Ethena’s multi-week rally at risk as whales exit ahead of 171m token unlock

Ethena jumped more than 140% in July, but a next token unlocking and whale outings are now threatening to reverse her earnings.

Summary

- Ethena jumped more than 140% in July, driven by the growth of the protocol, the expansion of the stable and a major buyout.

- Dollars’ $ 103.6 million token unlocking for August 5 and whale sales have raised concerns about short -term price pressure.

- ENA is currently negotiating near a key level of support in a lower area model.

According to Crypto.News, Ethena (This one) was negotiated at $ 0.61 at the time of the press, marking an 11% gain in the last 24 hours. The last jump extends its 30 -day rally to around 142%. The volume of daily trading has also climbed 33%, making ENA the most efficient token of the day and placing it 41st among all cryptocurrencies by market capitalization.

What led to Ethena’s July rally?

Ethena’s July rally was not the result of a single event but rather of a coordinated accumulation of bullish developments through market access, protocol growth, regulatory alignment and whale activity.

According to ParadeThe protocol TVl increased by 73% in just 30 days, increasing Ethena to the sixth larger DEFI platform in the world. This placed it right behind established players such as Aave, Lido and Eigenlayer.

In parallel, the Synthetic Stablecoin of Ethena, USDE, experienced a spectacular increase in supply. The data show that the supply of USDE circulation has climbed 75% per month, reaching $ 9.3 billion. This increase allowed him to exceed the FDUSD and to become the third largest stablecoin by market capitalization, to follow only the attachment (USDT) and the USD part (USDC).

The major holders, or whales, also played an essential role in the food of the rally. As has reported Crypto.News, several whale wallets have accumulated significant quantities of ENA throughout July.

These fundamentals were reinforced by the main catalysts at the beginning of last month. On July 11, Ethena obtained a list on Upbit, the largest cryptocurrency exchange in South Korea, strengthening its visibility and liquidity in the Asian markets.

Less than two weeks later, Stablecoinx announced a fundraising cycle of 360 million dollars, with 260 million dollars reserved specifically to buy the ENA tokens. This large -scale capital injection has created a short -term demand shock which has further accelerated prices.

On the regulatory front, Ethena and Digital Anchorage announcement A breakthrough of conformity on July 24. Their synthetic dollar, USDTB, has become one of the first stablecoins to meet the requirements of the new American engineering law.

Approaching tokens unlocking

Despite Ethena’s strong performance in July, the token could soon face winds, as approaching a large unlocking.

According to the Tokenomist data171.88 million ENA tokens, worth around $ 104.56 million, should unlock on August 5. This represents approximately 2.7% of the current supply offer of around 6.35 billion tokens. Until now, only 42.3% of the total offer of 15 billion ENA has been unlocked.

The dropouts of tokens often cause additional sales pressure, especially when the feeling of the market is positive. Although not all of the unlocked tokens are not sold, the increase in the offer could slow the momentum, especially if traders choose to take advantage of recent gains.

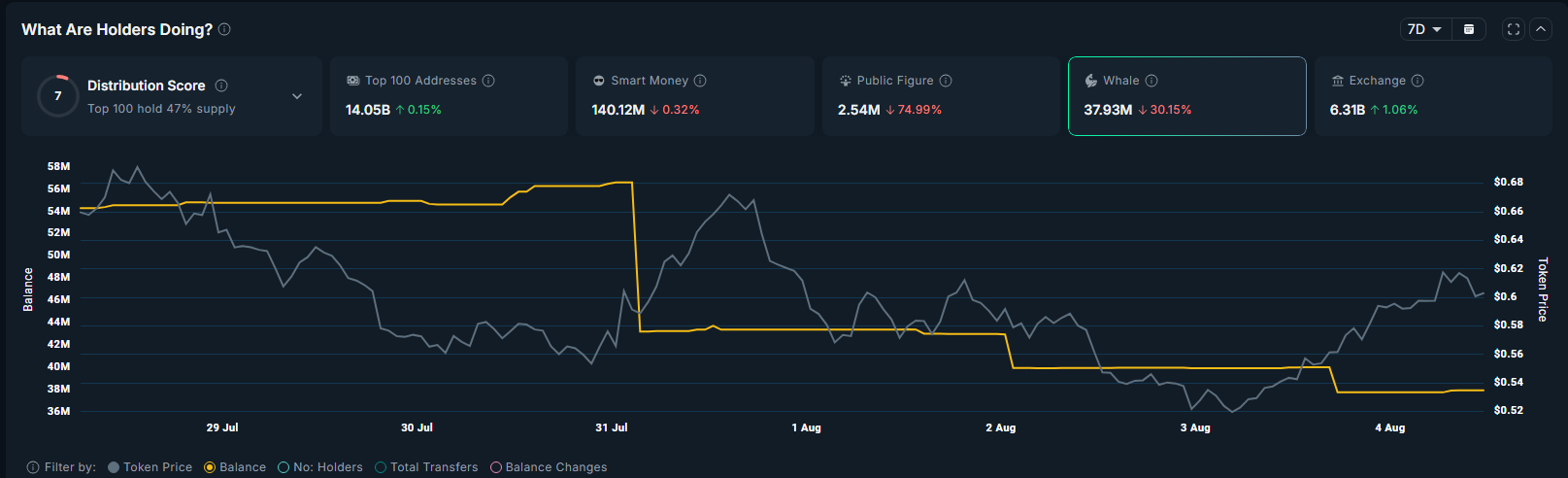

Whales are discharged in

Adding to the concerns, recent data on the chain indicate a weakening of the conviction among the major holders. During last week, whale portfolios reduced their ENA participations by 30%, now totaling 37.93 million tokens, according to Nansen. Likewise, portfolios of public figures, often used as feelings of feeling, reduced their assets by 75%, with sales falling to only 2.54 million ENA.

Even the veteran merchant Arthur Hayes, who ENA accumulated In July, recently sold around $ 4.62 million in token. He quoted Growing macroeconomic risks, including low data from American jobs and the slowdown in global credit growth, such as reasons to move away from volatile assets such as crypto.

Such reductions may point out that influential investors locate profits before unlocking event, anticipating short -term prices. Lower assets among whales and known public portfolios often precede the withdrawals of the market, especially when the token supply should increase.

ENA price analysis

On the daily graphic, ENA reached her hollow of the year up to date of $ 0.23 on June 23. He then went to a consolidation phase until the beginning of July before launching a solid upward rally.

More recently, the price has formed an ascending widening corner, a model generally considered to be lower because of its growing volatility and its lack of directional stability. This training often precedes a reversal, especially when it emerges after a steep rally.

At the time of writing the editorial time, ENA is negotiated near the lower trend support at around $ 0.52. A decisive break below this level could confirm the downstream configuration and trigger a wider withdrawal.

Elan’s indicators support this weakened perspective. The MacD (Blue) signal line has already crossed the MacD (Orange) line, confirming a lower crossover which signals a momentum up. In addition, the relative resistance index (RSI) fell to 62, still near the territory on the purchase, but now pointing down, indicating the coolant purchase force.

If ENA does not hold above the level of psychological support of $ 0.47, the price can be vulnerable downwards. A rebound at this level would temporarily invalidate the lower structure.

However, ventilation could open the door to a deeper correction to $ 0.24, releasing its stockings in July. A sustained movement below which could extend the losses to $ 0.07, which aligns the measured target involved by the corner model.

Disclosure: This article does not represent investment advice. The content and equipment presented on this page are only for educational purposes.

Post Comment