Solana could rally to $164 if it breaks out of this key pattern

Solana could be on the verge of a rally at $ 164 as soon as it seems ready to get out of a popular bullish model, according to an analyst.

According to a July 9 job On X by analyst Ali, Solana formed a symmetrical triangle pattern on the 4 -hour graphic, characterized by two convergent trend lines representing the lower ups and higher stockings. Such a model suggests a period of price consolidation which generally peaks in an escape in both directions.

Ali noted that an confirmed break above the upper limit of the pattern, located near the resistance level of $ 153, could trigger a bull movement with a short-term lens of $ 164.

At the time of the press, Solana (GROUND) was negotiated exactly with this key threshold, preparing the way for a potential technical break.

Enimony indicators support upward perspectives. On the 4 hour / USDT graph, the line of divergence of Mobile average convergence has crossed above the signal line, both upwards. Traders consider this as a sign that the purchase of interest increases, and the price can continue to increase.

Additional technical information has been provided by another pseudonym analyst, SDX, which observed This soil has wounded under a descending trend line formed since the beginning of the year.

A successful escape and retain of this level, notes SDX, could act as a catalyst for a stronger positive trend, potentially opening the door to a new top of all time if the purchase volume confirms the escape.

The fundamentals are also in favor of Solana. First, Sol was recently Understood As one of the assets presented in the “Blue Chip” cryptocurrency FNB of Trump Media and Technology Group, according to a file with the American Sec.

Second, reports indicate that the SEC in the United States has asked the issuers to modify and submit requests to present ETF Solana at the end of July, potentially accelerating the calendar for formal approval. When the SEC makes such a request, it generally indicates that the agency does not reject the proposals, but is open to move forward if certain conditions are met.

Merchants often consider this type of regulatory commitment as a bull sign, interpreting it as a step more of approval that could unlock a new request from institutions and retail investors.

Meanwhile, Solana also emerged as a leading blockchain in the tokenization sector of real assets. Dune Analytics data show that RWA in token on Solana has reached a record of $ 418 million, with an increase of 631% of active users in the last 30 days.

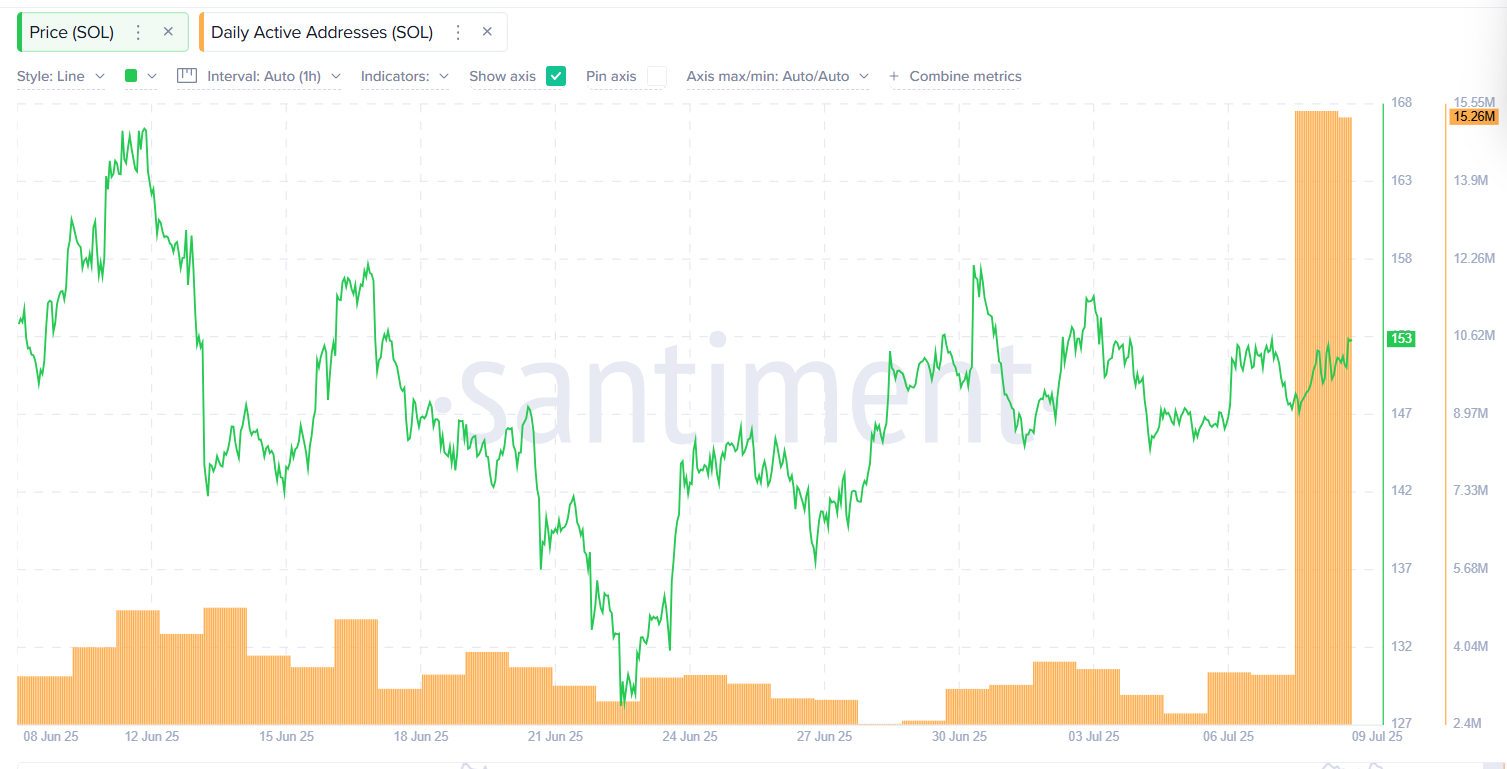

This is also supported by a strong network activity. The daily active addresses of Solana climbed up to 15.39 million, against only 3.46 million the day before, marking a spectacular increase of 345% of the activity of the network.

The stablecoin supply on the Solana network also increased regularly during last week. Stablecoins are the backbone of decentralized finance, serving as critical exchange of exchange, value reserve and account unit in blockchain ecosystems.

For Solana, this could mean that an influx of new users takes advantage of the chain for payments, trading and token asset establishments, which in turn can further support the Haussier story.

Sol was negotiated at around 48% below its $ 293 summit at the time of the press.

Post Comment