Bitcoin price tanks as short-term holders capitulate, echoing August 2024 crash, analysts say

A wave of capitulation of short-term holders reduces the lower Bitcoin price, strengthening the bearish pressure, Glassnod analysts warn.

The price of bitcoin (BTC) is now subject to high sales pressure, as short -term holders have started to unload their parts at a loss, much like the slowdowns of the past market, according to a Glassnod research report.

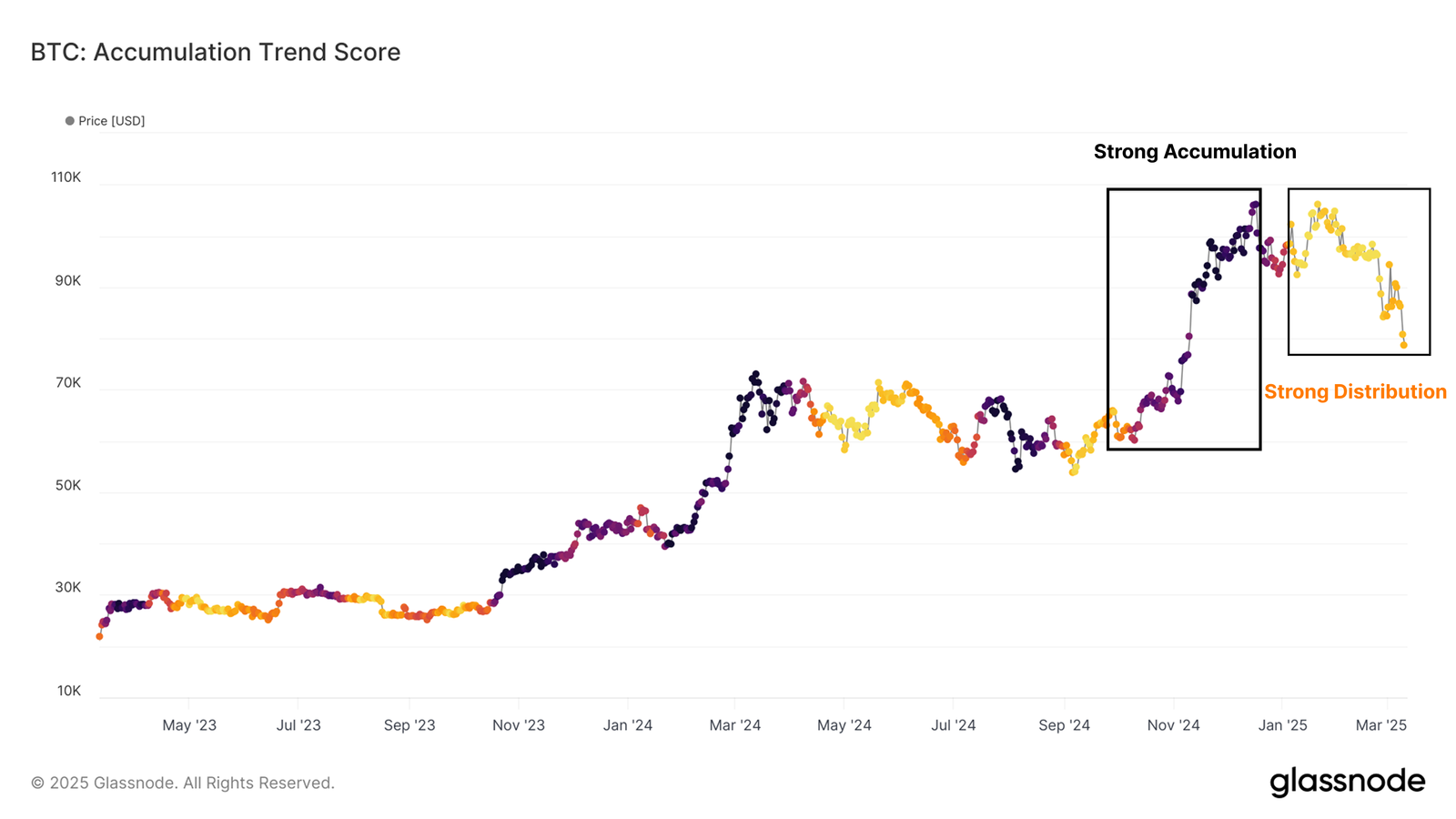

Since January, the accumulation trend has remained low, showing that buyers do not enter to absorb the sale.

The decline aligned with the Bitcoin slide from $ 108,000 to $ 93,000, which sparked concerns concerning the discoloration of demand, wrote Glassnode in a March 11 report. Market confidence has weakened at the end of February as external risks, especially SUBLE CYBERATTAC And the increase in American tariff tensions, additional uncertainty.

“Unlike the previous phase, there was no significant response to the drop in decline this time, indicating that feeling had moved to risk aversion and capital preservation rather than continuous accumulation.”

