Bitcoin already priced in recession fears, but downside risk still remains: Bitwise

Although Bitcoin has taken into account many recession problems, Bitwise analysts warn that risks could still be in advance.

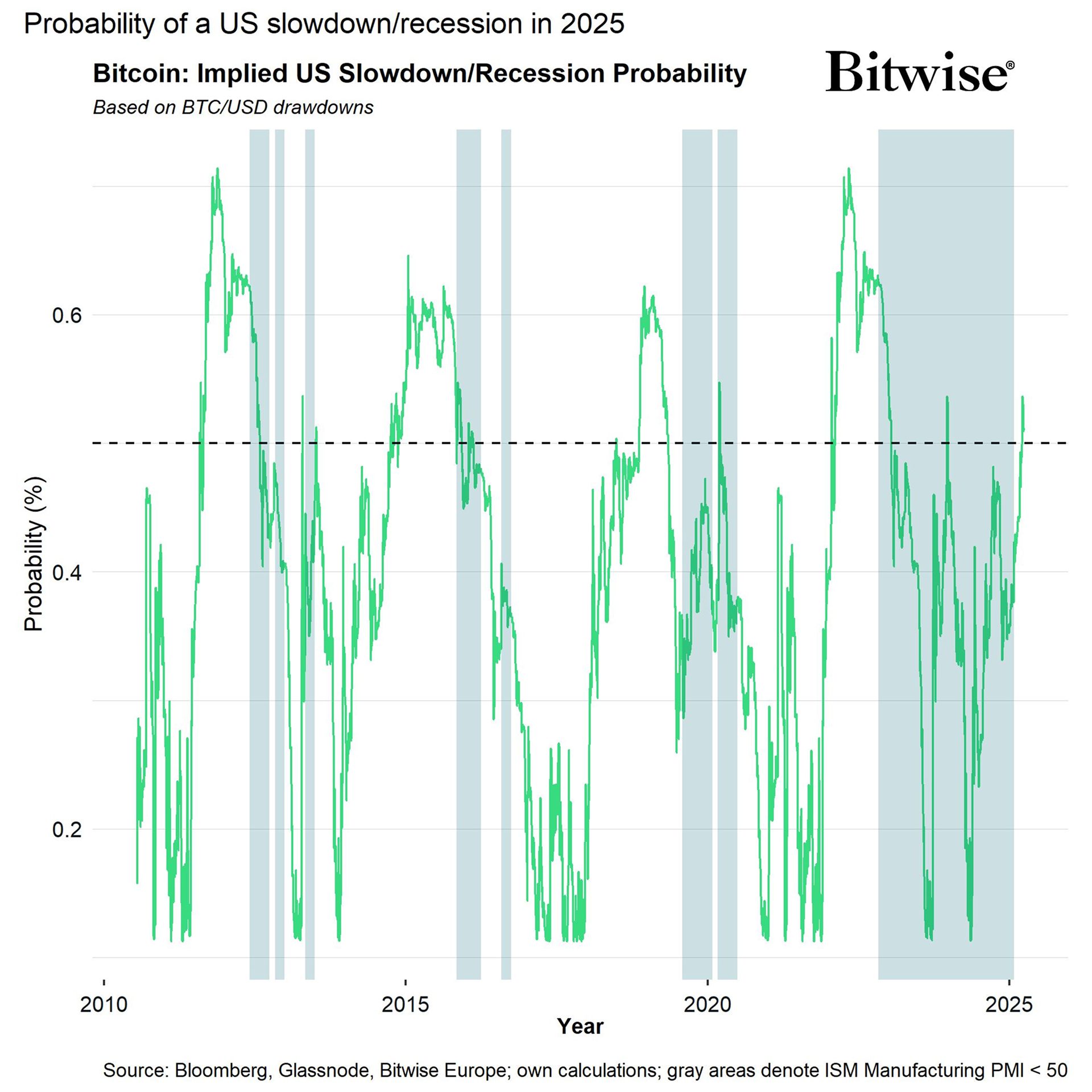

Bitcoin (BTC) as well as other altcoins probably already have a price in many fears of American recession, but there is still a chance for a little more drawbacks if the recession really occurs.

In a recent research reportAnalysts of the Cryptography Management Company In the world stressed that Bitcoin’s performance in past recessions have shown mixed results. For example, during the 2020 cocoin recession, Bitcoin sold by more than 50% but still finished the year by more than 300%.

Based on this case, analysts say that it is “very likely that Bitcoin will probably stay under pressure if the decrease in equity continues”. Until now, Bitcoin has already experienced a withdrawal of around 27% of its peak, which suggests that most of the recession fears are reflected in the price.

“The intimate to remember here is that the fears of American recession are already being bitcoin and other cryptocurrency as we are talking about, but there could still be a little more down if an American recession really materializes.”

In the world

However, analysts also see signs of “peak of uncertainty”, noting that the uncertainty of American economic policy is “as high as during COVID” and that “Google research trends for the word” recession “as high as during the cocovan”.

As Capital QCP analysts noted it earlier in a telegram jobThe markets are now focusing on the announcement of President Donald Trump’s “liberation day” on April 2, where he should reveal new reciprocal rates.

Analysts stressed that with consumer confidence at a low level of 12 years and actions already under pressure from a weekly withdrawal of 4 to 5%, aggressive trade policies could deepen fears of recession and weigh more on risk assets, including Bitcoin.

Post Comment