Bitcoin’s hashrate hits record high amid miner sell-offs

Bitcoin’s calculation power has increased at record levels, even if minors increase BTC sales to deal with the reduction in beneficiary margins.

The strength of the Bitcoin network has reached a new step minors increased their bitcoin (BTC) Sales to stay afloat. On April 5, the hashrate obtained a historical hash 1 sextillion per second on a daily basis, according to data de Bitinfocharts.

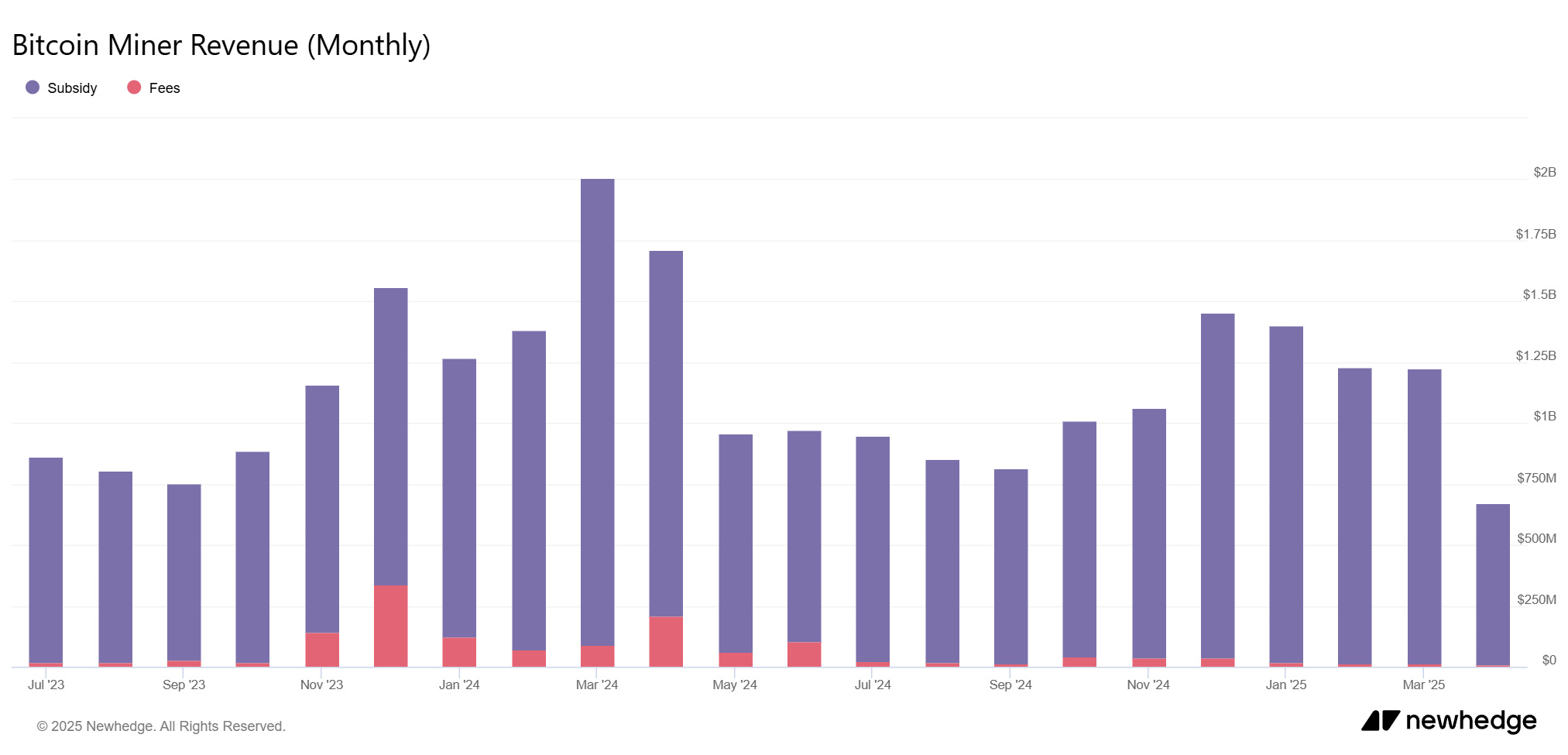

But while Hashrate climbs, the revenues of minors remain under pressure. Bitcoin minors’ income in March fell by almost 50% from March 2024 to around 1.2 billion dollars, according to data From the Blockchain Newhedge analysis platform.

Minors gain awards from two sources: block grants and transaction costs. With the last reduction in April in April of awards of the awards to 3.125 BTC per block, the costs became larger. But the costs remaining low and the blocks are often empty, minors see narrowed margins.

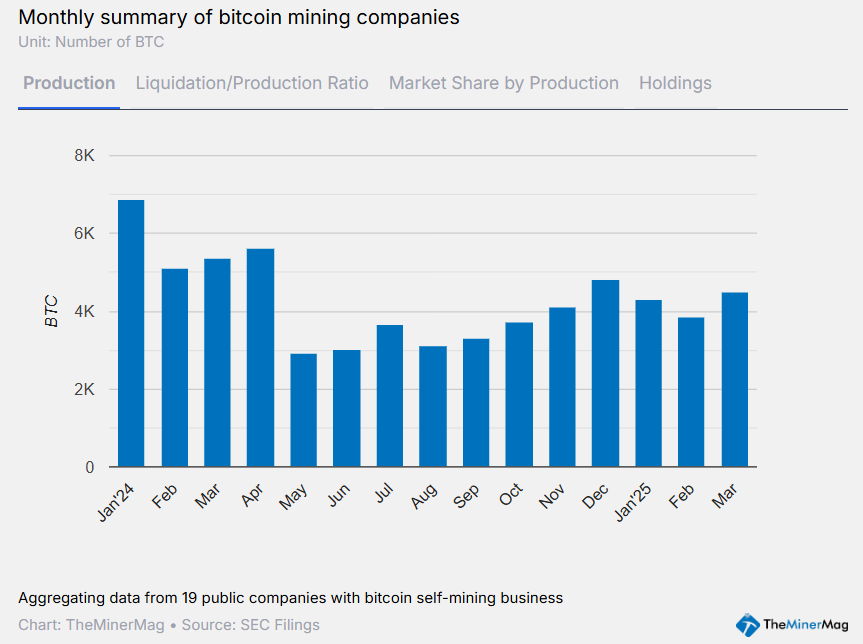

According to data From Theinermag, the minors listed on the stock market sold more than 40% of their production of bitcoin in March – the highest level since October 2024. The report notes that the increase in sales “suggests that minors can react to the tightening of beneficiary margins in the midwife levels and growing commercial growth.”

Some companies have gone even further. According to the report, Hive, Bitfarms and Ionic Digital sold “more than 100% of their production in March”, while others, like Cleanspark, seem to adjust their strategy.

Post Comment