Ethena Clears XRP, HYPE for USDe backing after onboarding BNB

Ethena Labs officially approved XRP and the threshing media as part of its new eligible asset framework. The metric -oriented approach, which recently integrated BNB, obliges strict liquidity and depth requirements for all the assets that support the USDE -term hedges.

Summary

- Ethena Labs approved XRP and the threshing media as eligible active ingredients to support its USDE synthetic dollar, after the integration of BNB.

- The two tokens have crossed strict thresholds for liquidity, open interest and trading volume as part of the new eligible asset framework of Ethena.

According to an announcement on August 22, the independent risk committee of Enthena Labs officially approved Ripple (Xrp) and hyperliquid (THRESHING) Tokens as eligible active ingredients to support its USDE synthetic dollar.

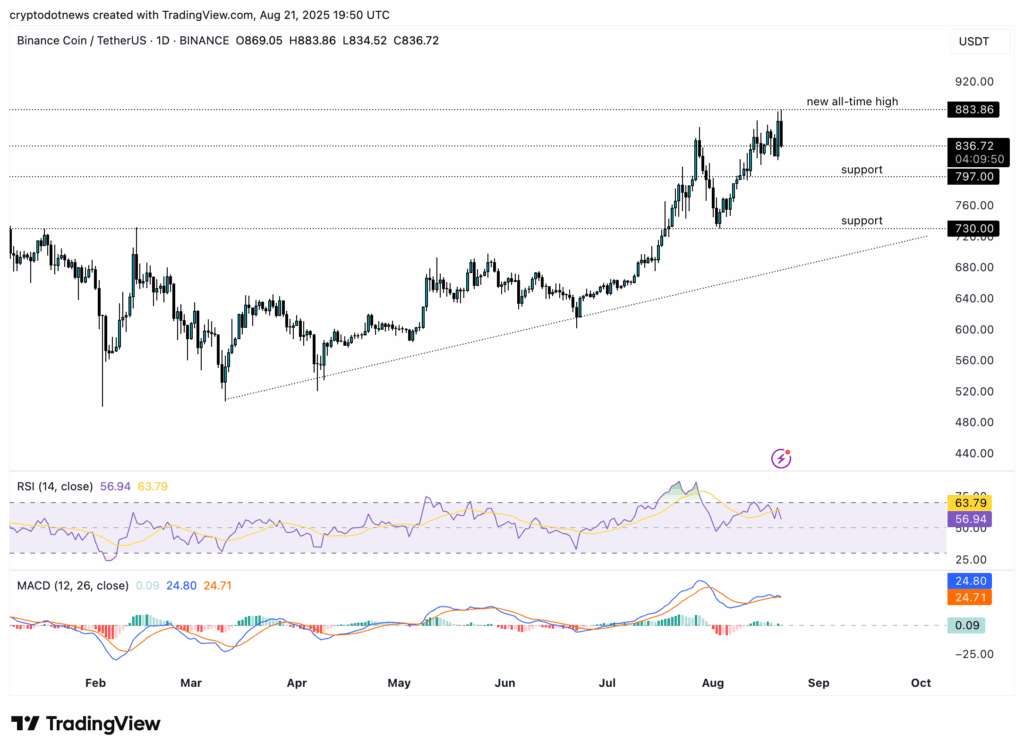

This decision follows the successful integration of Binance Coin (BNB) and is the first application of the newly unveiled eligible assets framework of the protocol. Ethena Labs said that the committee’s decision was based on a cold and lasting analysis of quantitative data, the two assets giving off minimal thresholds for open interest, commercial volume and market depth through the main exchanges.

The data behind the decision

To examine these assets, the committee relied on a rigorous data pipeline mainly from the Open Coinglass API, with a deadline of August 16. data Screen of major centralized exchanges, including Binance, Bybit, and OKX, which serve as places of cover of Ethena.

XRP and Hype approval was not a close call based on published measures. The two assets have convincingly exceeded each minimum threshold. Everyone has an average open interest of two weeks well above the reference to $ 1 billion, a critical measure which guarantees that the Ethena trading team can establish large short positions without moving the market.

In addition, their perpetual negotiation spots and volumes regularly exceeded $ 100 million a day, while their market depth, including the available liquidity at less than 1% of the current price, has proven to be robust enough to manage significant transactions without major shift.

The Committee also found that the two assets had cleaned the obstacle to minimum open interests of $ 300 million, demonstrating their maturity and their market resilience, even during periods of volatility, said Ethena Labs.

This data centered approach has also clearly delimited which assets did not cut. Despite their popularity and their decent volatility profiles, Sui (Suis) and Cardano (ADA) were rejected by the Committee.

Post Comment