72 crypto ETFs are awaiting SEC approval, from altcoins to memecoins

Crypto ETF issuers jump on each opportunity, in the hope of enjoying a more friendly cryptographic dry.

This year, the Securities and Exchange American commission will have its hands full with ETF applications. On Monday April 21, Bloomberg analyst Eric Balchunas stressed that 72 crypto Fund negotiated in exchange are currently waiting for approval.

The list includes altcoins, NFT tokens, same, as well as lever effects that bet on the Melania Trump token. The Melania 2x Fund is one of the ten leverage and Altcoin funds by Turtle Capital, recorded in the Cayman Islands. Due to the number of these deposits, Balchunas predicted a “wild year” for the crypto.

“There are now 72 ETFs linked to cryptography sitting with the dry awaiting approval to list or list the options. Everything, from XRP, Litecoin and Solana to the Penguins, Doge and 2x Melania and everything else. It’s going to be a wild year. ”

XRP is underway with the depots ETF

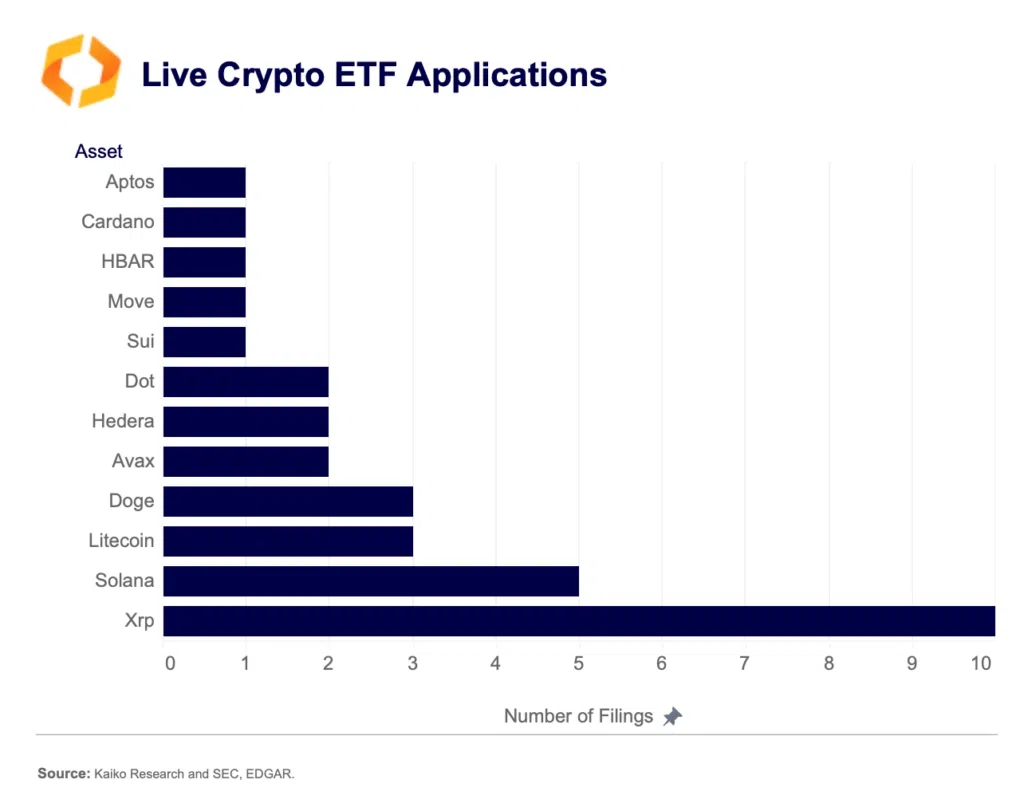

Although the list of ETF deposits is at least diverse, there is clear leaders in space. In particular, altcoins like XRP (XRP)Solana (GROUND), and Litecoin (Thal) are in the lead with regard to the number of individual deposits. More specifically, by April 15, 10 individual deposits for XRP and five for Solana. Like some of the largest altcoins on the market, they drew institutional attention.

At the same time, Litecoin and Dogecoin (DOGE) were tied in third place, with three potential transmitters. These two tokens benefit from their decentralization, while DOGE also attracted general attention thanks to its association with Elon Musk.

FNBs become a key account for the adoption of cryptography because they offer an easier way for retail and institutional investors to expose themselves to digital assets. Instead of directly holding the assets, the fund has underlying assets, while having to meet strict regulatory requirements on its guard.

Post Comment