Glass knot

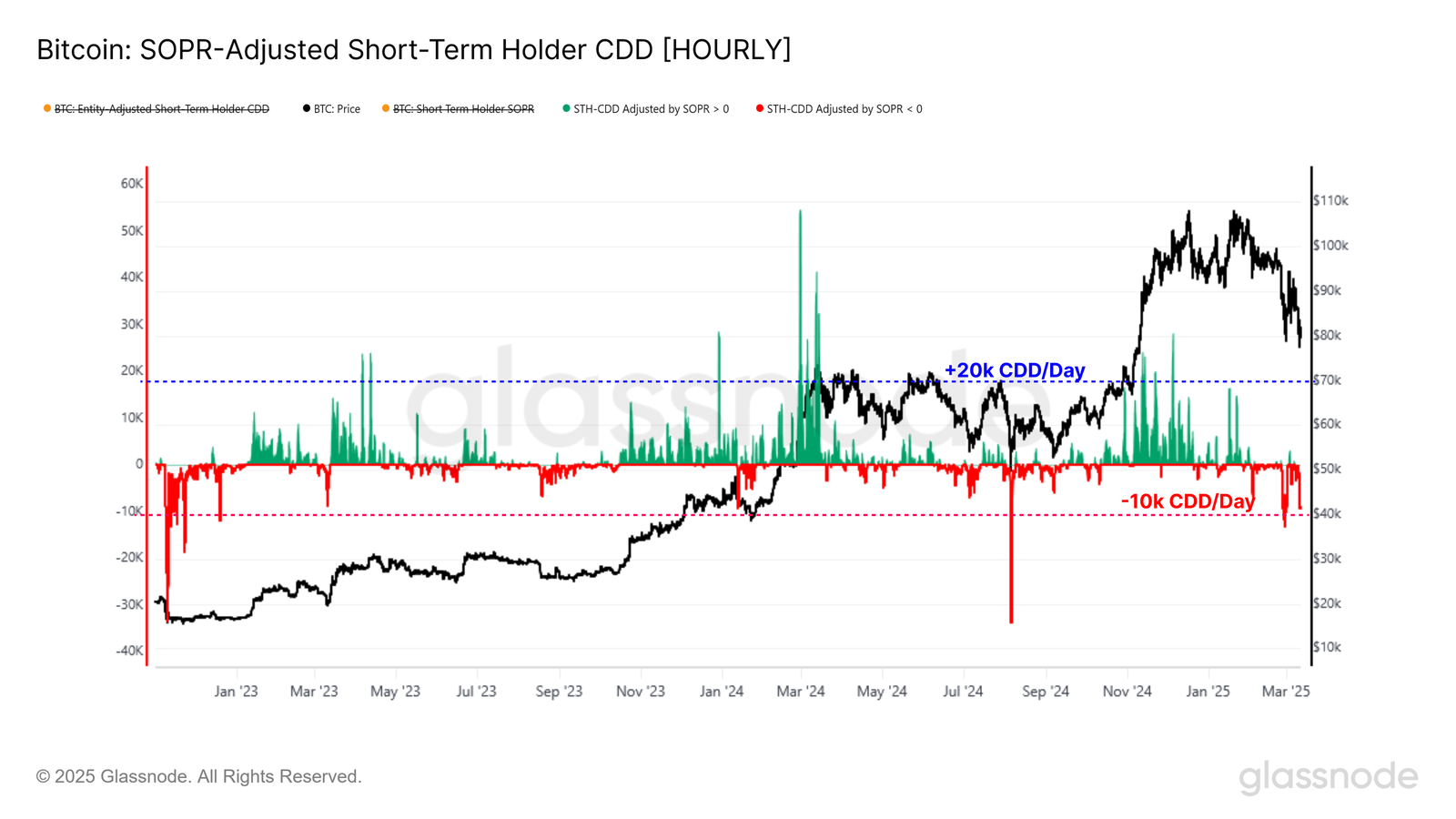

Short -term holders take the greatest success as Bitcoin prices fall, according to data. Since he fell below $ 95,000, the most recent buyers have sold at a loss. At worst, the sale pressure has pushed the production profits ratio spent in the short term – follows if short -term holders are sold to profit or loss – at 0.97 when Bitcoin crashed at $ 78,000, showing the extent of panic.

Another key metric, short -term short -term storage holder days confirms panic -ordered sale, says Glassnode, adding that recent sales by the main buyers “led this indicator to -12.8,000 days of parts per hour, reflecting an intense realization of losses and a moderate capitulation event.”

“A similar model emerged in August 2024, when Bitcoin plunged $ 49,000 in the middle of market stress and macro uncertainty. The current structure suggests a comparable capitulation phase. »»

Glass knot

Bitcoin is now trading near the key levels of cost, analysts suggested that the market could enter a consolidation phase before finding business support.

Post Comment