a technical analysis deep dive

XRP approaches a large high -time support area near the $ 2 mark. This level has always acted as a structural base in the past few months, now pricing for several corrections. Now, with the price by pressing again in this area, the reaction of this level will probably determine if XRP continues in its wider bull or risk structure.

Price action remains rotating. XRP (Xrp) Traveling from the high value area to the low value area, creating a cycle of manual auctions between keys volume levels. This movement coincided with the drop in volume, a pioneer common to volatility. From a technical point of view, this configuration can be the start of a new higher leg – if the market confirms support and volume increases.

Key technical points

- $ 2 delay support zone of $ 2: The strong confluence of Fibonacci’s retracement 0.618 and the low value area make this area a major technical demand area.

- Liquidity cluster below $ 2: Liquidity at rest just under the support suggests the possibility of a sweep before a reversal, often used by market manufacturers to trap late sellers.

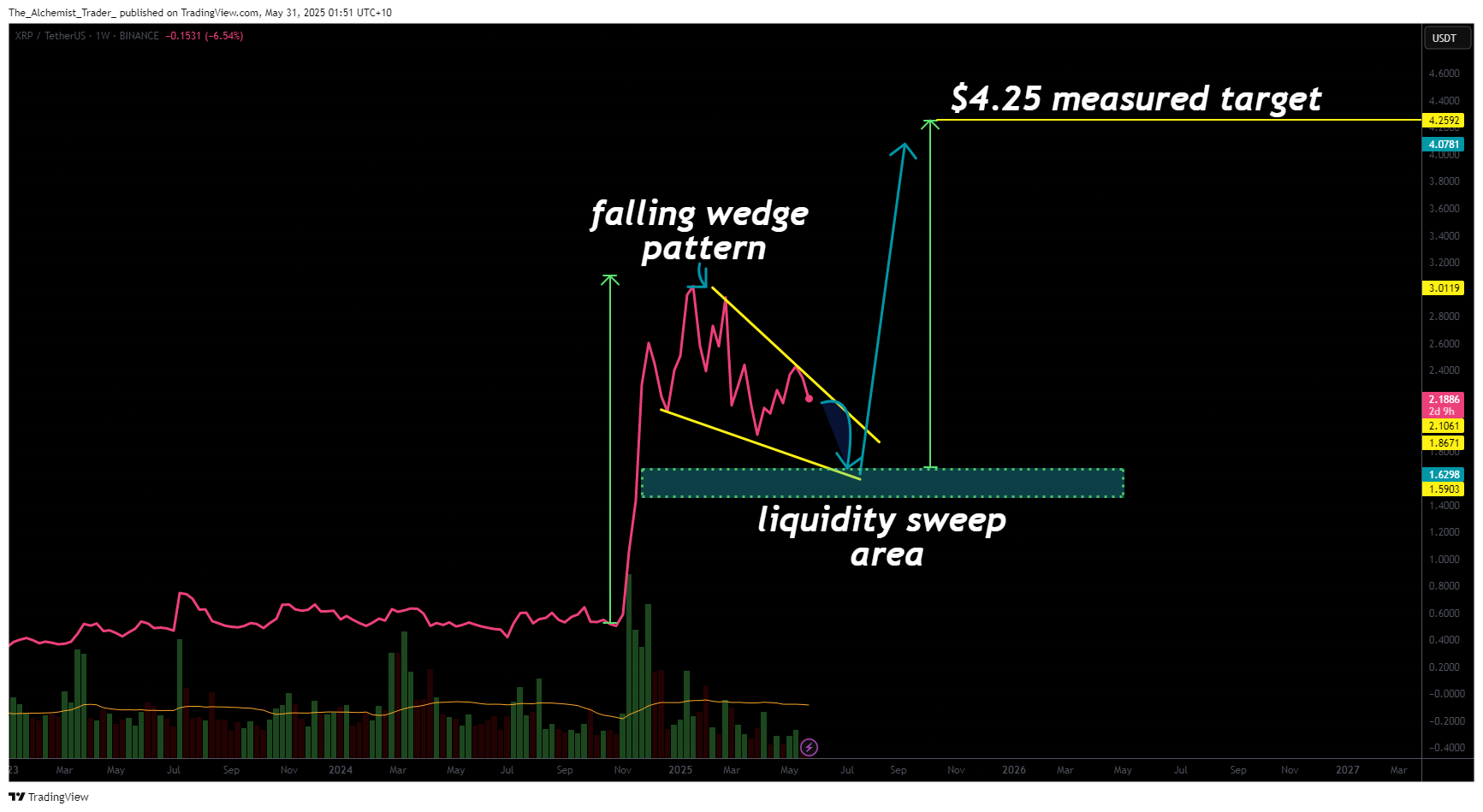

- Haussier fall corner training: The price rolls up in a downward corner diagram. An escape from this structure projects an evolution around $ 4.25.

- RSI flattening at the midline: The relative resistance index stabilizes near the beach from 40 to 50, referring to the reset of the momentum and upside down the potential of the occurrence conditions.

- Volume profile contraction: A significant drop in trading volume shows compression. An influx of volume close to the support can ignite the break and rotation to higher resistance levels.

An important structural observation lies in the repeated defense of XRP from the lower swing to $ 1.59 – an area which also aligns with historical support and dynamic reactions of trend lines. If this level is violated with force, it would confirm a rupture of the structure of the Haussier market. However, if he was defended and followed by a strong volume and a bullish reaction to or just below $ 2, this would validate a higher hollow and would provide a strong launch so that the price runs higher.

From the market profile point of view, the recent XRP price action has completed a complete rotation: from the high value area nearly $ 3.10 to the value area drops by almost $ 2.00. These movements generally reset liquidity and feeling. The low value area is historically known to act as a springboard in trendy environments. Combined with the structure of the falling corner at this level, the conditions seem ideal for a breakdown of rupture.

