Why is crypto down today?

Cryptographic markets are down on the latest inflation figures, because traders realize the recent market gathering, which has pushed the BTC over $ 100,000.

Taking profit and inflation data have reduced cryptographic markets today. On Tuesday, May 13, the total market capitalization of crypto dropped 0.48% to 3.32 billions of dollars, while Bitcoin (BTC) dropped by 0.21% to $ 103,228. Despite this, several signs show that the markets remain strong.

The drop in the market has coincided with the publication of the latest figures from American inflation, which showed the lowest inflation rate since 2021. In April, consumer price increased at an annual rate of 2.3%, compared to 2.4% in March. Low inflation can indicate the slowdown in consumer demand due to recession problems.

In April, new Trump administration prices had not yet struck consumers. However, low figures will probably not encourage the federal reserve to reduce interest rates, despite President Donald Trump’s pressure. Interest rates below are also something that cryptographic markets hoped, due to their effect on market liquidity.

Interest rates are likely to remain stable, traders have chosen to make profits while Bitcoin was more than $ 100,000. However, there are signs that the market is in a bullish state, especially with altcoins.

Cryptographic markets remain strong

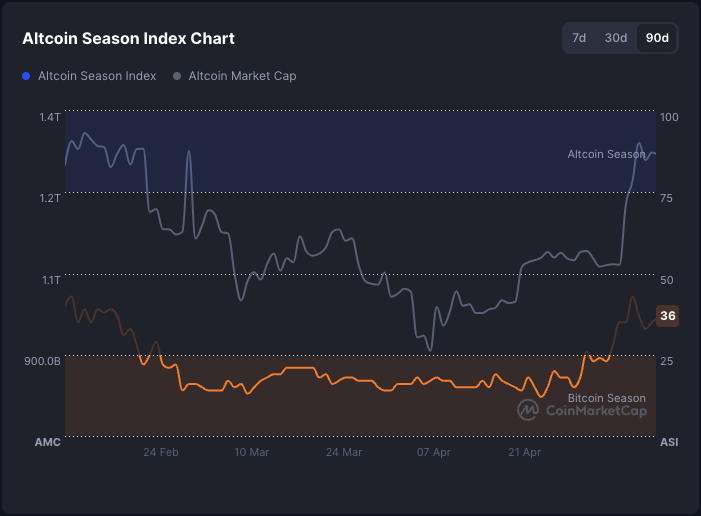

In recent weeks, altcoins have experienced improved performance, the Altcoin index reaching the highest value since February. In the past 90 days, 36 of 100 altcoins have shown better performance than bitcoin. In addition, during last week, the Altcoin market capitalization increased from $ 1.1 billion to $ 1.35 billion.

The Altcoin market strength suggests a bullish momentum for crypto and risk assets in general. However, the continuous growth of the market will depend on what the Fed decides to do in the coming months. In particular, the Fed can decide to wait with rate reductions until SeptemberTo see what will be the effects of the new trade agreement between the United States and China.

Post Comment