US court permits Three Arrows Capital to expand claim against FTX, rejects FTX’s objections

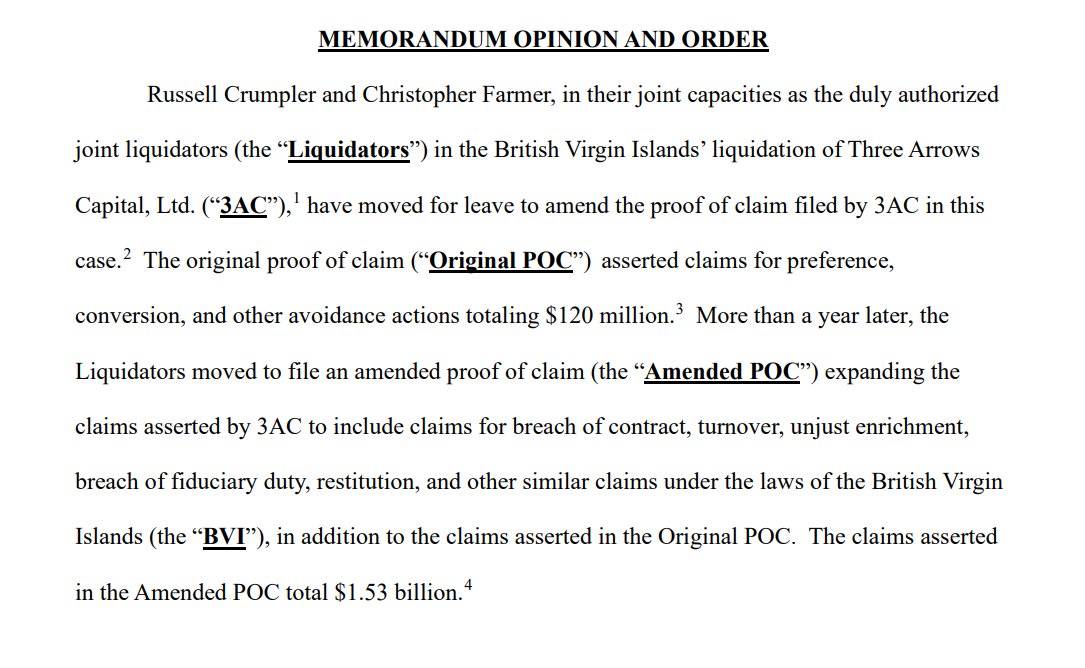

A bankruptcy court of the United States has enabled the liquidators of the deceased Hry-sided hedge of three arrows to considerably pass its complaint for the FTX of the exchange of collapsed crypto from $ 120 million to $ 1.53 billion.

In a March 13 decision By the United States Court of bankruptcy for the Delaware district, the judge ruled that the FTX should pay $ 1.53 billion to three Arrows Capital, increasing the claim of the $ 120 million initial dollars filed in June 2023. However, the judge ranked on the side of 3ac liquidators, believing that they had provided sufficient notice for their complaint. The judge determined that the delay in filing the greater complaint was mainly due to the fact that FTX did not quickly share the relevant files with 3ac liquidators. 3ac liquidators needed this information to assess and detail their complaint correctly.

3ac liquidators claim that FTX held $ 1.53 billion in 3ac assets, which were then liquidated to repay 3ac debts. In addition, 3ac liquidators argued that these transactions were avoidable and that the FTX did not provide the information that would have discovered the liquidation.

3AC and FTX were once major actors in the world of cryptography, but the two were not disappeared. Capital of three arrows was one of the largest hedge funds Crypto which collapsed in June 2022 due to the forced liquidation of the Bitcoin (BTC), Ethereum (Ethn), and other altcoins. They laid For bankruptcy in July 2022. Its liquidators are now trying to recover funds by selling their remaining assets and thanks to various prosecution, notably against FTX and Terraform Labs to reimburse its creditors.

FTX Crypto Exchange declared bankruptcy in November 2022 and also saw having tried to recover funds thanks to various prosecution, including one against Binance and Changpeng Zhao. FTX recently begin Their reimbursement process was made easier by Bitgo and Kraken exchanges.

Post Comment