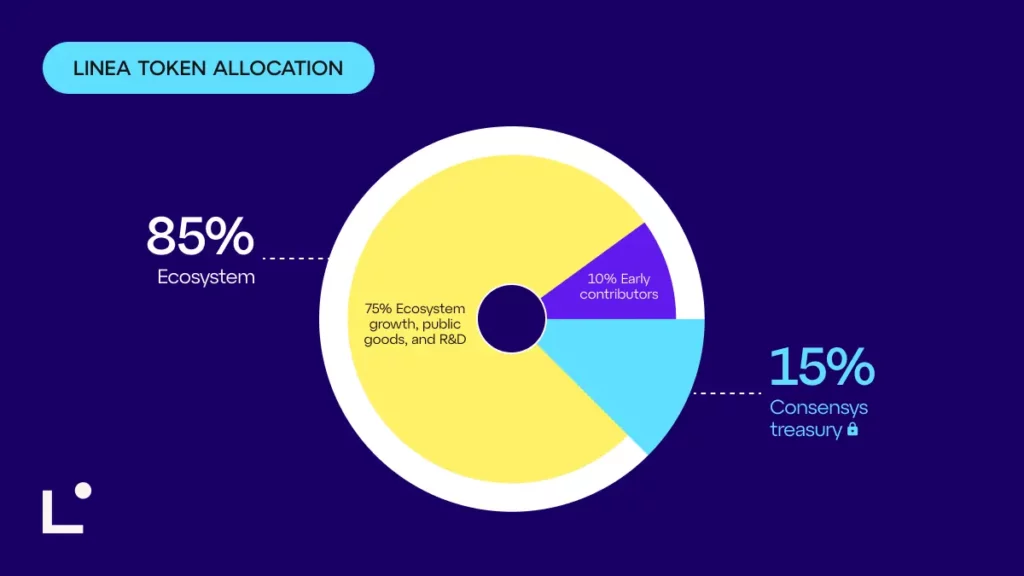

ETH Gas, 85% ecosystem, 15% treasury

Linea, the Ethereum Layer 2 network developed by Consensys, officially published its framework for Tokenomics Linea, revealing a unique model aligned by Ethereum.

Summary

- Linea released tokenomics showing ETH as gas and no governance role for Linea.

- 85% of the 72B offer of Linea goes to ecosystem incentives while 15% are reserved for consensys.

- The structure of the costs burns ETH linea to link use to the long -term value.

The update was shared in a July 29 blog And arrives in front of the planned token generation event in Linea. ETH will serve as a unique gas token, while the new Linea token will work as an incentive and funding mechanism.

Linea not for gas or governance

Unlike typical L2 models, Linea separates usefulness and value capture using ETH exclusively for gas while burning both ETH and lines network costs. 20% of ETH ETH income is burned, the remaining 80% used to buy and burn Linea. This double combustion mechanism is designed to strengthen ETH’s monetary premium while linking the value of Linea to actual use.

Linea will not serve as a governance token, and the protocol will not be governed by a DAO. Strategic decisions will be rather managed by the Linea Consortium, a council of native projects Ethereum, in particular Ens Labs, Eigen Labs and Sharplink, within the framework of a non-profit entity based in the United States.

Tokenomics line

The total Linea offer is set at 72 billion tokens, with 85% allocated to the growth of the ecosystem and 15% reserved for consensy treasury. HAS launch22% of the total supply will circulate, largely through the first air parameter and user liquidity programs. No token has been sold to investors or employees.

The ecosystem fund, representing 75% of the total offer, will be deployed over a period of 10 years. During the first 12 to 18 months, around 25% will go to community development, to support manufacturers, to prepare exchanges and to supply in liquidity. The remaining 50% will go to ecosystem infrastructure, public goods and the research and development of the protocol.

9% of the offer will be distributed to the first users via Airdrops and will be completely unlocked at TGE. Eligibility is based on the Linea XP and Onchain activity which reflects the authentic use and the commitment of the ecosystem.

Another 1% will go to strategic manufacturers, such as key decentralized applications and infrastructure partners, chosen through an organized selection process focused on long -term alignment.

Ethereum alignment

Instead of frame the Linea token as a governance tool, Linea positions it as an “economic coordination tool”. Participation, not capital, will determine how it is allocated to ecosystem users, manufacturers and contributors. The model, which emphasizes decentralized growth and the financing of long -term public goods, echoes that of Ethereum (Ethn) Launch of 2015.

Currently, Linea has $ 155 million of total locked value, according to Defilma dataand hosts more than 350 applications. Two major updates that have been recently deployed include native USD coin (USDC) Integration and costs grant Partnership with Dratswap to reduce the cost of linea puncture.

Post Comment