cyrpto

ETF, Franklin, joins, lawsuit, Nears, race, reportedly, resolution, Ripples, Templeton, XRP

Mark

0 Comments

Franklin Templeton joins XRP ETF race as Ripple’s lawsuit reportedly nears resolution

Franklin Templeton filed a launching file for a bargain -based fund based on Ripple’s XRP, joining Bitwise, Canary Capital and others in the ETF XRP race.

Franklin Templeton has laid To launch Ripple (Xrp) ETF, depending on its cash price minus the costs. ETF shares will be negotiated on the CBOE BZX exchange, while Coinbase will serve as a goalkeeper. ETF holders will not receive any advantage of the forks or airfields linked to XRP.

By depositing ETF Ripple, CBOE joins Bitwise, 21Shares, Wisdomtree, CornersCanary Capital and Gray Level Investments in the race to launch investment products based on XRP. The American Securities and Exchange (SEC) commission has already recognized the proposals of these companies and is taking advantage of approval decisions. It is also important to note that the dry delayed his decision On the Graycale ETF, pushing it until May.

According to Bloomberg analysts, ETF XRP have 65% chance of approval, which makes it less likely than Litecoin (Thal), Solana (GROUND), and even Dogine (DOGE).

However, they released their chances in February, which means that they did not take into account recent development. More specifically, the legal battle between Ripple Labs and the American Commission for Securities and Exchange (SEC) could be packagingAccording to the journalist of Fox Business Eleanor Terrett.

https://twitter.com/elean boretrett/status/1899852341374779587

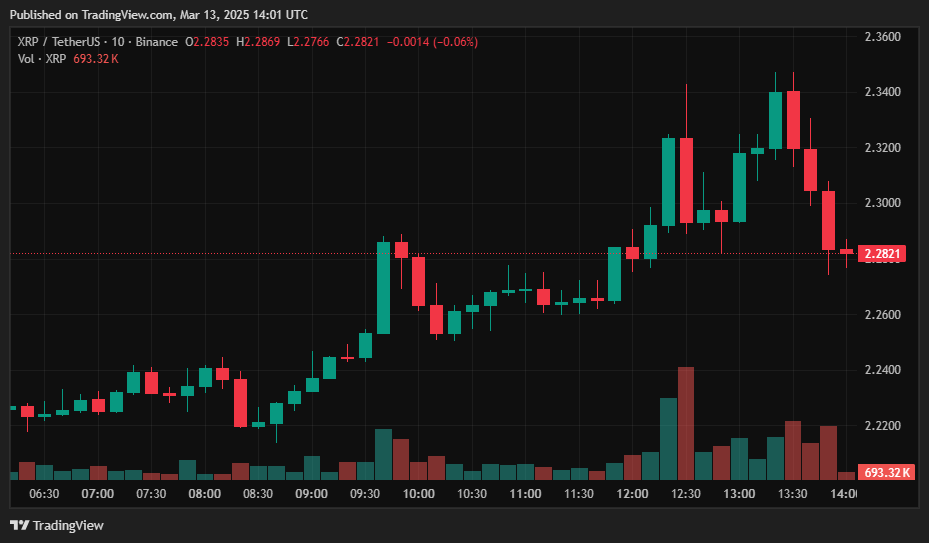

The reaction of the market to this scoop reflected a classic case of purchase of the rumor, to sell the news. On the first reports of the XRP case potentially at the end of the conclusion, the XRP price increased by 4% in the last 24 -hour period, but after cooling the media threshing and more news followed, a wave of sales pressure was launched, as evidenced by the four consecutive lower candles on the graph of the shorter period.

With the prolonged undulation trial potentially approaching the resolution, in particular given the recent rejection of prosecution by the dry against other cryptography companies, the approval of the ETF XRP seems more and more likely. The case was probably the main obstacle to corps based on ETFs, because it created a regulatory uncertainty around the status of XRP as security. If this regulatory obstacle is ultimately removed, the arrival of the XRP ETF discrepancy could go from speculation to reality, potentially preparing the ground for a more sustained XRP price movement. In addition, Franklin Templeton’s entry into the ETF XRP race is another good sign, which suggests that they see a decent chance of approval.

Post Comment