Bitcoin mining expansion in U.S. at risk as tariffs hit equipment imports

Trump’s latest tariff increases on China can move the Bitcoin mining industry to offshore, as national minors are faced with increased material costs.

Bitcoin (BTC) The mining could soon move more to offshore while American minors are faced with the increase in material costs. On Wednesday, April 9, a new report by the CEO of Hashlabs Mining, Jaran Mellerud, underlined the economic impact of American prices on the national cryptography industry. According to the reportThese prices could increase mining costs in the United States by at least 22% compared to other countries.

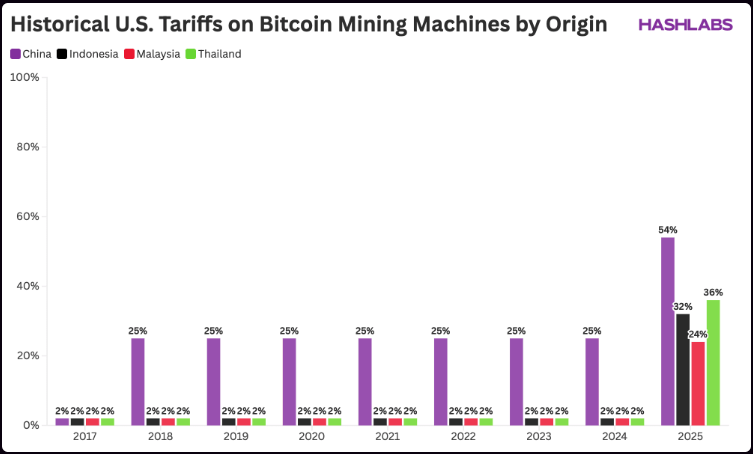

More specifically, American crypto minors are strongly based on equipment imported from Asian countries such as China, Indonesia, Malaysia and Thailand – which are all now subject to a minimum rate of 24% on all goods, including operating platforms.

Even in the most favorable scenario – supplies exclusively from Malaysia, which faces the lowest rate – equipment costs would always increase by 24%. However, this scenario is not realistic, as American imports come from a mixture of suppliers across the region. In particular, the figures cited in the report do not yet explain Recent 50% price hike On Chinese products, which increases the total rate rate to 104%.

However, there is a stock of mining equipment in the United States, which will lower prices. As these actions are exhausted, minors will probably have to pay a bonus somewhere between 22% and 36% for equipment, compared to other countries. These figures come from Ethan Vera, CEO of Luxor Crypto Mining Company, and are taken up in the Hashlabs operating report.

American minors rushed to import platforms before prices

This report conforms to the previous fears of the initiates of the industry. Gadi Glikberg, CEO of codstream, said that while prices would slow down at the bottom of the growth of the American mining industry. Due to the cost of equipment with an impact on their performance of investments, new expansion plans are unlikely.

“It is unlikely that the newly imposed prices will trigger a massive exodus. However, they can slow down or redirect future expansion plans, as minors reassess the long-term efficiency of scaling operations in the United States, “said Gadi Glikberg, CEO of codstream.

Taras Kulyk, CEO of Mining Equipment Brokerage Synteq Digital, revealed that his business was trying to precipitate the deliveries before the price hike took effect.

Post Comment