Crypto markets on edge as Trump threatens historic tariff hike on China

In an unprecedented decision, Trump has increased the challenges of the current trade war, threatening to increase tariffs on China to 104% while the cryptography market remains on board.

After Chinese reprisals to the last American price push, US President Donald Trump threat of new measures. On April 7, Trump announced on his social media platform Truth Social that China would face an additional 50% rate if he did not remove countermeasures.

In particular, China has introduced 34% reprisals on all American products, reflecting the same measure by the United States. Now Trump has given China an ultimatum to eliminate his reprisal rates by April 8 or face new measures.

“If China does not withdraw its 34% increase above its trade abuses already long-term by tomorrow, on April 8, 2025, the United States will impose additional prices on China by 50%, from April 9.” Donald Trump

The prices combined on Chinese imports to the United States are currently 54%, taking into account existing rates plus new measures from Trump. If the new price takes effect, Chinese products will face at 104%prices. For specific goods, such as cars and electronics, tariff rates would be even higher.

The trade war degenerates with Trump’s last threat to China

Since the announcement of the “Liberation Day” of April 2, the American average prices on foreign products have increased to 18.8%. This is the highest level since the 1930 Smoot-Hawley law, which caused a major concern on the markets in stock and cryptography.

Cryptographic markets Lost 1 dollars In value since February, the feeling of risk dominated the markets. Namely, traders fear an increase in inflation, a drop in growth and employment due to the economic effects of prices.

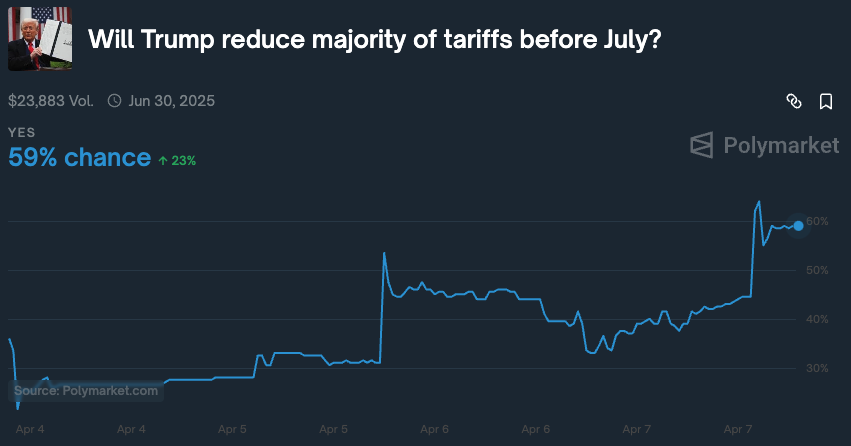

However, it is not clear how long these prices will last and what would be the long -term rates. In particular, 59% of polymarket merchants expect Trump to reduce the majority of prices by July. One day before, on April 6, these ratings were only 33%.

Following the news, Bitcoin (B) Enriched with a daily top of $ 81.119, before moving to $ 78,321.

Some traders hope that Trump’s prices are a negotiation tool rather than a long -term measure. This scenario has become more likely once Trump alluded to a 90 -day possible break On all prices, except on China, because commercial negotiations are underway.

Post Comment