USDC hits record $60B market cap, surpassing 2022 high and outpacing USDT growth

The Stablecoin USDC of Circle reached a record market capitalization of $ 60 billion, exceeding its previous summit of $ 55 billion in June 2022.

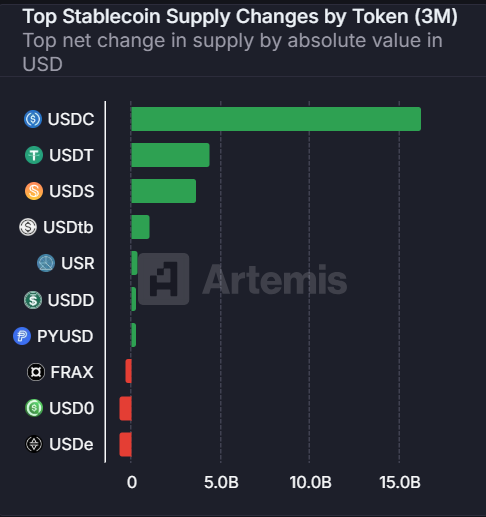

USD coin (USDC) has reached a new historic summit, exceeding a market capitalization of $ 60 billion and exceeding its main competitor’s attachment (USDT) growing in the past three months. During this period, the USDC added $ 16.3 billion to its supply while the USDT offer increased by only $ 4.4 billion, according to Analytics Artemis. However, the USDT still dominates the classification of the Stablecoin market capitalization, its market capitalization currently at $ 144 billion.

The main engine of this growth was the sharp increase in the activity of Stablescoin on Solana (GROUND), with the value of the stablecoins on the network recently exceeding $ 10 billion for the first time, largely fed by the USDC de Circle emission. According to ParadeThe USDC now represents almost 80% of the Solana Total Marche capital at more than $ 12 billion.

Stablecoins have recently gained ground while governments around the world provide greater regulatory clarity on their emission and use. In 2024, Stablecoin transaction volumes exceeded the visa and the Mastercard Combined total of almost 8%, according to Landscape report to the stable range by Cex.io. During this period, the Stablecoin offer increased by 59% – exceeding $ 200 billion –Put the stable -co -lecoing share of the total US dollar offer at 1%against 0.63% at the start of the year.

In addition, many financial services and crypto providers have launched their own stablecoins. Notable examples include Pyusd de PaypalSupported by deposits in US dollars and short -term treasury bills, and RUSD supported by the Ripple dollar.

More recently, World Liberty Financial Inc. spear USD1, a stablecoin entirely supported by American treasury bills and cash deposits, initially deployed on Ethereum (Ethn) and Binance Smart Chain (Bnb). Responding to the concerns that the USD1 could replace USDT and USDC, Changpeng Zhao recently declared that the most stable, “the happiest”. The growth of the stablescoin is good for the crypto because they serve as a key source of liquidity, and their expansion supply means an increasing demand for investors.

Post Comment