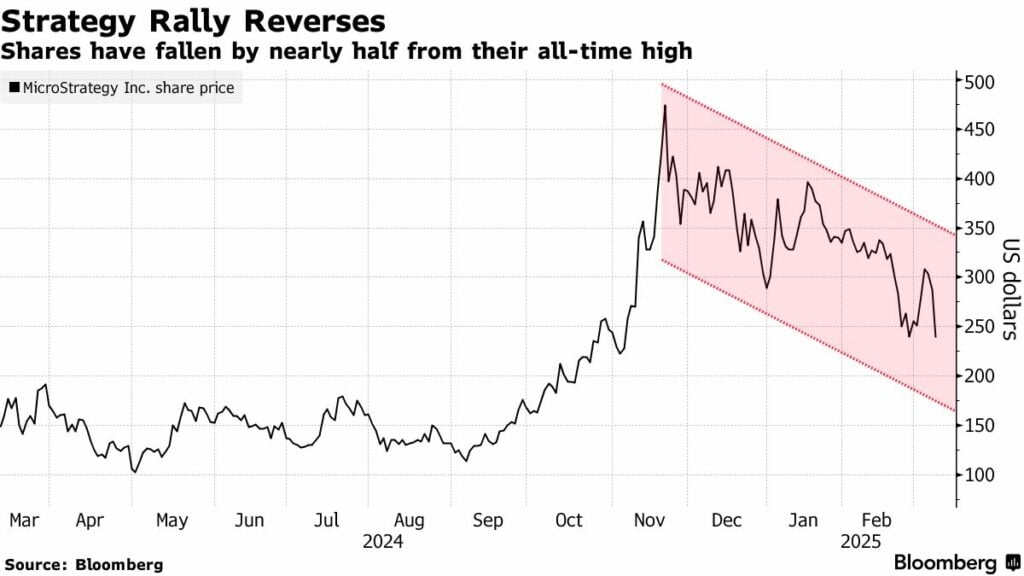

Strategy stock plummets 50% from November peak, but Saylor keeps betting big on BTC

Strategy shares are down almost 50% compared to its November peak, but the company continues its aggressive bitcoin accumulation strategy in the middle of the current crypto Bloodbath.

The actions of the strategy plunged 17% yesterday, closing at $ 239.27. This marks a shaving of almost 50% of its value since its peak of $ 473.83 in November 2024. According to BloombergThe actions of the strategy have increased even faster than Bitcoin, motivated by optimism that Trump would create a strategic bitcoin reserve. However, as Bitcoin (BTC) made most of its recent gains, strategy actions have dropped at an even higher pace.

The feeling of investors has become particularly sour Trump decree It is clear that the reserve would consist of a bitcoin owned by the existing government (acquired from the BTC crisis in criminal cases), and that no additional purchase beyond the budgetary strategies will be made.

Bitcoin and strategy had to face additional pressure on Monday due to a broader change in risk assets in the middle of macroeconomic uncertainty, mainly due to Trump’s trade war with Canada, Mexico and China. Bitcoin dropped by 4%merchant about $ 80,000.

Despite the drop in stock and Bitcoin who finds it difficult to have key support, the recently strategy announcement That he wants to collect $ 2.1 billion by selling his privileged class A strike actions and using this money to buy more bitcoin. This is part of a broader plan (“21/21 roadmap”) led by their executive president, Michael Saylor, to lift a total of $ 42 billion and invest it in Bitcoin. In addition, the strategy remains ahead of its Bitcoin purchases, recently snap 20,356 BTC for almost $ 2 billion at an average price of $ 97,514, when its stock was Already in free fall.

With the latest addition, Bitcoin Stash of Strategment is now 499,096 BTC, purchased with around $ 33.1 billion to buy it, with an average of $ 66,357 per Bitcoin, and financed it mainly through stock sales. Its total assets are now worth around 40 billion dollars representing approximately 21% of unrealized gain Current BTC price of $ 80,381.

Even if some are skeptical about the purchases of BTC de Saylor in the current climate, analysts generally have a positive vision of the future of the strategy. More specifically, the eleven financial analysts interviewed by Bloomberg Recommend to investors buys the actions of Strategy, predicting that the course of action will exceed the peak of $ 540 that it reached last year.

Post Comment