Stock market crash weighs on crypto with continuing sell-offs and slowed stable coin inflows

The cryptography market is bleeding due to a broader sale in technological actions, fueled by concerns about potential trade wars and a possible economic slowdown in the United States.

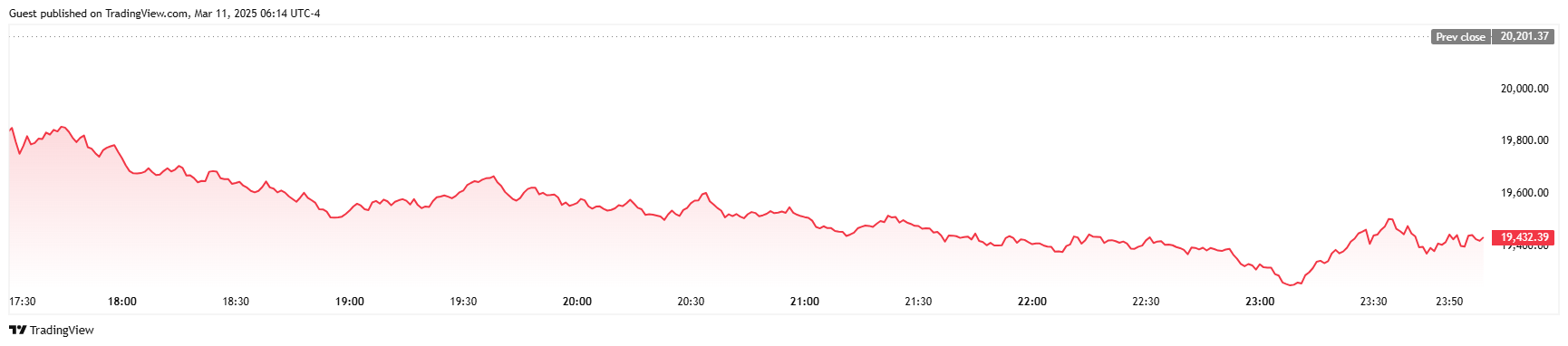

Monday, Bitcoin (BTC) The price dropped from 4% to $ 80,000 while Ethereum (Ethn) The price dropped by 6% to $ 1,756, a level that we have seen since October 2023, although the two active has since recovered some of these losses. At the time of the press, the BTC is back at $ 81,600, while the ETH climbed to $ 1920, although both is down 1% and 8% compared to yesterday, respectively.

The drop in cryptography prices has been triggered by a larger sale of technological stocks in the United States. The Nasdaq index 100which is strongly weighted for technological companies, has known its worst day yesterday since October 2022, fell by 3.8%. Economic experts are croissant Their forecasts of a potential economic slowdown in the United States Donald Trump warned against a potential “disturbance” of trade wars With Canada, Mexico and China.

“Now that the industry has its strategic Bitcoin reserve management decree, Crypto has a catalyst before less positive at a price, and we are at the mercy of macro-risk appetites”, ”

Hawk The world co-chief of markets, said Joshua Lim.

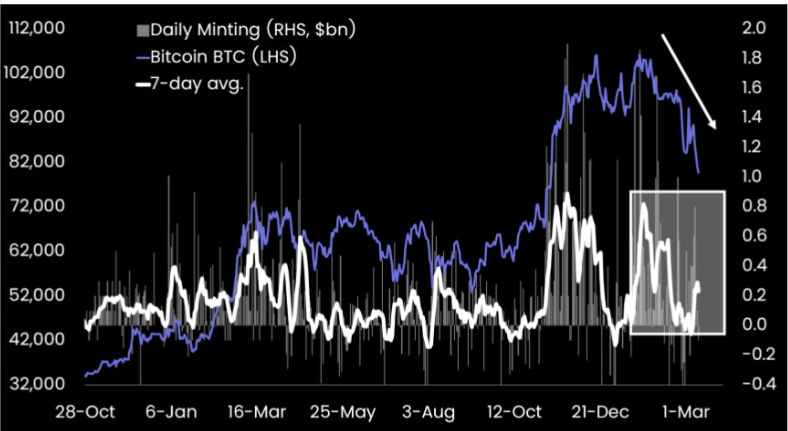

The crypto stroke following a stock market market is also obvious in the slowdown in stable Entrances. Depending on the graph Matrixport shared on x Today, Stablecoin entries have dropped by more than 50%, correlation with the drop in bitcoin prices of its peak. In December 2024, the Stablecoin striker culminated nearly $ 1.8 billion. In March 2025, it fluctuated between $ 0.4 and $ 0.8 billion, a drop of more than 50% compared to the summit.

Stablecoins are often used for the entry / exit from the market and ensure stability, therefore a drop in their strike has a direct impact on liquidity. This suggests less crypto demand, pushing the market more to consolidation. Matrixport analysts attribute the slowdown in stablecoin strike with two main factors. Either the stablecoin transmitters have accumulated sufficiently in the reserves. Or, there is simply not enough market demand. Whatever the cause, the cryptography market needs a significant injection of new capital to increase prices.

Post Comment