Here’s why SYRUP surged over 35% today

The syrup jumped up to 36% today, driven by a strong growth in ecosystems and an accumulation of whales.

On April 17, the Maple Finance syrup token reached an intra -day summit of $ 0.15, which set it up more than 76% compared to its monthly hollow. At the time, its market capitalization experienced around $ 128.8 million, and the daily negotiation volume jumped from 157% to more than $ 10.7 million.

A large part of the media threw came from growing demand on the Maple derivative market, because an open interest in the term contracts on syrup increased by 90% per day, reaching $ 359.6,000.

The rally is largely linked to an increasing excitement around the expansion ecosystem of Maple Finance, which recently crossing $ 1 billion of total locked valuePlacing it before competitors like Ondo Finance and Clearpool.

Community members sharp The lighting is now almost halfway to make up for the Buidl fund of $ 2.46 billion in BlackRock. Buidl is a tokenized US Treasury Fund and one of the largest asset products in the real chain world.

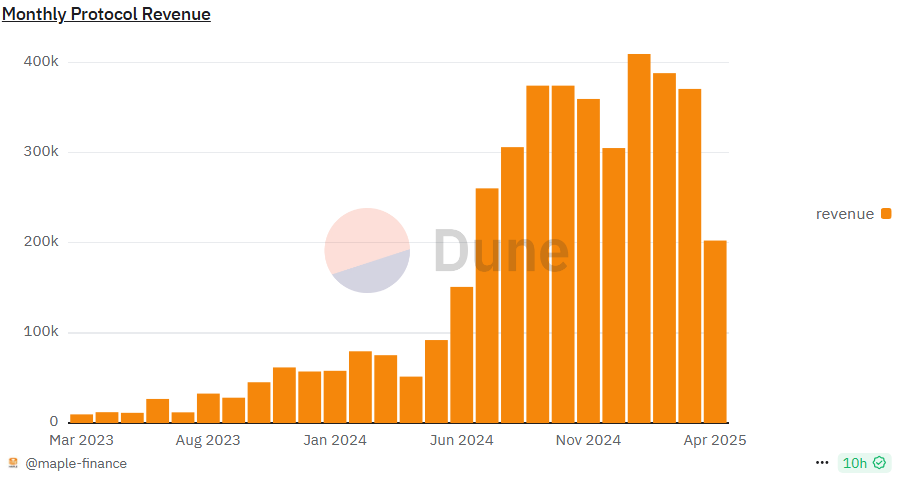

Data According to Dune Analytics shows that this growth has been mainly motivated by the institutional demand for chain credit, fueled by the Syrupusdc and LSTBTC of Maple products. While the Sirupusdc offers stable defects from loans, LSTBTC gives institutions a means of Win yields on their bitcoin Without having to move guards assets.

Another factor contributing to the high syrup performance is its 10%yield, which is significantly higher than the other large platforms. In comparison, Ethereum display yields vary between 2.15% and 3.34%, while Solana offers approximately 5.64% to 8.25%.

Meanwhile, whales have also expressed their interest in syrup, health data showing an increase in the number of holders holding between 10,000 and 100 million syrup tokens, suggesting that large investors position more in advance.

Maple’s revenues also experienced strong growth, from around $ 150,000 in June in June to almost $ 370,000 last month.

The institutions also started to take note of the project, with gray levels recently addition Maple in his list of the 20 best crypto, saying that he had great potential for the upcoming quarter, adding to the credibility of the project.

Analysis of syrup prices

Technical indicators also show signs that the current rally still contains steam.

On the 4 -hour USDT graph, the syrup has formed a reversal head and shoulder pattern, a classic bullish configuration.

The MacD also points upwards, showing a dynamic of increasing purchasing, while the Superrend indicator overthrew green, suggesting that the trend could move in favor of the bulls.

That said, the RSI has gone through a territory on the purchase, which means that a short -term decline could occur before the syrup continues its race.

If the rally takes place, the following objective is probably about $ 0.191, its walking summit, which is more than 46% above the current price. But if the upward configuration fails, the syrup could return to the key support at $ 0.10. Falling below could open the door to a deeper drop to $ 0.085.

Disclosure: This article does not represent investment advice. The content and equipment presented on this page are only for educational purposes.

Post Comment