XRP futures debut on CME as Garlinghouse hails key ‘milestone’

Brad Garlinghouse, chief executive officer of Ripple Labs, praised the CME group’s decision to launch the first regulated XRP term contracts.

In a press release, Garlinghouse said that the launch of Ripple (Xrp) and micro XRP Futures were a “key step” for his business.

He also revealed that Hidden Road, the leading brokerage recently acquired by Ripple Labs, released the first block to the CME Open. The launch of XRP Futures gives investors an exposure to the price of XRP, while offering greater transparency and risk management capacities.

More importantly, the launch will allow asset management companies to offer negotiated funds in exchange to follow the XRP term contracts. A good example of this is the Bitcoin Strategy Fund proshares, which has accumulated more than $ 2 billion in assets.

The long -term beginnings occur in the middle of the growing signs of the demand for XRP follow -up assets. XRP has received the largest number of Altcoin stock market deposits, with nine companies, including Franklin Templeton, Proshares, Canary Capital and Grayscale Investments, looking for approval. Solana (GROUND) Arrives second with seven applications.

In addition, the newly launched Teucrium 2x long daily XRP The Stock Exchange Fund has already raised more than $ 106 million in assets. In comparison, the 2x Solana Exchange fund, with the symbol Symbol Solt, collected less than $ 35 million assets four months after the launch.

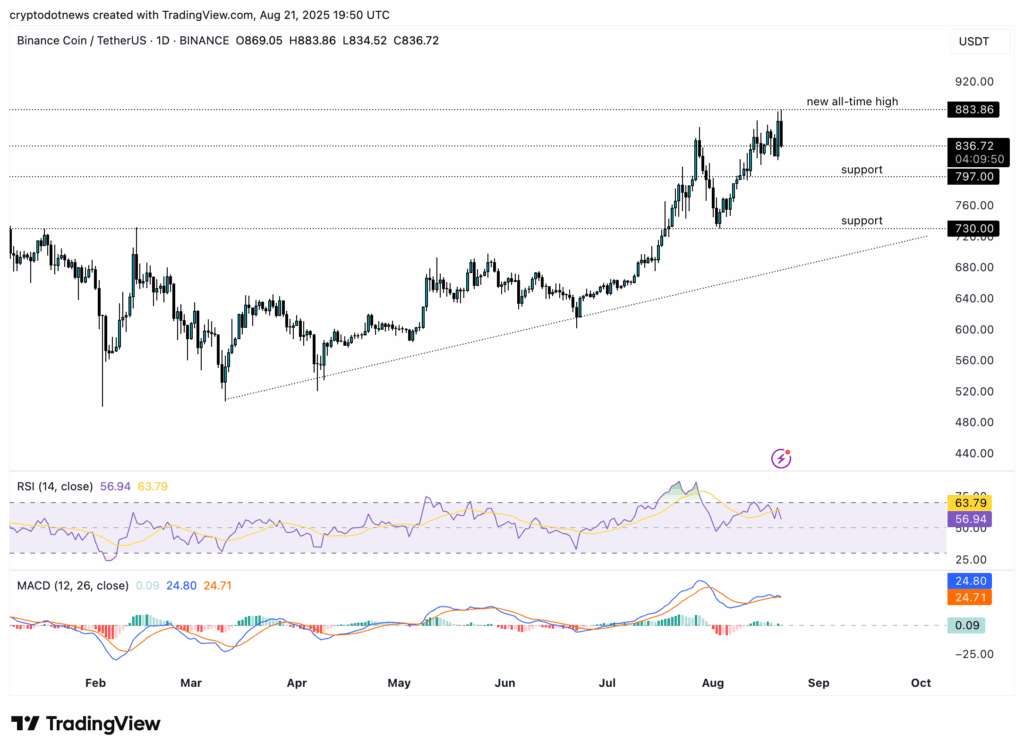

The XRP price reacted slightly to the launch eventually when it fell to $ 2.33, down 12.25% compared to its highest point this month. This drop was in accordance with cryptography market crash And the fact that the launch is already at the price.

Post Comment