 on March 4, 2025, in the midst of the concerns of the trade war, movement (movement (movement (movement (movement (movement (movement (movement (movement (movement (movement (movement (movement (movement (movement (movement (movement (movement (movement (movement (movement (movement (movement (movement (movement (movement (movement (movement (movement (movement (movement (movement (movementMOVE) Rebounded at an intraday summit of $ 0.505 on March 6, displaying two -digit gains of approximately 29.1%.

According to the latest check during the Asian afternoon session, its earnings amounted to more than 33% of its local hollow on Tuesday. Altcoin’s market capitalization was based on more than $ 1.15 billion, while its daily exchange has almost tripled, oscillating more than $ 258 million.

Today’s earnings were launched after US President Donald Trump has linked the cryptographic project “World Liberty Financial” Bought $ 1.5 million in moving The tokens, among other altcoins, from a newly created multi-signature portfolio.

With White House Crypto summit One day, Move has triggered speculation in the cryptographic community that it could be part of the Crypto Strategic Reserve plans that President Trump recently revealed in the United States as the “cryptographic capital of the world”.

The summit, scheduled for Friday, March 7, will be chaired by venture capital David Sacks and the member of the Bo Hines congress. It should bring together founders, CEO, investors and crypto decision-makers to discuss the future of digital assets in the United States and marks another step in Trump’s push to make America a leader in digital finance.

With the pro-Crypto feeling that is gaining ground in policies’ development circles, investors seem to bet that the decision could also benefit from potential initiatives supported by the government, especially since it aligns the “Made in the United States“narrative.

By data From Coringlass, the demand of derivative merchants has recently increased, with an open interest in the Altcoin term market, leaping by 50% during the last day to $ 91 million at the time of the editorial staff.

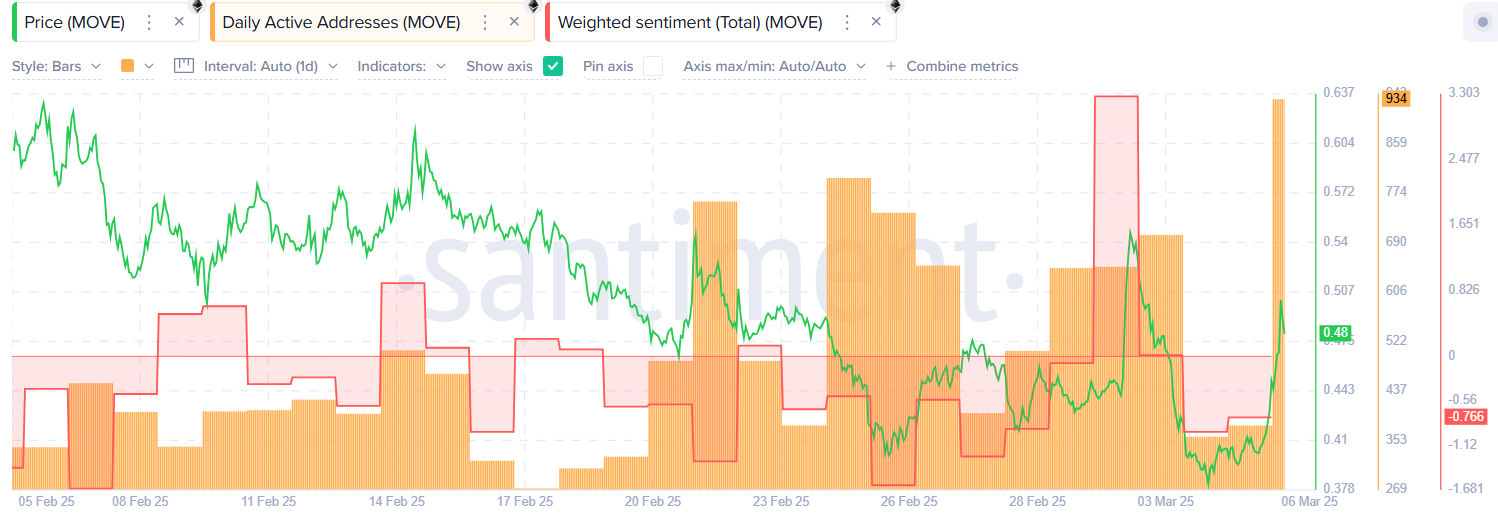

Meanwhile, data on santly show an increase of 146% of daily active addresses, which are often observed during the increase in commercial activity between the holders.

The move was trendy on X and Coingecko even if his social feeling was negative at the time of the press. As a rule, this means that price gains have followed recent events.

Travel price analysis

Technical indicators show that Altcoin is recovering from its bearish momentum, which has prevailed since the beginning of January this year.

On the 4-hour price table / USDT, MOVE again broke above the descending trend line which had been formed with lower ups and lower stockings since January 6, which traders consider a precursor for a trend reversal.

Move was negotiating near the Bollinger’s upper band, suggesting strong purchase pressure, with new flowing money on its market.

The MacD lines also pointed out, the MacD line crossing the signal line while remaining above the price line, confirming a possible trend reversal, especially because the Altcoin trading volume increased during the last day.

Other Rininglass data show that investors have accumulated a movement, net outings of exchanges totaling almost $ 11.5 million in the past 12 days, showing that its investors believe in more potential future gains.

Consequently, the movement could potentially reach its psychological resistance at $ 0.55, a level which it did not succeed on March 3. If he manages to move above this level, the next moving target would be $ 0.68, a level of resistance which he had trouble breaking several times in early February.

Disclosure: This article does not represent investment advice. The content and equipment presented on this page are only for educational purposes.

Post Comment