Crypto bloodbath drives options buying as volatility surges

Crypto’s current Blood Bath Bath pushes investors to seek protection by buying options.

According to Bybit x Block Scholes Analysis report of Crypto derivativesThe current slowdown in the cryptography market has prompted investors to buy options like covering themselves against new losses.

When Trump announced that the United States would create a Crypto Strategic Reservewhich would consist of bitcoin (BTC), Ethereum (Ethn), Ripple (Xrp), Solana (GROUND), and Cardano (ADA), Price of all these pumped assets. However, their rallies were short -lived like Trump’s promises again price On imported goods, discourage investors from risky assets due to the resulting macroeconomic uncertainty.

The sudden swings caused by these two developments – first, the news of the reserve pushing the prices of cryptography, then the new tariffs leading them – increased market volatility.

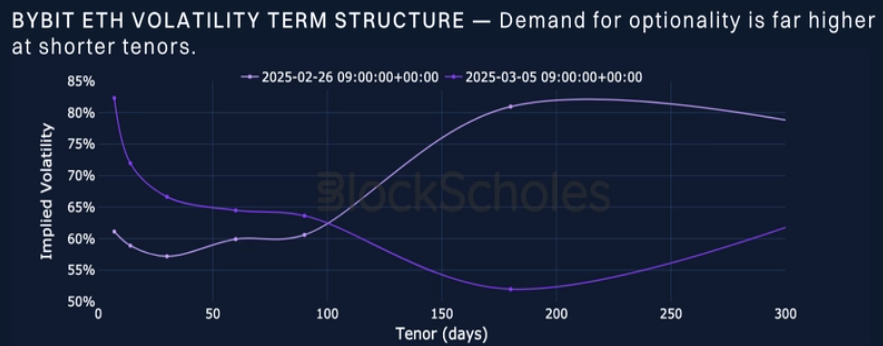

Consequently, the volatility made (how much the price really moved) is now higher than implicit volatility (which options of options expect the price to evolve). This change prompted traders, worried about new decreases, to start buying short -term options to cover yourself against potential losses.

The fact that traders turn to installation options suggest that they expect a significant short -term drop. It aligns a lot analysts’ predictions. For example, Arthur Hayes said in his Recent article on x That it expects Bitcoin to hold the level of $ 78,000, and maybe even lower at $ 75,000.

Post Comment