Why is Pi Network price down despite crypto market recovery?

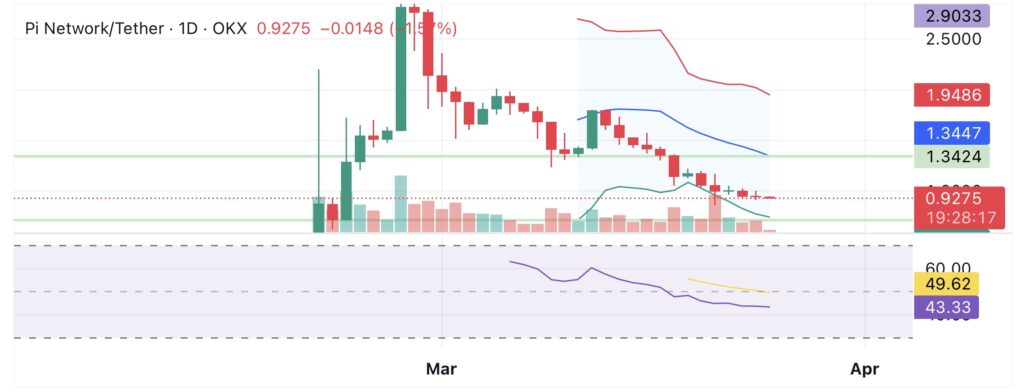

The price of the PI network fell below $ 1, now negotiating $ 0.92 after a drop of 4% during the last day despite a broader recovery in the cryptography market.

PI continues to fight, below More than 65% compared to its previous $ 3 summit this year. The growing power pressure is one of the main causes of this drop. According to data From Pi Scan, nearly 99.3 million pi (Pi)) The tokens, worth around 91 million dollars at prices on March 25, should be unlocked over the following 30 days.

An average of 3 million tokens will be unlocked every day during this period. On April 3, the largest unlocking of a day will take place, putting 6.8 million tokens in circulation. With a total of 115.57 million in April, 182 million in May, and 222 million in June, even larger unlocks are planned in the future. More sales pressure could result.

The uncertainty surrounding the exchange lists also had a negative impact on the feeling of investors. Many people hoped for a binance registrationBut they become more and more frustrated because there was no confirmation. Centralization concerns also increase.

Unlike most blockchains where nodes are executed independently, the Pi Core team is in charge of PI supernodes. Although there are now 42 of these nodes instead of three at launch, Pi Network did not specify how these nodes were chosen.

According to some, burning tokens could help at the price stabilization. On a post of March 24 on X, the cryptocurrency analyst, Dr. Altcoin, recommended reducing the offer from 60 to 100 million PI parts to balance the market. Although the PI network has recently burned 10 million tokens, reducing the total number of traffic to 6.77 billion, the price has not benefited much from this burn.

On the technical side, PI is negotiated at $ 0.9253 and displays a low trend. The support is $ 0.70 and the price is struggling to hold more than $ 1.00, which is used for immediate resistance.

With Pi near the lower strip, the Bollinger strips indicate that the sellers control prices’ oscillations. Although it has not yet reached the levels of occurrence, the index of force relating to 43.27 indicates a downward trend. Significant mobile averages (10, 20, 30 periods) indicate a sale pressure, and the divergence of the moving average convergence is also lower.

PI can fall into the region of $ 0.70 if it was less than $ 0.85. With $ 1.34 as a next target, a break greater than $ 1.00 could change the momentum. For the moment, PI remains weak unless buyers push it higher.

Post Comment