Bitcoin dips below $94,000 as ETFs record $3b weekly inflow

Us Bitcoin Spot ETFS recorded 3.06 billion dollars in net entries for the week ending on April 25, 2025, their strongest weekly performance since November 2024.

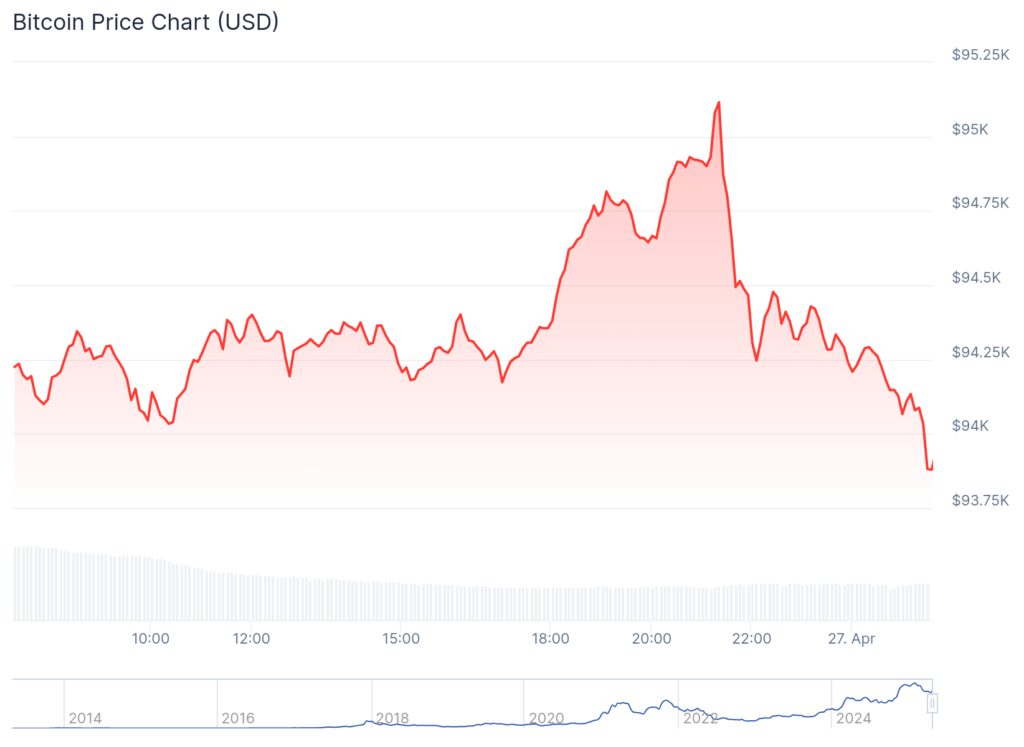

This influx of capital coincides with Bitcoin (BTC), which dropped below $ 94,000 on Sunday and is currently in the red. See below.

Combined ETF products now hold $ 109.27 billion in total net assets and represent approximately 5.8% of the total Bitcoin market capitalization, according to data from Socal.

Blackrock leads Bitcoin Etf Afflux

The latest Bitcoin ETF data reveals a strong rebound in the interest of investors after several weeks of mixed performance. The daily entries of April 25 reached $ 379.99 million, contributing to a weekly total of $ 3.06 billion.

For the context, the week ending on April 11 recorded $ 713.30 million in net outings, followed by a modest input of $ 15.85 million the week ending on April 17.

The Ibit of BlackRock leads with 240.15 million dollars in daily admissions and maintains its position as the largest ETF Bitcoin with $ 56.03 billion in management assets. The fund has accumulated 41.20 billion dollars in net cumulative admissions since its launch.

The FBTC of Fidelity obtained second position with $ 108.04 million in daily admissions and $ 19.12 billion in total net assets. The other notable artists include ARKB (Ark 21Shares) with $ 11.39 million in daily entries and Graycale BTC with $ 19.87 million. However, its GBTC converted flagship product continues to experience outings, $ 7.53 million leaving the fund on April 25.

Commercial activity also increased considerably, with $ 18.76 billion in total value negotiated for the week, against $ 7.15 billion the previous week. The total cumulative net influx in all ETF Bitcoin Spot is now 38.43 billion dollars since their launch.

Despite Graycale’s GBTC, cumulative outings of $ 22.69 billion since its conversion of a trusted structure, the FNB overall ecosystem continues to cause new considerable capital.

Post Comment