Fidelity files with the SEC to launch blockchain-based U.S. dollar money market fund

The asset manager Fidelity Investments filed with the Securities and Exchange American Commission for regulatory approval in order to launch a class of tokénized shares based on the blockchain of its monetary market in US dollars.

Fidelity Investments has subject a proposal To create a version based on the blockchain of its American monetary market fund. The proposal, filed with the SEC, aims to record a class of “onchain” actions of its Fidelity Treasury Digital Fund (FYHXX), which holds cash and American cash securities.

Currently, this fund uses Ethereum (Ethn) Network, with plans to potentially include other blockchains in the future. If it is approved, this fund will become active on May 30.

Fidelity’s deposit is part of a trend among financial institutions to move traditional financial products such as government obligations on blockchain platforms for better efficiency and faster transactions. Franklin Templeton was the pioneer of this trend, launch It is Monetary chain market funds FOBXX in 2021.

After the pioneering efforts of Franklin Templeton, other financial giants, including financial heavy goods vehicles such as JPMorgan and Blackrock, entered space.

In 2023, JPMorgan launched a Treasury-Trésor bond funds in the United Stateswhich invests in the debt securities of invoices, bonds and tickets of the US Treasury.

In March 2024, BlackRock, in partnership with the SECURITIZE digital asset company, spear A BUIDL of the US Treasury bill tokenized, which recently exceeds 1 billion dollars of assets under management.

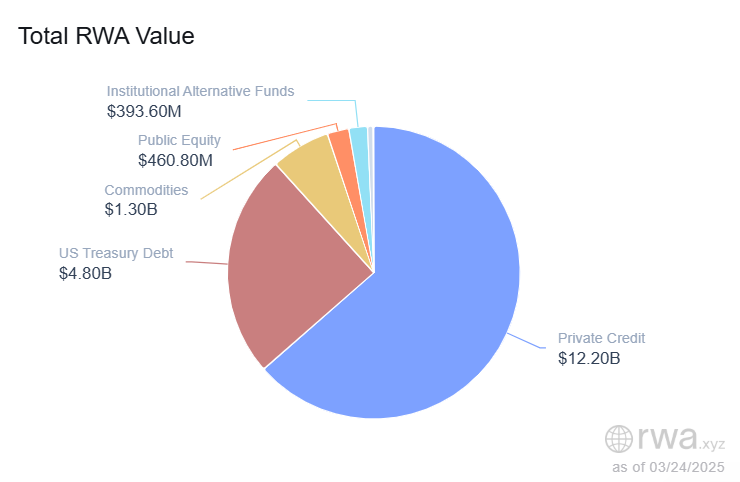

According to Rwa.xyzThe debt of the US Treasury Tokenized is now the second contributor to the total value of the tokenized active assets, with a market capitalization of $ 4.80 billion, following only private credit funds, which hold $ 12.20 billion.

Post Comment