Japan’s 40Y Bond Yield nears all-time high, here’s how it impacts the crypto market

The yield of Japan bonds 40 years reached 2.85%, dangerously close to its historic level of 3%. The difficult situation of Japan could cause a delay effect that can make us climb the yields and finally send the cryptography market to a descending spiral.

According to data of the commercial economy, Japanese The yield of bonds at 40 years peaned at 2.85% on March 10, on the basis of over -the -counter interbank return quotes. The site indicates that the last time that the bond performance of Japan 40 years has reached a summit of 3% of all time in January 2011. However, Bloomberg noted that he reached This level in January 2024.

Japan is the holder of the world’s largest heap of debt, which represents more than double its economy worth 5 billions of dollars. Reference of this debt to higher yields will require higher costs, and with the Bank of Japan holding around 70% of their state obligations, the markets could start to doubt its sustainability

For decades, Japan monetary policy has maintained its extremely low rates. However, the peak in the yield of Japan bonds 40 years could point out a gap in inflation and interest rates at the national level. If the yields continue to increase and potentially reach the highest 3%, it can attract Japanese investors to interior returns and far from American returns.

For the context, Japan is one of the greatest foreign holders of American treasury bills. As Japanese yields become more attractive, Japanese investors may prefer them to American debt that offers lower yields. This could reduce the demand for American treasury bills, which could lead to higher American yields while the US government is trying to compete.

An increase in American yields could signify an increase in loan costs for government and private societies. Not only could that high yields strengthen US dollars alongside treasury bills.

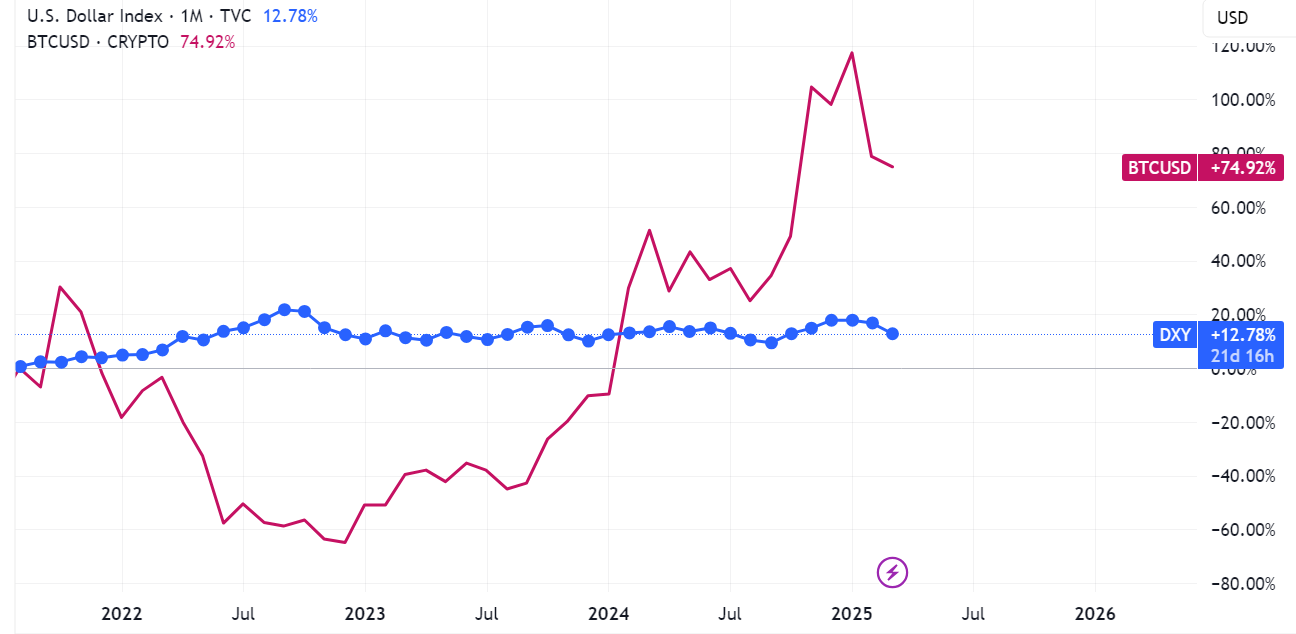

As we can see in the above graph, the US dollar index and the cryptography market (represented by the bitcoin of the staples (BTC) Price) have an opposite relationship. Therefore, when the dollar increases, crypto tends to drop.

When conventional assets like the dollar and American treasury bills offer better yields, investors can flock to them and divert their funds from more risky alternative assets, such as shares and the cryptography market. In addition, the increase in yields on state bonds could also indicate stricter global liquidity.

For the cryptography market, which generally benefits from bulk monetary conditions and many liquidity, this monetary change could be catastrophic. Cryptographic markets are particularly sensitive to changes in overall liquidity and the feeling of risks, so this change could lead to an increase in volatility and downward pressure for cryptographic assets.

Investors keeping their funds away from risky assets, this could possibly reduce the entrances to the crypto on the cryptography market, causing drag on cryptography prices.

Overall, Japan’s obligations’ return 40 years could cause trouble for the cryptography market. The change under the monetary conditions led by the yield of Japan bonds 40 years reaching its 3% more could strengthen the dollar, to strengthen global liquidity and to reduce the capital of investors in more risky assets such as crypto.

Post Comment