OKX chief executive defends aggressive compliance rules

If OKX asks you to prove that your father is your father, do not take it personally – it’s just a compliance.

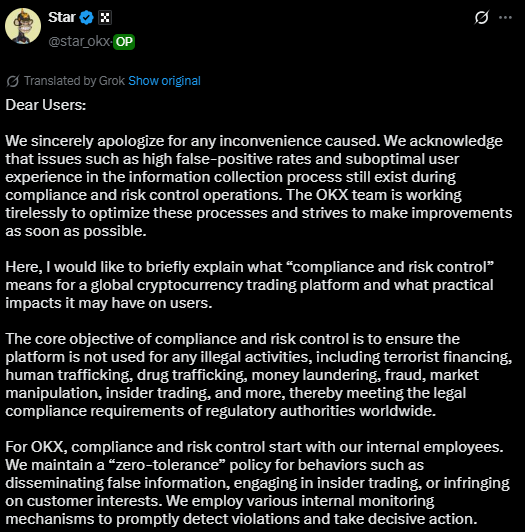

It is according to the star of the CEO of OKX, XU, who published a detailed explanation of the procedures for compliance and risk control of exchange in response to user complaints concerning account restrictions and verification requests.

The declaration recognizes high positive rates and sub-optimal user experience while defending the global regulatory obligations of the platform.

XU pointed out that OKX’s compliance team exceeds 600 members dedicated to the prevention of illegal activities, including terrorist funding, human trafficking, drug trafficking, money laundering, fraud and market manipulation.

The CEO stressed that these measures are necessary to meet legal requirements through the jurisdictions where OKX operates.

VPN use triggers an in -depth examination

Exchange indicators are accounts based on several risk factors, the use of VPN in restricted regions being a main trigger for additional verification requirements.

Users using Tor browsers or having potential links with sanctioned countries or political figures are faced with increased documents, including address proof, residence history and employment verification.

Xu described the challenge of “false positives”, where legitimate users are wrongly reported as risky despite normal behavior. The CEO noted that even databases and advanced industry technologies cannot reach 100% accuracy in compliance determinations.

“Many service providers adopt an” aggressive identification “strategy and regulatory authorities often encourage platforms to be mistaken on the side of prudence,” said Xu. He justified why compliant users sometimes receive requests to “prove that your father is your father”.

OKX account restrictions may include asset freezing

OKX maintains the power to issue warnings, request additional documents, suspend the functions of the account or terminate the accounts for the violations of the policy.

In cases involving sanctions or terrorist activities, the exchange is legally required to freeze related assets.

The platform incorporates third-party databases with internal behavioral analysis models to identify potential risk accounts.

XU stressed that the compliance system begins internally with zero tolerance policies for the misconduct of employees, including the initiate offense and the violations of customer interests.

Customer -oriented compliance includes identity verification, transactions monitoring, sanctions screening and market manipulation detection. The system automatically examines user activity against global surveillance lists and regulatory requirements.

Users have reported additional verification requests for receipt of documentation of the source of funds, proof of address and employment history. XU assured users that the truthful submission of documents would not compromise the security of accounts for those who are not involved in illegal activities.

The CEO has highlighted access to strict data and confidentiality protections for submitted documents. He also noted that a poor disclosure would result in serious legal consequences for the platform.

Post Comment