The lower time price also has important indices. XRP has formed a higher own low sequence, suggesting that traders position stops below the region of $ 2. This group of stop orders can create a liquidity pocket, which market manufacturers often sweep to trigger inversions. If this happens and the golden pocket of 0.618, just under the low value area, absorbs movement, a solid rebound becomes very likely.

A liquidity difference or scan at $ 2 in the level of 0.618 must be accompanied by an increase in the volume of purchase to confirm a reversal. Traders should monitor a sharp wick below $ 2, followed by rapid recovery of this level on a higher volume. It would be a classic optimistic deviation, an ideal entry signal for many swing traders.

The addition of additional weight to this configuration is the falling line pattern, better visualized on the line graphic. The falling wedges are generally optimistic inversion training, and the current corner of XRP is narrowing near a key support region. The measured movement of this corner, calculated from the widest point of the model – projects a price lens of around $ 4.25. This level also aligns with the macro areas of previous resistance of past bullish rallies.

The feeling of the market also shows the first signs of a change. Open interest increases slightly, while funding rates remain neutral, which suggests that long long or shorts dominate the market. This neutral backdrop gives no more credibility to a relaxation held once triggered, because the price will not fight against extreme positioning.

The current REGNER READING SCENARIO for the bulls is convincing. As long as Price holds the swing at $ 1.59 low and recovers $ 2 the support of the force, the upward structure remains valid. A confirmed escape from the falling ditch scheme could return XRP to $ 2,42 initially, then to the $ 3 mark, the complete measured movement targeting the region of $ 4.25.

What to expect in the action of upcoming prices

XRP is negotiated in a region of hinge support. A scan less than $ 2 in the gold pocket can act as a bullish trigger if it is followed by a strong volume and a recovery of the level. Monitor an escape from the fall of the corner model, which could send a price at $ 2.42 and finally $ 4.25. If the bulls do not defend $ 1.59, the structure would be in danger, but for the moment, all the signs suggest that the market rolls up for a significant movement higher.

Post Comment