Bitcoin choked by ‘exacerbating sell-side pressure’ from short-term holders: report

Bitfinex analysts said Bitcoin buyers with purchases in the last month were touched during recent cryptocurrency sales.

Bitcoin (BTC) lost 13.5% of its value in the last 30 days and has dropped more than 29% of its whole of all time in January, the largest correction of the current bull cycle, according to the Bitfinex Alpha ratio released March 17.

Previous cycles have experienced similar withdrawals ranging from 30% to 50%. However, some expected a different result this time due to a new institutional adoption through negotiated funds in exchange for BTC in Wall Street.

US SPOT BTC ETF recorded a blitz at more than $ 100 billion in assets under management in a year, because issuers like Blackrock and Fidelity attracted massive capital.

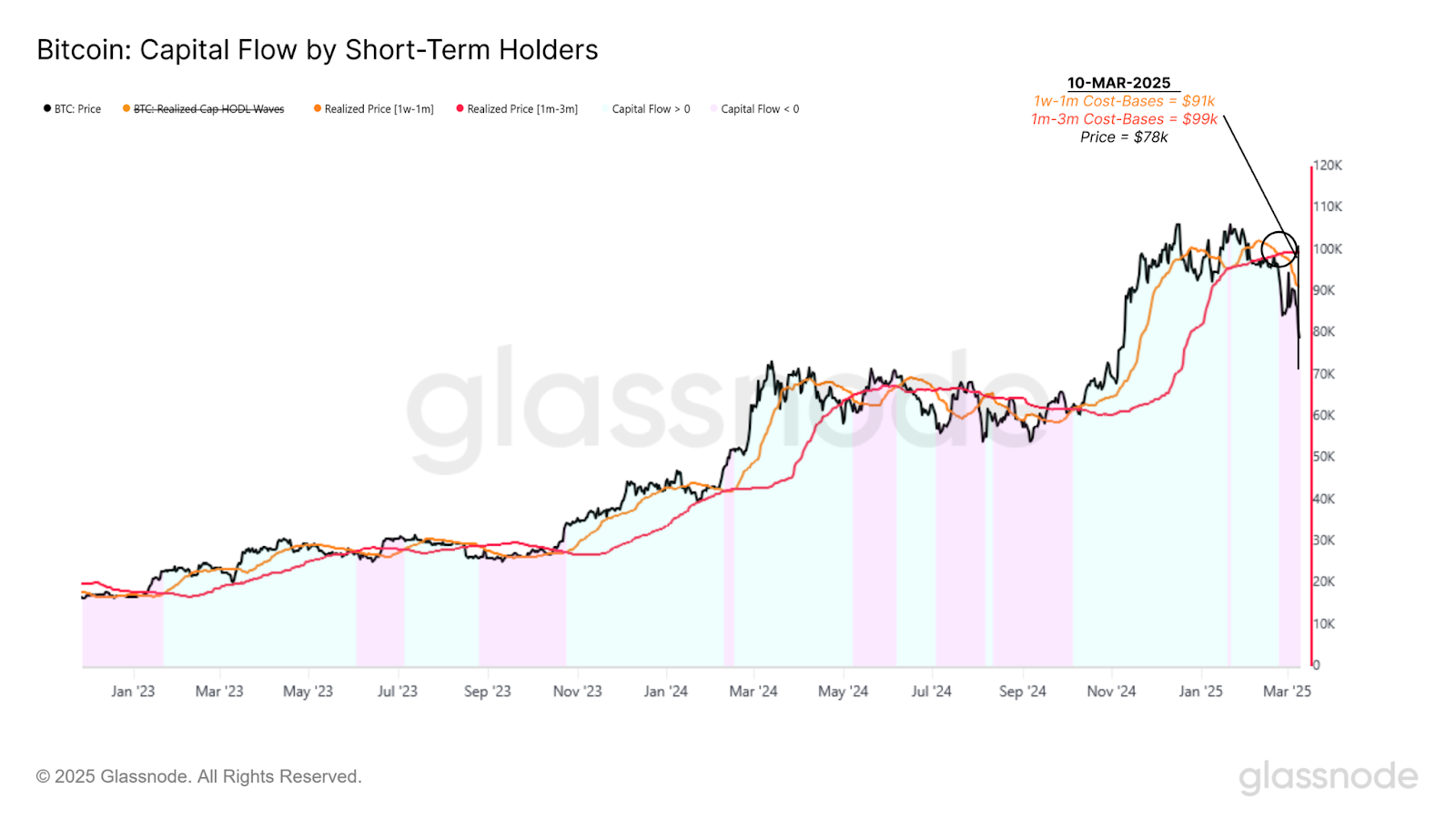

Capitulating short -term Bitcoin capitulants

The species allocated to these EFTs has flowed in recent weeks, while consecutive outings have now established records. Last week, almost a billion dollars left These products noting that “institutional buyers have not yet returned with sufficient force to counter the sales pressure,” wrote Bitfinex analysts.

Teepid Price action has also shook the feeling of cryptography. Indicators such as the Fear & Greed index fell on multi -year stockings, “exacerbating sales pressure” like capitulated short -term holders, according to the Bifiniex report.

Intotheblock data supported the assertion of Bitfinex analysts. The metric “Global in / Out of the Money” has shown 20% of all BTC holders in unrealized losses. Most of these buyers bought their bitcoin between $ 85,700 and $ 106,800 per intothebloc.

Historically, when new capital entries slow down and basic cost trends are changing, it signals a weakening request environment. This trend has become more and more obvious while Bitcoin is struggling to maintain above key levels. Without new buyers involved, the risk of prolonged consolidation bitcoin, or even more downwards while the lower hands continue to leave their positions.

Bitfinex analysts

Possible turning

Additional drop-down action can also follow as the financial markets digest the result of Trump prices and American macro-data.

While inflation has cooled and the job market has shown signs of resilience, an increase in underemployment and macro uncertainty has aroused a practical approach to many investors. However, Bitfinex analysts believe that a bullish result remains possible if the right factors line up.

The key factor to be monitored is whether long -term holders or institutional demand reappear at these lower levels. If deeper investors are starting to absorb the offer, this could point out a transition to accumulation, potentially stabilize prices and to reverse the feeling.

Post Comment