Raydium’s share of memecoin volume surges in Q1 but Pump.fun’s DEX poses risk

The domination of Raydium in trading samecoin, based in Solana, has increased to 83% in the last three months, even if the overall activity of the Memecoin market has decreased.

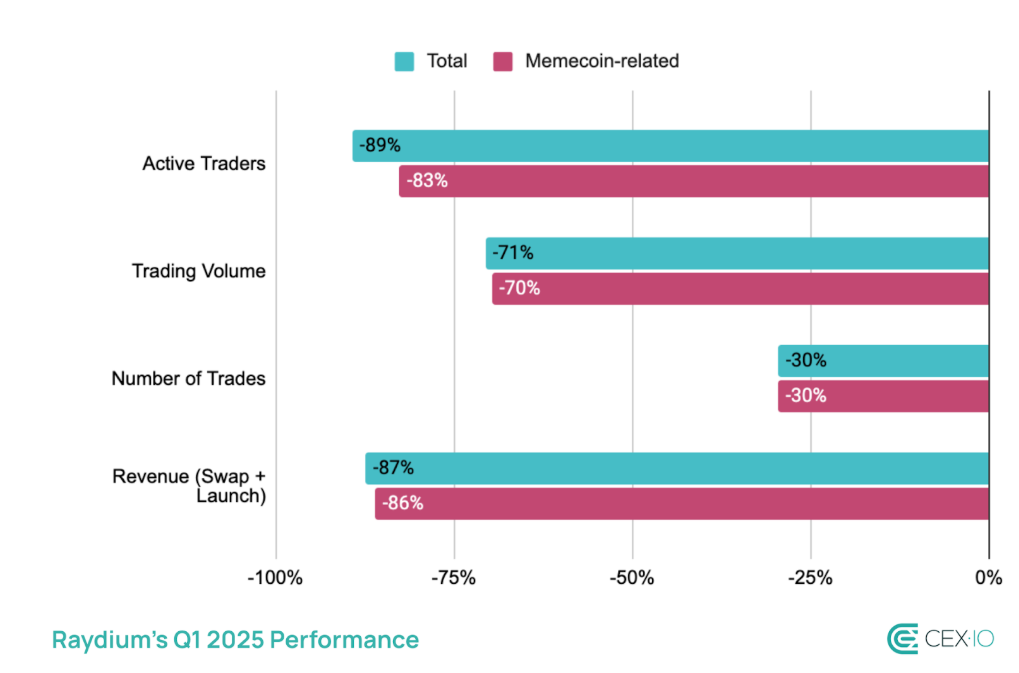

According to Even in Report of the first quarter 2025 by Cex.ioRaydium saw its same trading volume increase to 83% despite the contraction of the overall activity of the same market and market capitalization.

Evencoins went up to the top of the speculative momentum in January following high -level political launches like the Trump (ASSET) and Melania (Melania) Damn. At their peak, same, represented 11% of the total volume of crypto exchanges on January 20, noted the CEX.IO. However, by April 1, the market capitalization even fell 58% compared to its January summit, their share of negotiation volume falling at only 4%.

Despite the drop in the overall activity of the same market, Raydium’s share of the same trading volume increased from 77% to 83% in the first quarter of 2025. This is the direct result of the unofficial partnership of the exchange with Pumpwhich is responsible for the daily creation of more than 50% of SPL tokens. Once these guys have reached a market capitalization of $ 69,000, they were automatically listed on Raydium.

However, with Pump.fun recently launching his own dexen for the same, it is uncertain how it will affect the position of Raydium in the Memecoin trading ecosystem. Despite Raydium’s launch of his own same launch platform, LaunchA large part of his past income came from the same migrant from Pump.fun. Experts have noted that the success of Launchpads as Pump.fun is largely motivated by their community and their tradition, which will be difficult to reproduce for Raydium.

To summarize, while the share of Raydium of the volume of trading of the same has increased in the first quarter, a large part of this growth was powered by the migration of pump chips. Now that Pump.fun has introduced his own Dex, Raydium can face a significant blow to his trading volume. The extent of this drop will probably depend on the success or failure of its own Launchlab platform.

Post Comment