Solana Foundation to slash support for ‘validators in name only’ in a decentralization push

In an effort to increase decentralization, the Solana Foundation aims to reduce “validators in name only”, which are based solely on the participation of the Foundation.

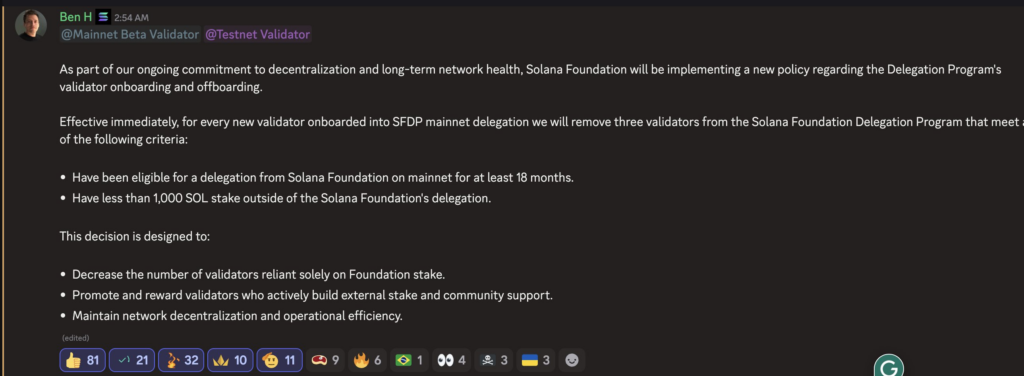

Solara (GROUND) makes changes which aim to revise the operation of its staging delegation program. On Wednesday, April 23, Ben Hawkins, chief of the Employee Ecosystem of the Solana Foundation, revealed that it would start to cut the validators with a low enumeration of external stake.

More specifically, for each new validator who enters the delegation program, the foundation will reduce three other validators with a low external stake. This applies to validators who have less than 1,000 soils marked outside of those of the delegation program. These can be cut if they have been eligible for the delegation for at least 18 months.

Solana faces centralization concerns for validators

The decision aims to reduce the number of validators which are based solely on the Solana foundation for their validation participation. At the same time, the Foundation wishes to promote validators who cultivate the community of brothers in Solana.

Due to high calculation costs, the execution of a validation node for Solana is extremely expensive. According to some estimates, the cost of simple management of servers goes $ 45,000 at $ 68,000 per year, which does not include material costs.

This means that only large validators can hope to make a profit of the race nodes, assuming no support from the Foundation. Conversely, this situation leads to risks of centralization, because the smallest validators cannot reach the network.

However, thanks to great awards for jealking, Solana has one of the highest actions of token marked among the big channels. Currently, 65% Solana The power supply is locked in ignition pools. In comparison, just 28% eth And 21% BNB are milestone.

According to Coinbase, users can obtain an annual yield of 5.84% on Solana. However, these yields are denominated in soil, not USD, which makes yields subject to significant volatility.

Post Comment